Non Banking Financial Company (NBFC) : Scaled Based Regulations (SBR)

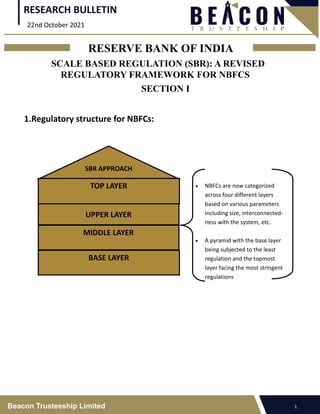

- 1. SCALE BASED REGULATION (SBR): A REVISED REGULATORY FRAMEWORK FOR NBFCS SECTION I 1.Regulatory structure for NBFCs: Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA 22nd October 2021 1 SBR APPROACH UPPER LAYER MIDDLE LAYER TOP LAYER BASE LAYER • NBFCs are now categorized across four different layers based on various parameters including size, interconnected- ness with the system, etc. • A pyramid with the base layer being subjected to the least regulation and the topmost layer facing the most stringent regulations

- 2. 2. FOUR LAYER CLASSIFICATION OF NBFCS : Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA 22nd October 2021 2 • NBFCs with an asset size below INR 1,000 cr. • peer-to-peer lending platforms, account aggregators. • non-operative financial holding companies. • NBFCs not accessing public funds nor BASE LAYER • All deposit-taking and non-deposit taking NBFCs with an asset size of INR 1,000 Cr and above • standalone primary dealers MIDDLE LAYER • NBFCs which are specifically identified by the Reserve Bank as warranting enhanced regulatory requirement based on a set of parameters and scoring methodology. • Top 10 eligible NBFCs in terms of asset size to be always reside in the upper UPPER LAYER • This Layer will remain empty. • It can get populated if the Reserve Bank is of the opinion that there is a substantial increase in the potential systemic risk from specific NBFCs in the Upper Layer. TOP LAYER

- 3. SECTION II 3. REGULATORY CHANGES UNDER SCALE BASED REGULATION (SBR) : I. Regulatory changes under SBR for all the layers in the regulatory structure: 1.Net owned fund (NOF) has been increased for NBFC from 2 Cr to 10 Cr in phase manner with some exceptions which is as under:- • NBFC-P2P, NBFC-AA, and NBFCs with no public funds and no customer interface, the NOF is continued to be ₹2 Cr. • No change have been made in the existing regulatory minimum NOF for NBFCs - IDF, IFC, MGCs, HFC, and SPD. 2. The timeline for NBFC-BL has to adhere to 90 days NPA norms in phase manner is as followed:- Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA NBFCs Current NOF (IN Cr ) By March 31, 2025 (Cr) By March 31, 2027 (Cr) NBFC-ICC ₹2 Cr ₹5 Cr ₹10 Cr NBFC-MFI ₹5 Cr(₹2 Cr in NE Region) ₹7 Cr (₹5Cr in NE Region) ₹10 Cr NBFC- Factors ₹5 Cr ₹7 Cr ₹10 Cr 3 NPA Norms for NBFC-BL Timeline >150 days overdue By March 31, 2024 >120 days overdue By March 31, 2025 > 90 days By March 31, 2026

- 4. II. Regulatory changes under SBR for different layers in the regulatory structure – Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA 4 Guidelines NBFC – Base Layer (NBFC- BL) NBFC – Middle Layer (NBFC-ML) NBFC – Upper Layer (NBFC-UL) 1.Capital guidelines Internal Capital Ade- quacy Assessment Process (ICAAP) — NBFCs are required to make a thorough internal as- sessment of the need for capital, commensurate with the risks in their business Common Equity Tier 1 – — — Maintaining at least 9 per cent of Risk Weighted Assets. Leverage — — A suitable ceiling for leverage to be prescribed whenever necessary. 2. Prudential Guide- lines Concentration of credit — lending and investments to be merged into a single exposure limit of 25% for single borrower/ party and 40% for single group of borrowers/ parties Sensitive Sector Expo- sure (SSE) — • Board-approved internal limits for SSE separately for capital market and commercial real estate ex- posures • Dynamic vulnerability assessments • Supervisory review

