Embed presentation

Downloaded 13 times

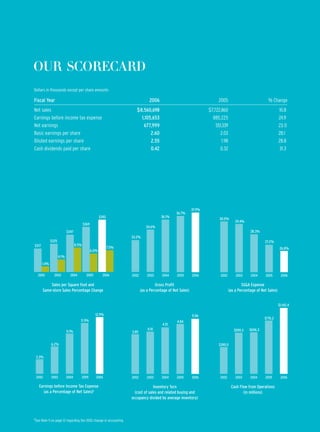

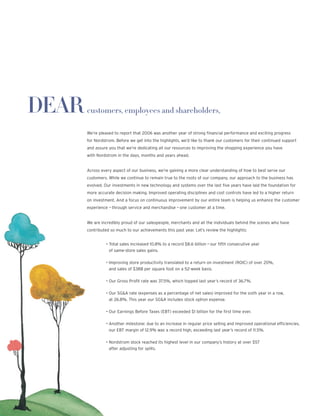

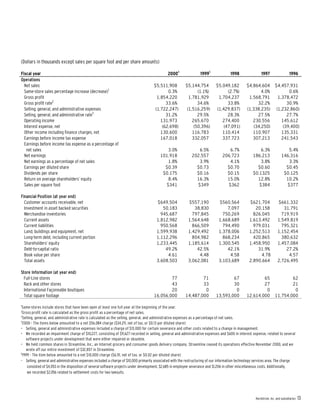

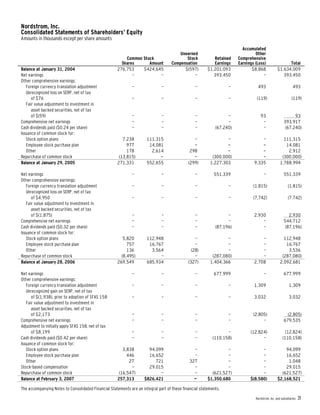

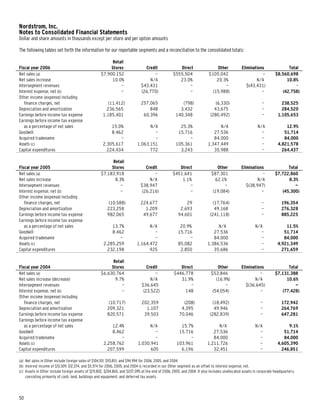

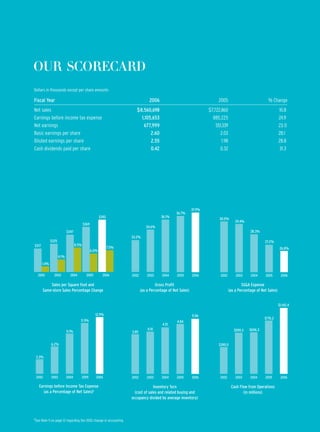

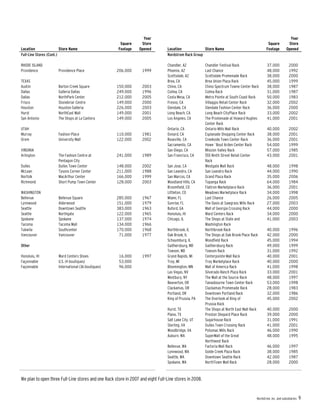

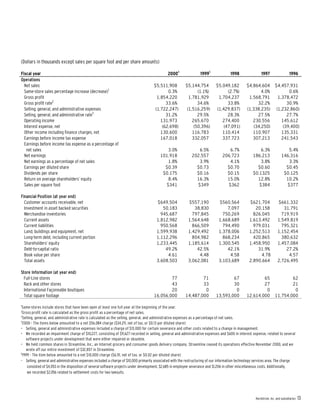

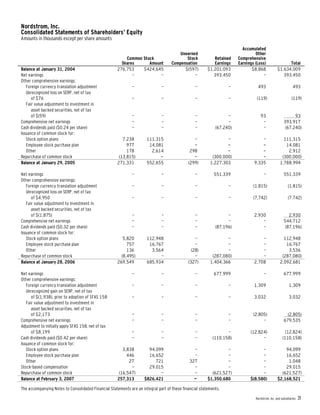

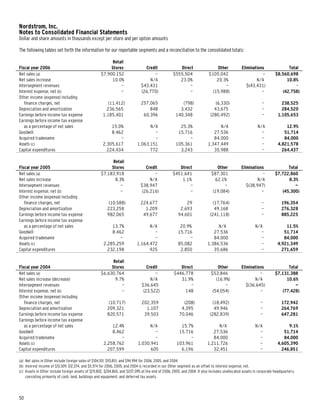

Nordstrom reported strong financial results for fiscal year 2006. Total sales increased 10.8% to a record $8.6 billion, with earnings before taxes exceeding $1 billion for the first time. The gross profit rate was 37.5% and expenses as a percentage of sales improved for the sixth consecutive year. Nordstrom also announced a $2.8 billion capital investment plan focused on new stores, remodels, and technology improvements to enhance the customer experience across channels. The Chairman expressed optimism for Nordstrom's future given its focus on serving customers and executing narrow initiatives through the lens of its values.