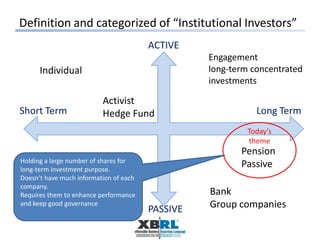

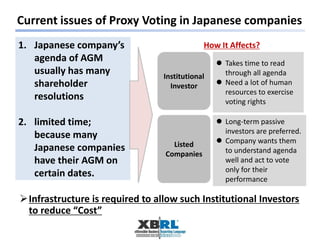

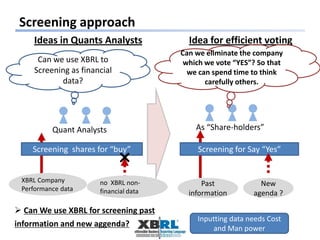

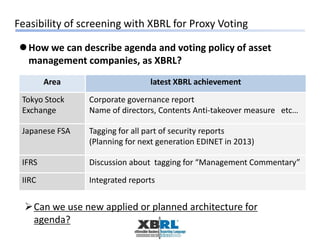

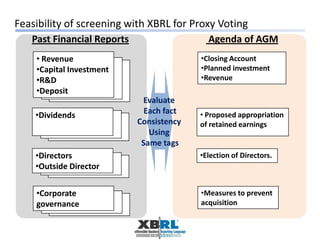

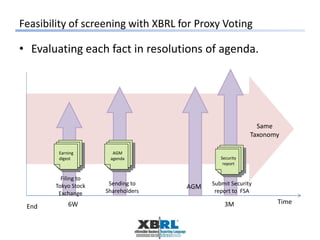

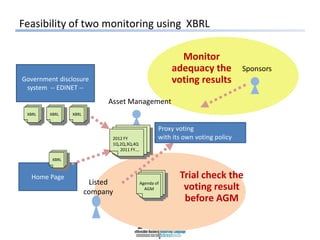

This document discusses using XBRL (eXtensible Business Reporting Language) to help institutional investors more efficiently analyze company agendas and vote in shareholder meetings. It outlines current issues with proxy voting in Japanese companies, and proposes using XBRL to tag past financial reports, current agendas, and voting policies to allow screening of companies. This could help investors globally access qualitative information and better monitor company performance and governance. Several challenges are noted, including standardizing the "facts" and terminology tagged in XBRL. Overall, the document examines the feasibility and potential benefits of using XBRL to improve transparency and efficiency in the proxy voting process.