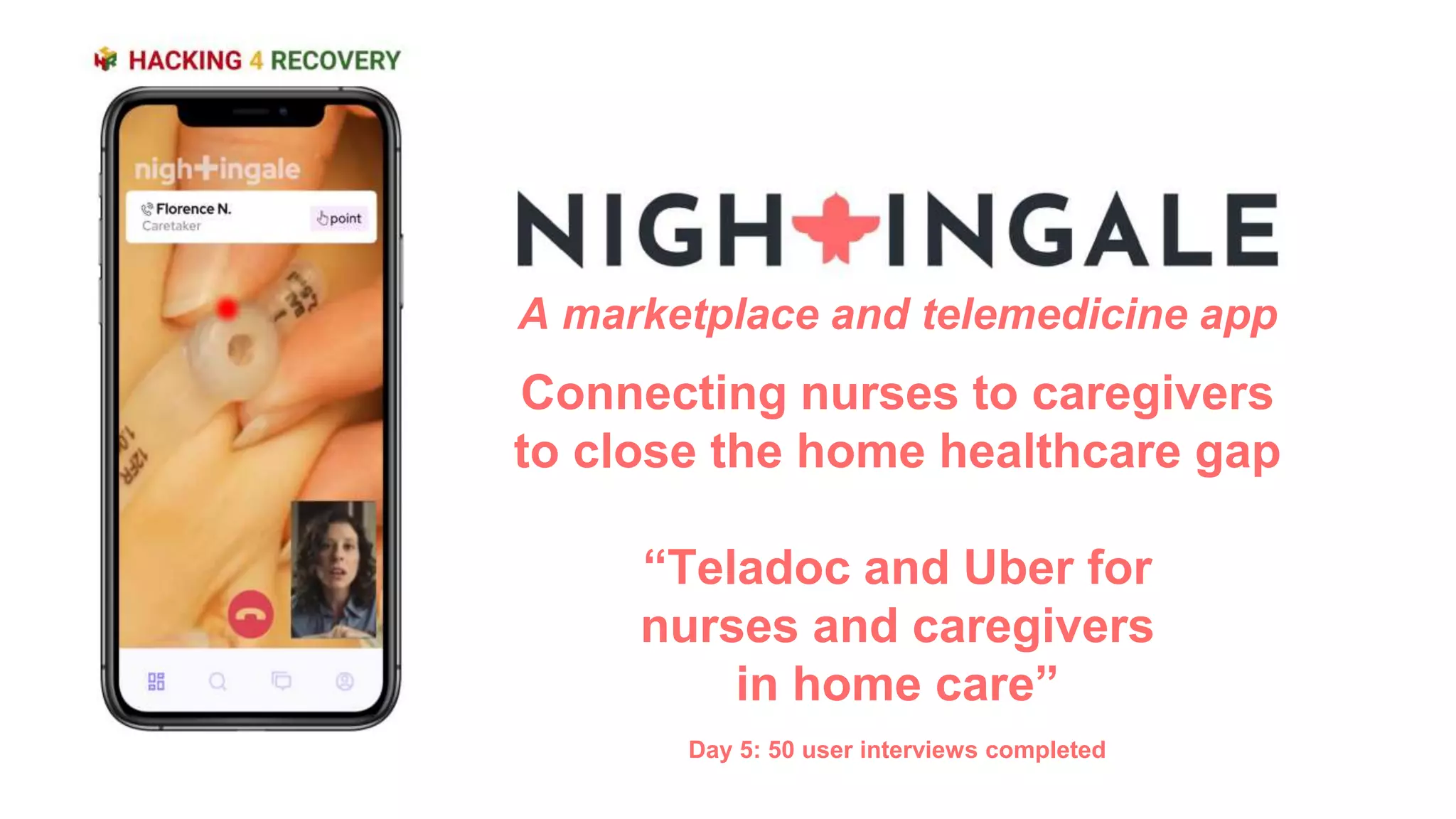

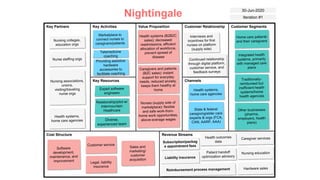

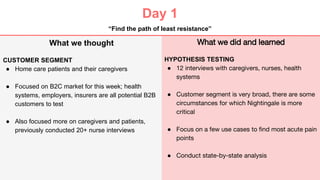

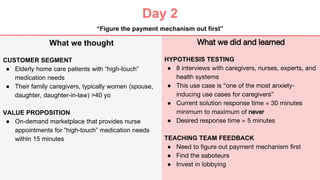

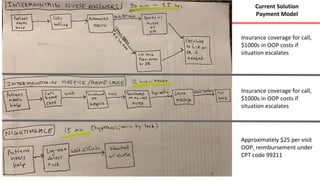

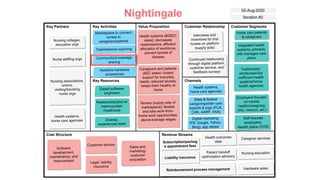

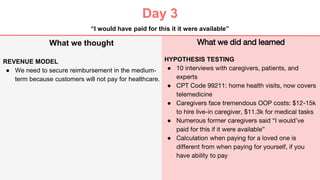

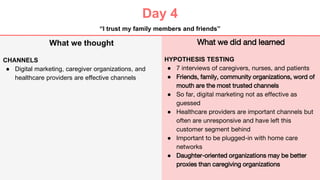

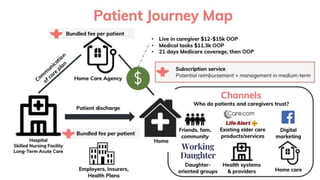

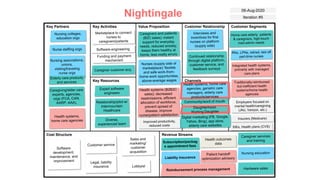

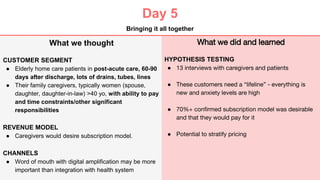

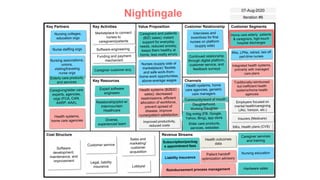

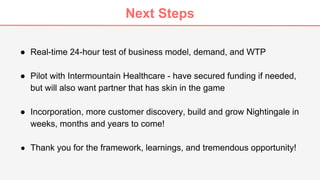

A telemedicine app called Nightingale connects nurses to caregivers to address gaps in home healthcare. Over 5 days, the team conducted 50 user interviews, identifying high-anxiety medication needs as an acute problem. They prototyped an on-demand marketplace allowing nurse appointments within 15 minutes, and found caregivers would prefer a subscription model. Moving forward, the team will pilot the business model with a healthcare partner to test demand and willingness to pay.