Embed presentation

Downloaded 15 times

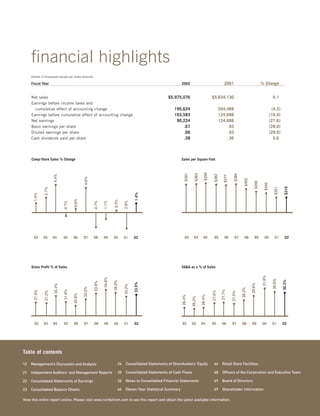

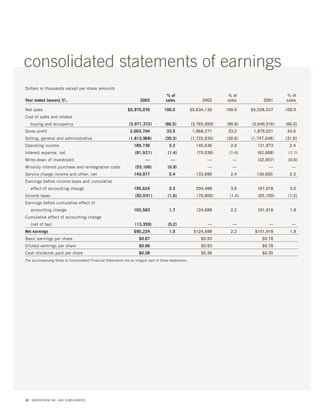

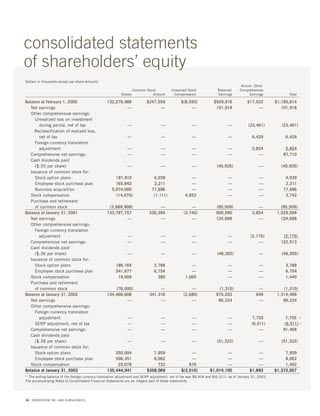

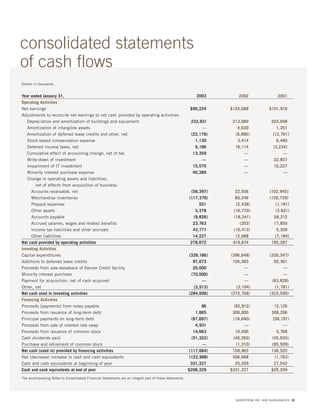

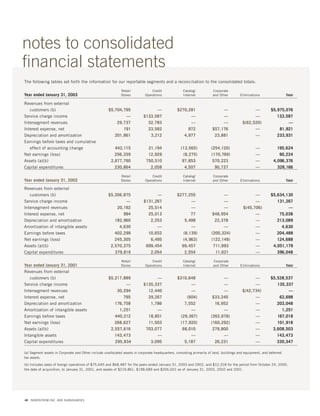

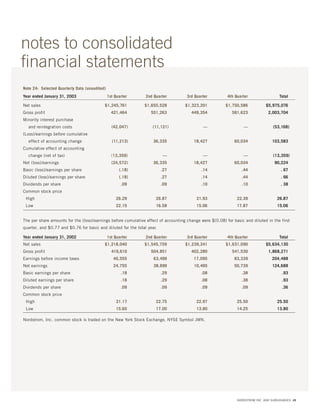

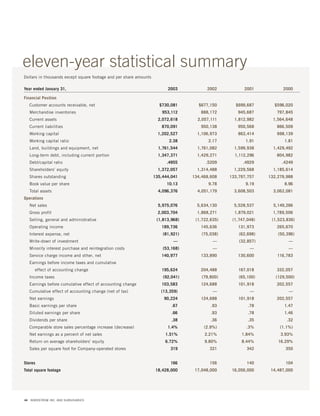

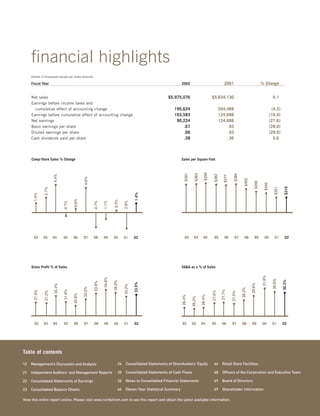

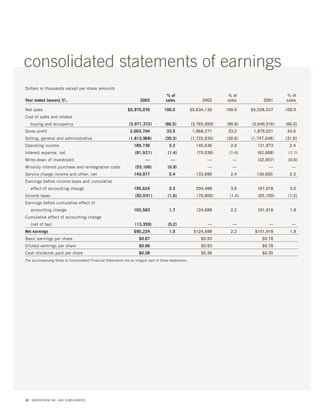

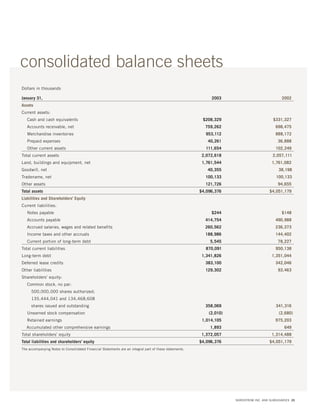

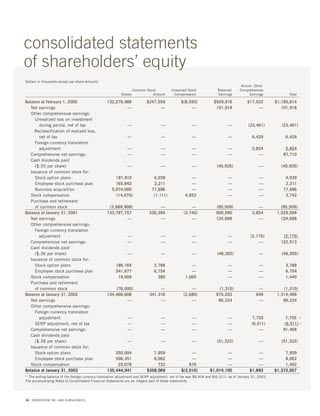

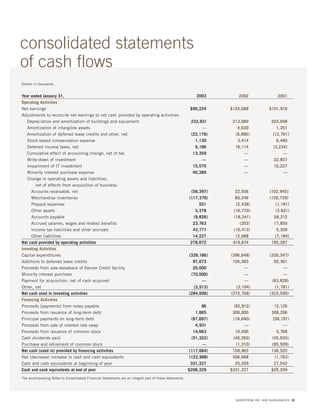

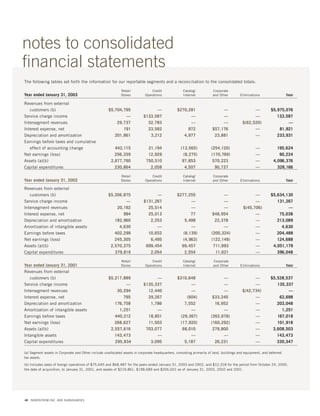

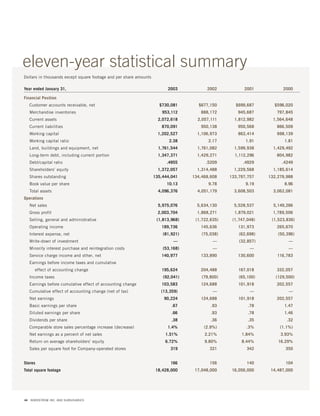

The annual report summarizes Nordstrom's financial performance in 2002. Net sales increased 6.1% to $5.975 billion compared to 2001. Earnings before taxes decreased 4.3% to $195.6 million. Net earnings decreased 27.6% to $90.2 million and basic earnings per share decreased 28% to $0.67. Nordstrom made progress increasing sales and reducing expenses as a percentage of sales but recognizes there is still work to be done to reach its goals.