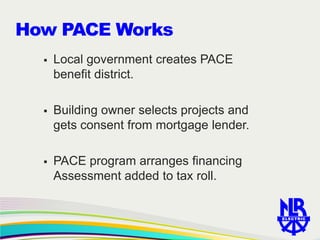

This document outlines Property Assessed Clean Energy (PACE) financing for energy efficient projects in North Little Rock. PACE financing provides property owners access to capital for energy improvements through a voluntary special assessment on their property tax bill. The assessment has priority over other liens and is inherited by new owners if the property is sold. The city would create a PACE district but not be financially obligated. Property owners would pay costs to implement the program and finance improvements through assessments or loans.