- 5. Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA 5 Guidelines NBFC – Base Layer (NBFC-BL) NBFC – Middle Layer (NBFC-ML) NBFC – Upper Layer (NBFC-UL) Large Exposure Frame- work — — large exposure of an NBFC to all counterparties and groups of connected counterparties to be considered for exposure ceilings. Internal Exposure Lim- its — — An internal Board approved limit for exposure to the NBFC sector to be determined. Governance Guidelines Risk Management Com- mittee Constituting a Risk Man- agement Committee (RMC) either at the Board or executive level. — — Disclosures Requirements expanded related party transactions, loans to Directors/ Senior Officers and customer com- plaints Loans to directors, sen- ior officers and rela- tives of directors To have a board approved policy on grant of loans to entities — — Key Managerial Personnel As per Companies Act, 2013 • Key Managerial Personnel to not hold any office (including direc- torships) • An Independent Director cannot be director in more than three NBFCs (NBFC-ML and NBFC-UL) at the same time • Corporate Governance report containing composition and cate- gory of directors, shareholding of non-executive directors, etc. • Items of income and expenditure of exceptional nature. • Breaches in terms of covenants in respect to loans and securities • Divergence in asset classification

- 6. Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA 6 Guidelines NBFC – Base Layer (NBFC-BL) NBFC – Middle Layer (NBFC-ML) NBFC – Upper Layer (NBFC-UL) Compensation guidelines — To have an approved board compensation policy and in- cludes: (i) Constitution of a Remuneration Committee (ii) Principles for fixed/ variable pay structures (ii) Malus/ claw back requirements Chief Compliance Officer — Appointment of Chief compliance officer is mandatory. Other Governance matters — Board to ensure good corporate governance practices in the subsidiaries of the NBFC and maintain mechanism for direc- tors and employees to report genuine concerns. Core Banking Solution — 10 or more branches of NBFCs are mandated to adopt Core Banking Solution. Listing & Disclosures - — — Mandatory listing within 3 years of identification as NBFC-UL. Qualification of Board Members • Professional experience in managing the affairs of NBFCs • At least one of the directors shall have relevant experience of having worked in a bank/ NBFC. Removal of Independent Directors — — Reporting to the supervisor in case of independent director been removed or resigned before completion of his nor- mal tenure. Ceiling on IPO Funding Ceiling of ₹1 Cr per borrower for financing subscription to Initial Public Offer (IPO) is manda- tory.

- 7. Scoring Methodology for Identification of NBFC as NBFC-UL • Scoring methodology for identification of an NBFC as NBFC-UL should be based on the set of NBFCs fulfilling the following criteria: ⇒ Top 50 NBFCs (excluding top ten NBFCs based on asset size, which automatically fall in the Upper Layer) based on their total exposure including credit equivalent of off-balance sheet exposure. ⇒ NBFCs designated as NBFC-UL in the previous year. ⇒ NBFCs added to the set by supervisors using supervisory judgment. The computation of scores of all NBFCs in the above set to be performed annually based on their position as on March 31st each year. Our Analysis: • This scale based regulations changes are expected to increase the flexibility of the sector going forward • A significant portion of the listed NBFCs would form part of the Middle/Upper layer and would need to comply with the new regulations related to capitalization, disclosure norms, and governance. • The level of regulation / compliance requirement increases with each layer. • Capital guidelines can ensure availability of adequate capital to support all risks in business as also to encourage NBFCs to develop and use better internal risk management techniques for monitoring and managing their risks. • In Base layer with asset size of less than INR 1000 cr no meaningful changes have been suggested. Beacon Trusteeship Limited RESEARCH BULLETIN RESERVE BANK OF INDIA Quantitative Parameters (70%) Qualitative Parameters (30%) Size & Leverage: 35% Nature/type of liabilities: 10% Interconnectedness: 210% Group Structure: 10% Complexity : 10% Segment Penetration: 10% Components of the parametric analysis 8