The 2015 Annual Report comprises three documents that provide information on NN Group's performance:

1) The 2015 Annual Review provides an integrated, concise review of NN Group's strategy, performance, and future prospects.

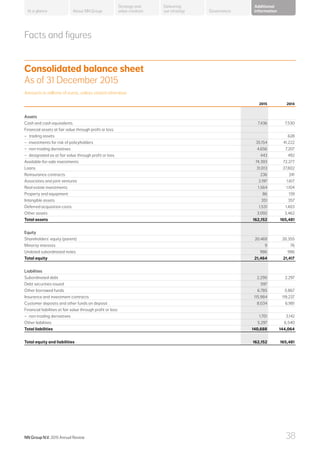

2) The 2015 Financial Report covers NN Group's financial developments, annual accounts, and approach to risk management, capital management, and corporate governance.

3) The 2015 Sustainability Supplement provides additional information on NN Group's strategy, objectives and achievements regarding social, ethical, and environmental aspects.