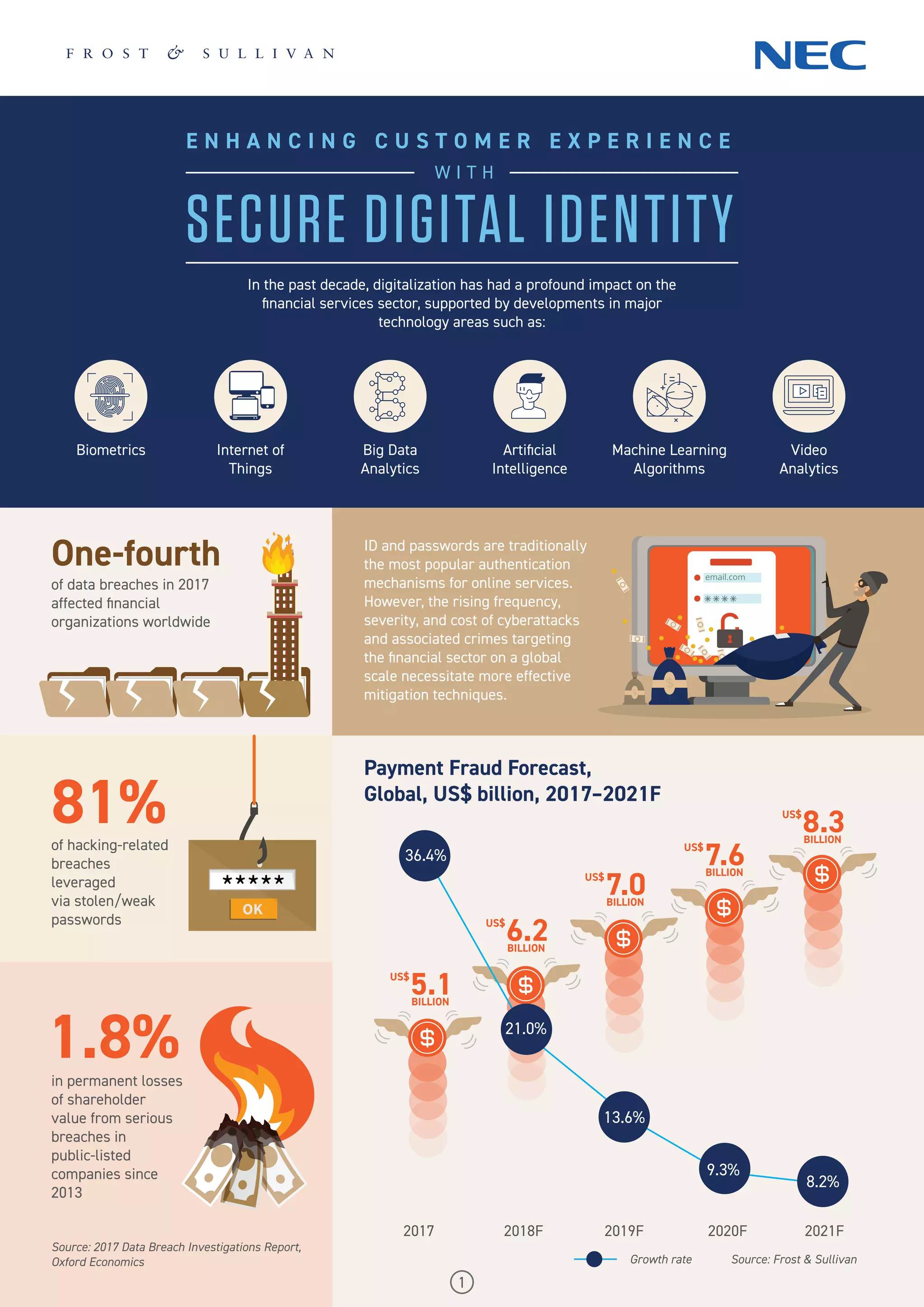

The document discusses the significant impact of digitalization on the financial services sector, emphasizing the increasing necessity for effective security measures due to rising cyber threats. It highlights the role of biometric technology in enhancing security and improving customer experience, noting the shift from traditional banking to digital solutions. Moreover, it points out trends and statistical data regarding biometric adoption, challenges in the BFSI sector, and the integration of advanced technologies in secure digital identity management.