Embed presentation

Download to read offline

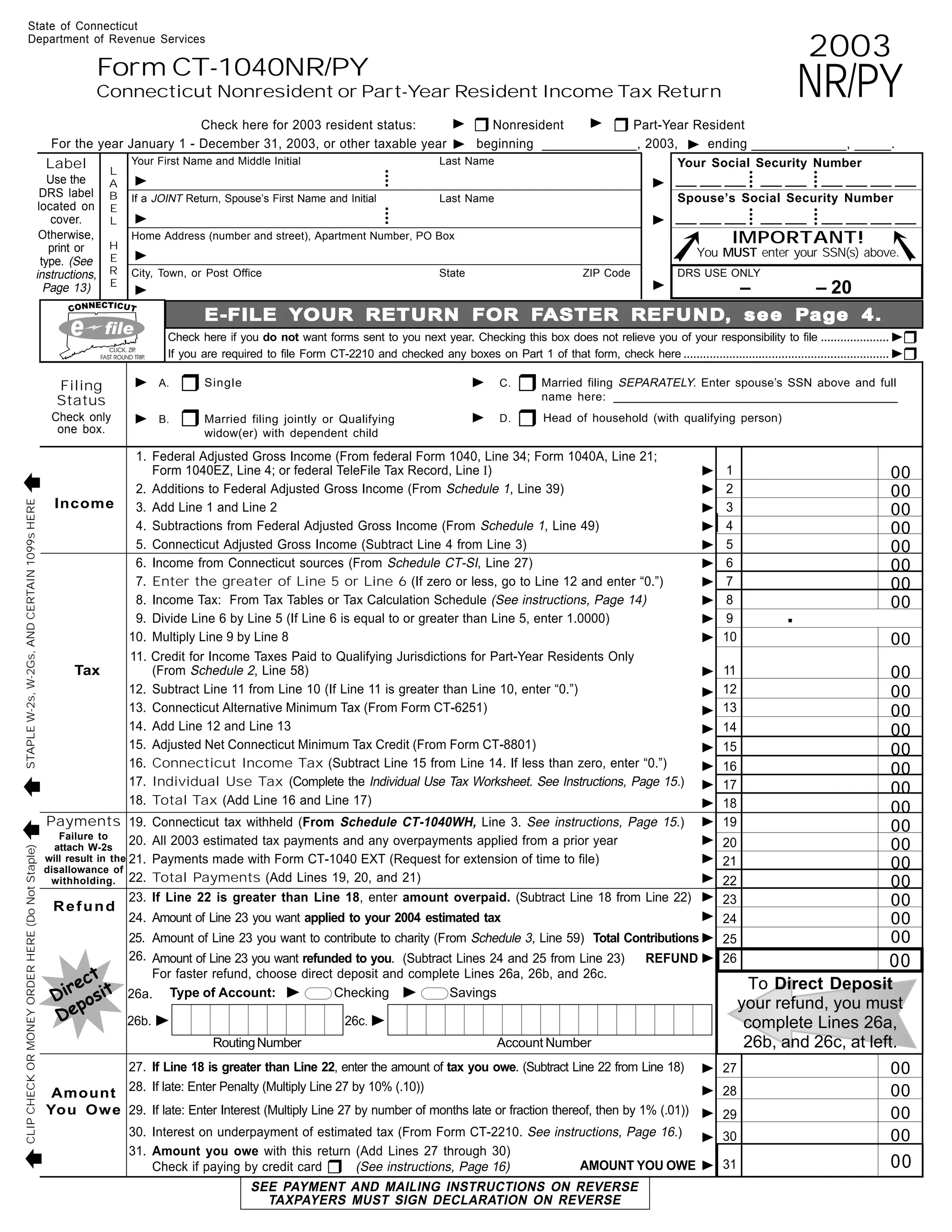

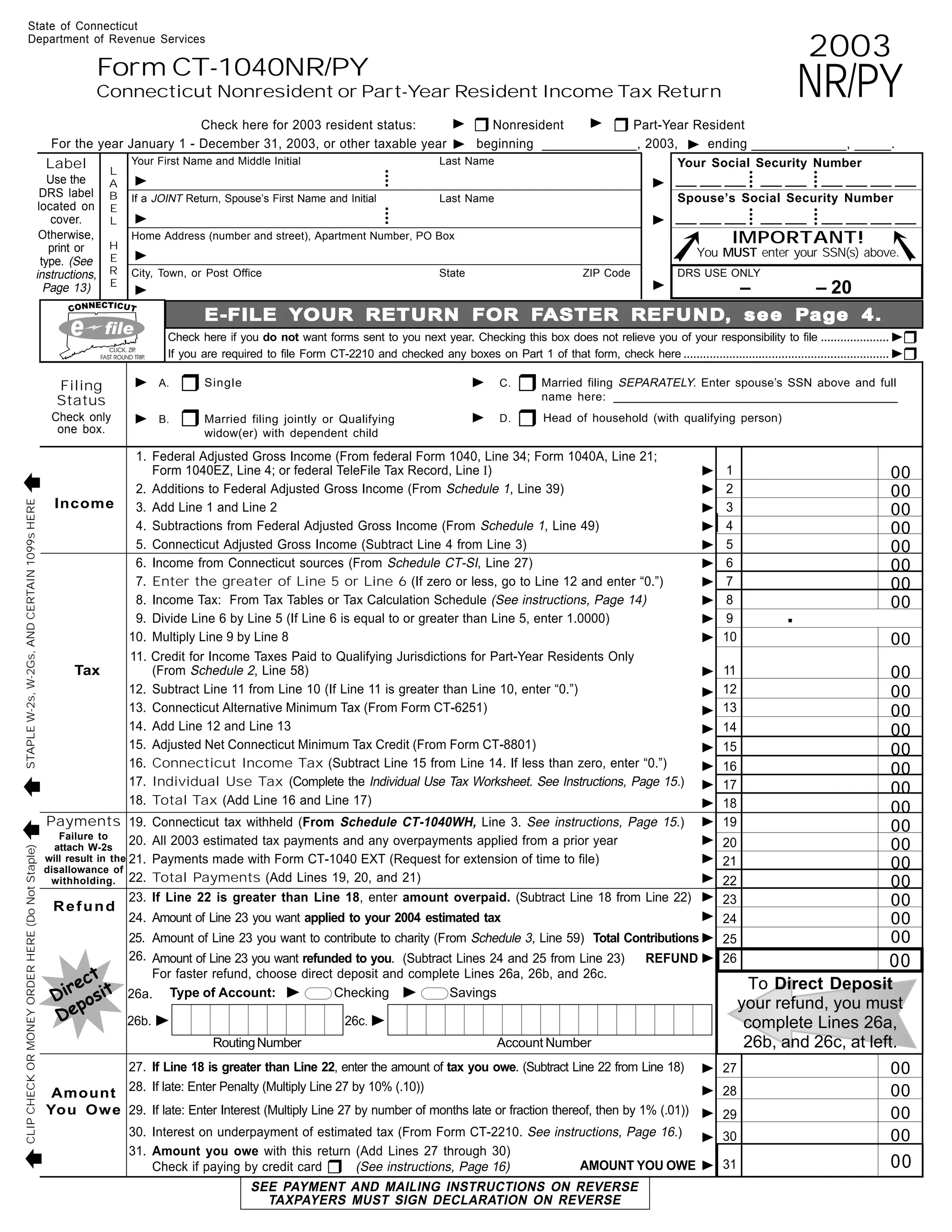

This document is a tax return form for nonresidents and part-year residents of Connecticut. It includes sections to report income, deductions, taxes owed or refund amount. The taxpayer must provide identification information like name and social security number. The main sections include calculating Connecticut adjusted gross income and taxes, reporting payments made and determining refund or taxes owed. The taxpayer needs to sign to declare the information provided is true and correct to the best of their knowledge.