- This numerical reasoning test comprises 21 questions to be completed within 21 minutes. Calculators are permitted.

- For each question, there are 5 possible answers but only one correct answer. Questions cover topics such as percentages, ratios, averages, and interpreting graphs and tables of financial data.

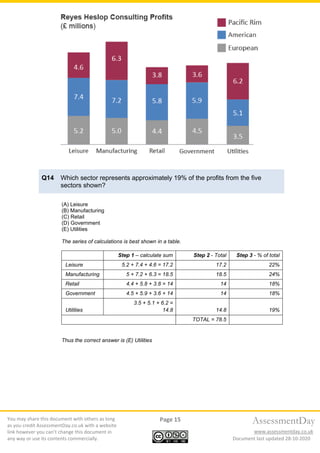

- The test provides information such as tables of share prices and graphs of company expenditures to draw data from for answering the questions.