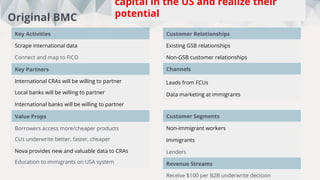

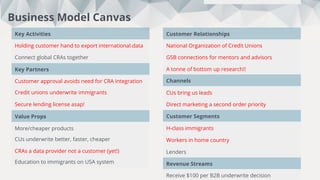

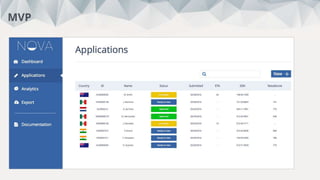

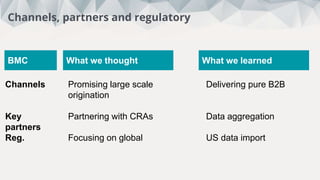

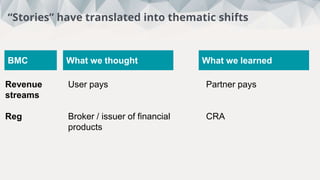

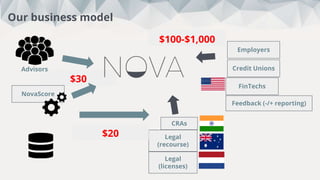

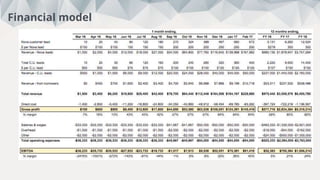

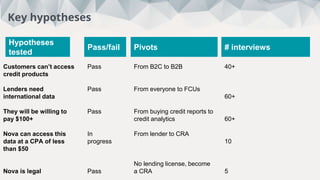

The document details insights from 88 interviews focused on enhancing access to credit for immigrants by leveraging global credit data integration. Key findings highlight the necessity for international credit data in lending processes and the potential for Nova to become a consumer reporting agency (CRA) with significant market opportunities, particularly among immigrants and underrepresented populations. It emphasizes the value of partnerships with credit unions and international CRAs to improve the lending landscape for immigrants facing barriers to credit access.

![This week:

5

Total:

88

Credit without borders

Interviews

Key stats

$220Bn

market

60%

approv

al rate

$1,000+

CLTV to

Lender

$100

ARPU

50%

Gross

Margin

$20 Av.

cost

per

report

$10/$120

b2B/b2C

CPA

3%

default

rate

3 pilots

[NEW]

$200

CLTV to

Nova](https://image.slidesharecdn.com/nova-llp-finalpresentation-160309081817/85/Nova-Stanford-2016-3-320.jpg)