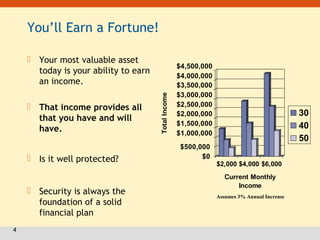

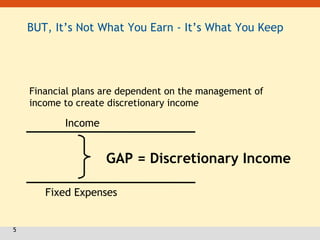

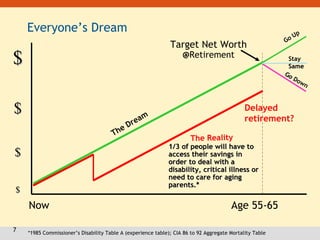

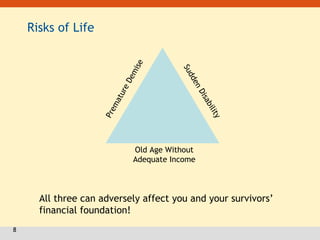

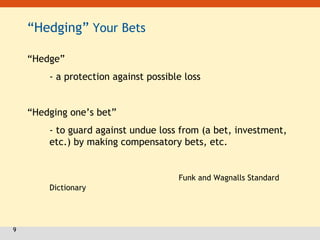

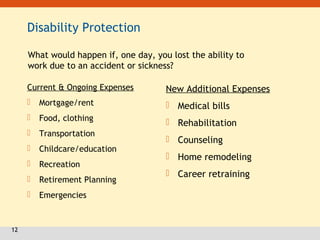

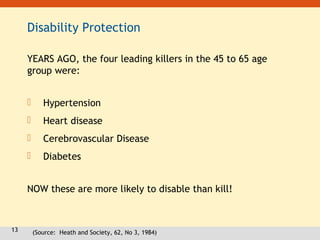

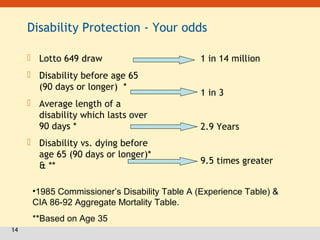

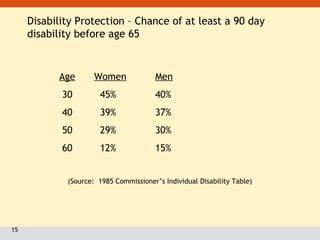

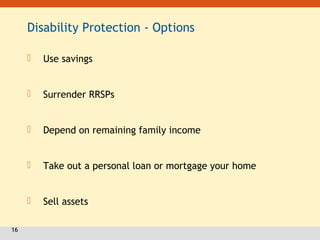

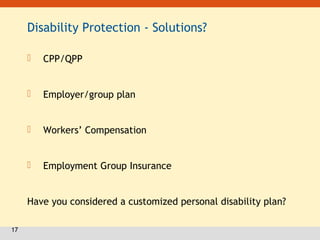

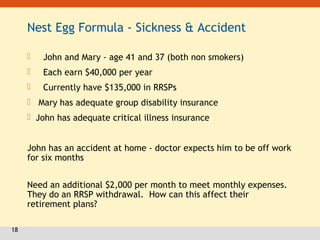

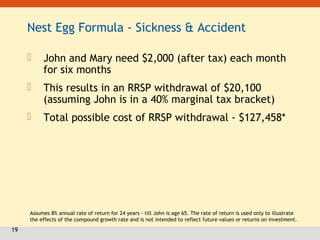

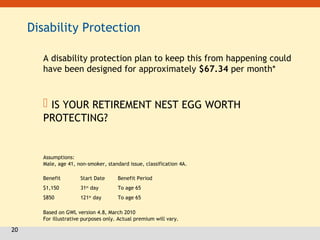

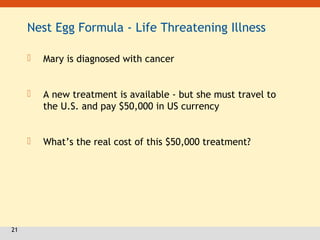

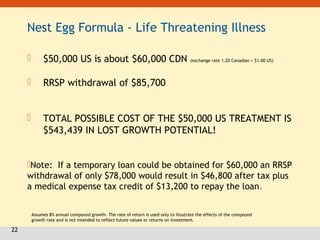

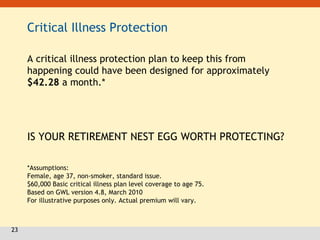

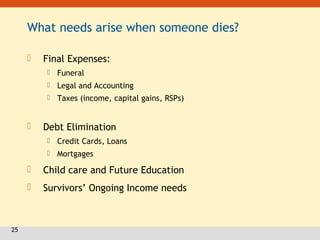

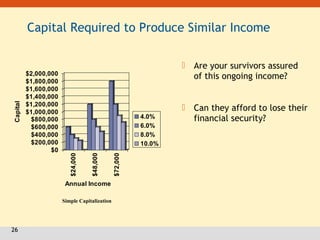

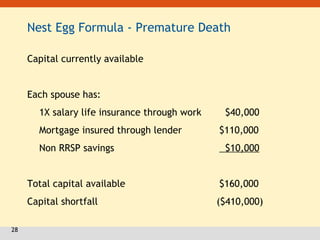

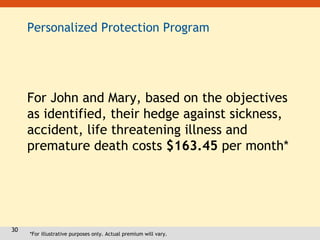

The document discusses the importance of financial planning and protecting income against unforeseen events such as disability, critical illness, and premature death. It emphasizes the need for hedging risks to secure one's financial future, using examples of potential financial repercussions and the costs of insurance options to safeguard retirement savings. The overall message is to assess and prioritize financial protection to ensure family security and sustain living standards in challenging circumstances.