Embed presentation

Download to read offline

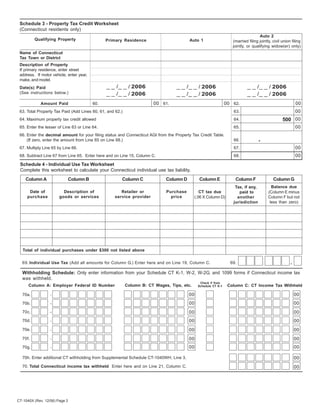

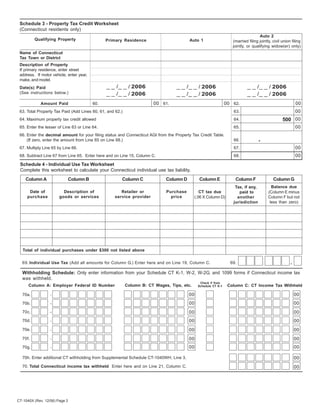

This document is an amended Connecticut income tax return for 2006. It provides instructions for correcting or adjusting items from the original 2006 return. The taxpayer must provide reasons for each amendment and attach supporting documentation. Calculations are provided to adjust income, deductions, credits, taxes owed or refunded.