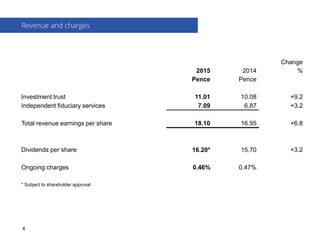

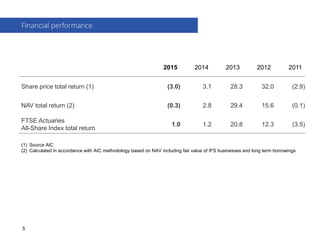

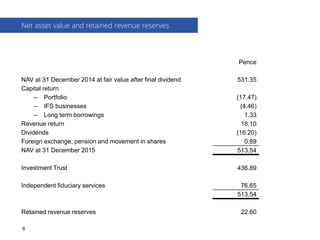

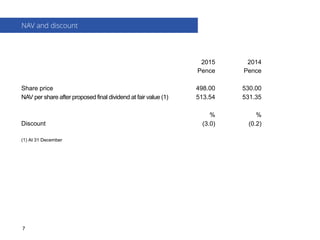

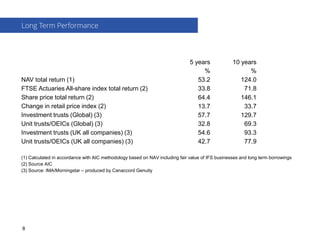

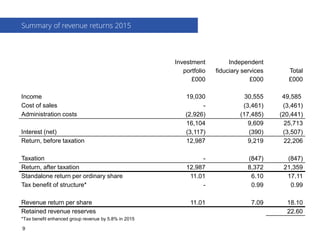

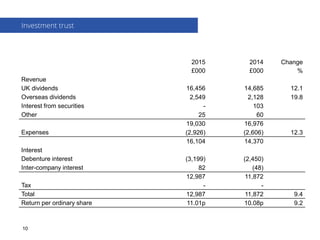

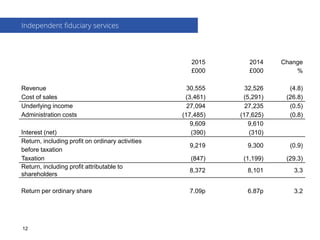

Law Debenture reported its annual results for 2015. It increased its long-term gearing in September 2015 and repaid short-term borrowings. The independent fiduciary services business was fair valued as of December 31, 2015 with restated historical data. The net asset value per share was 513.54 pence as of December 31, 2015, down slightly from the prior year, with the share price at a 3% discount. Revenue per share increased 6.8% to 18.10 pence for the year. The company aims to grow its businesses safely while maintaining its tax efficiency to enhance shareholder returns.