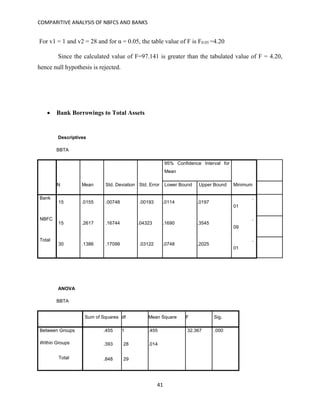

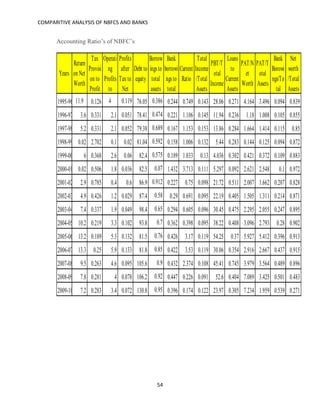

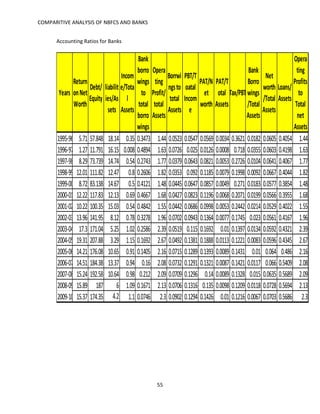

The document presents a comparative analysis of Non-Banking Financial Companies (NBFCs) and banks in India, highlighting their roles in financial inclusion and nation-building, particularly for Micro, Small, and Medium Enterprises (MSMEs). It discusses the evolution of NBFCs within the financial system, regulatory frameworks, and their competitive advantages over traditional banks in terms of service offerings. The study aims to evaluate the growth potential and performance metrics of both financial institutions, focusing on profitability, leverage, and liquidity ratios.