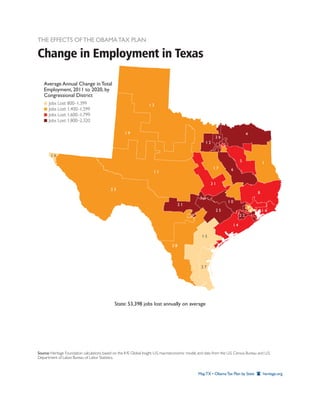

President Obama's tax plan would allow parts of the 2001 and 2003 tax cuts to expire, leading to significant tax increases starting January 2011, which are projected to result in a loss of approximately 53,398 jobs annually in Texas from 2011 to 2020. Additionally, households in Texas would see a drop in disposable personal income by about $20,208, alongside a rise in individual income taxes totaling $37,964 million. These findings are based on calculations from the Heritage Foundation using data from the U.S. Census Bureau and the Department of Labor.