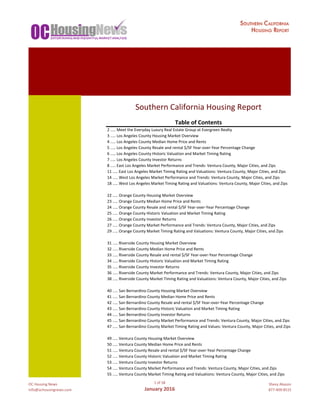

This document is a newsletter providing housing market data and analysis for Southern California counties including Los Angeles, Orange, Riverside, San Bernardino, and Ventura counties. It includes information on median home prices, rents, price-to-rent ratios, sales price per square foot, year-over-year price changes, and market performance ratings for different areas within each county going back to January 2015. Historic price and rent trends are shown dating back to 1988. The newsletter aims to help readers understand current housing market conditions and trends in Southern California.