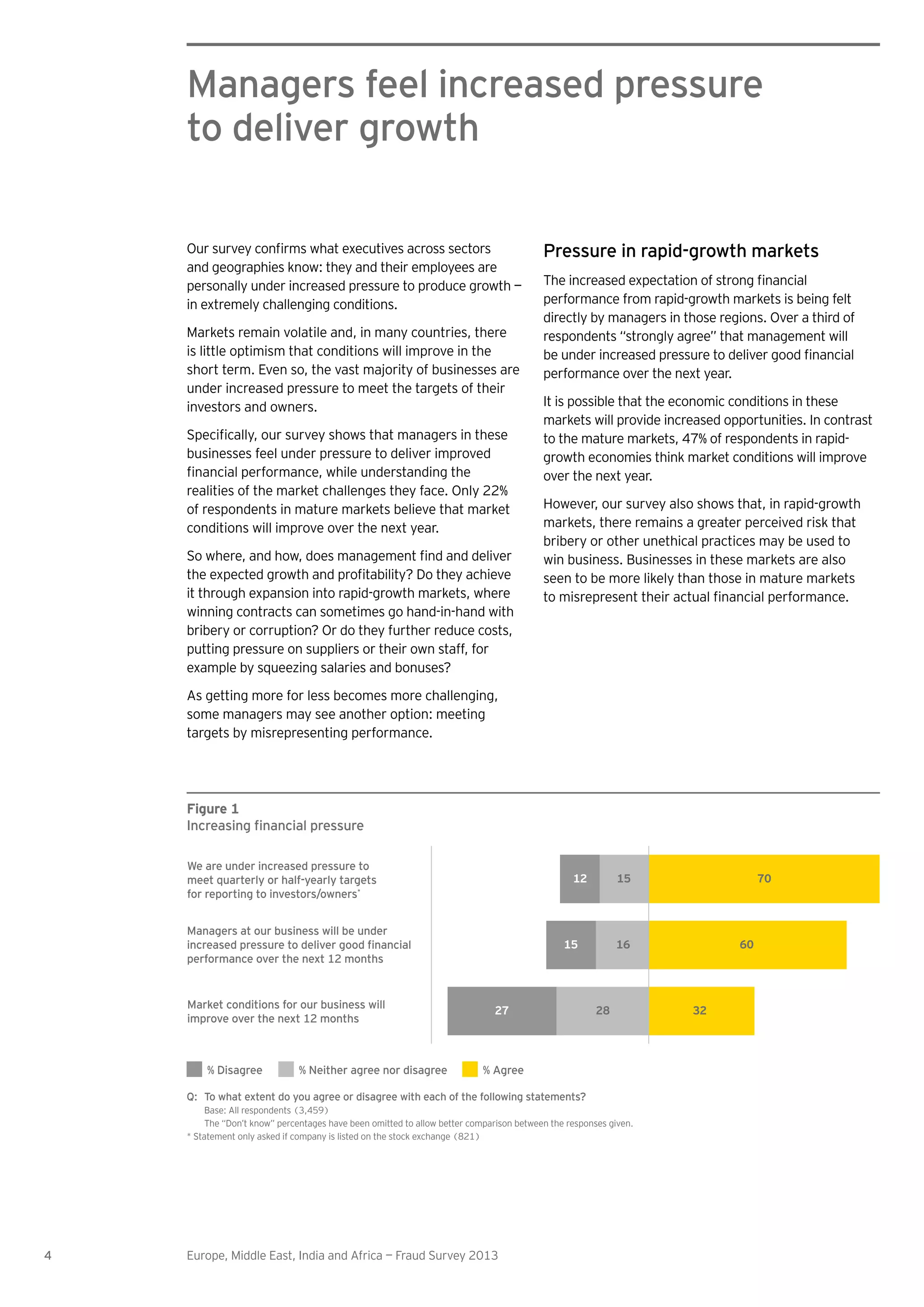

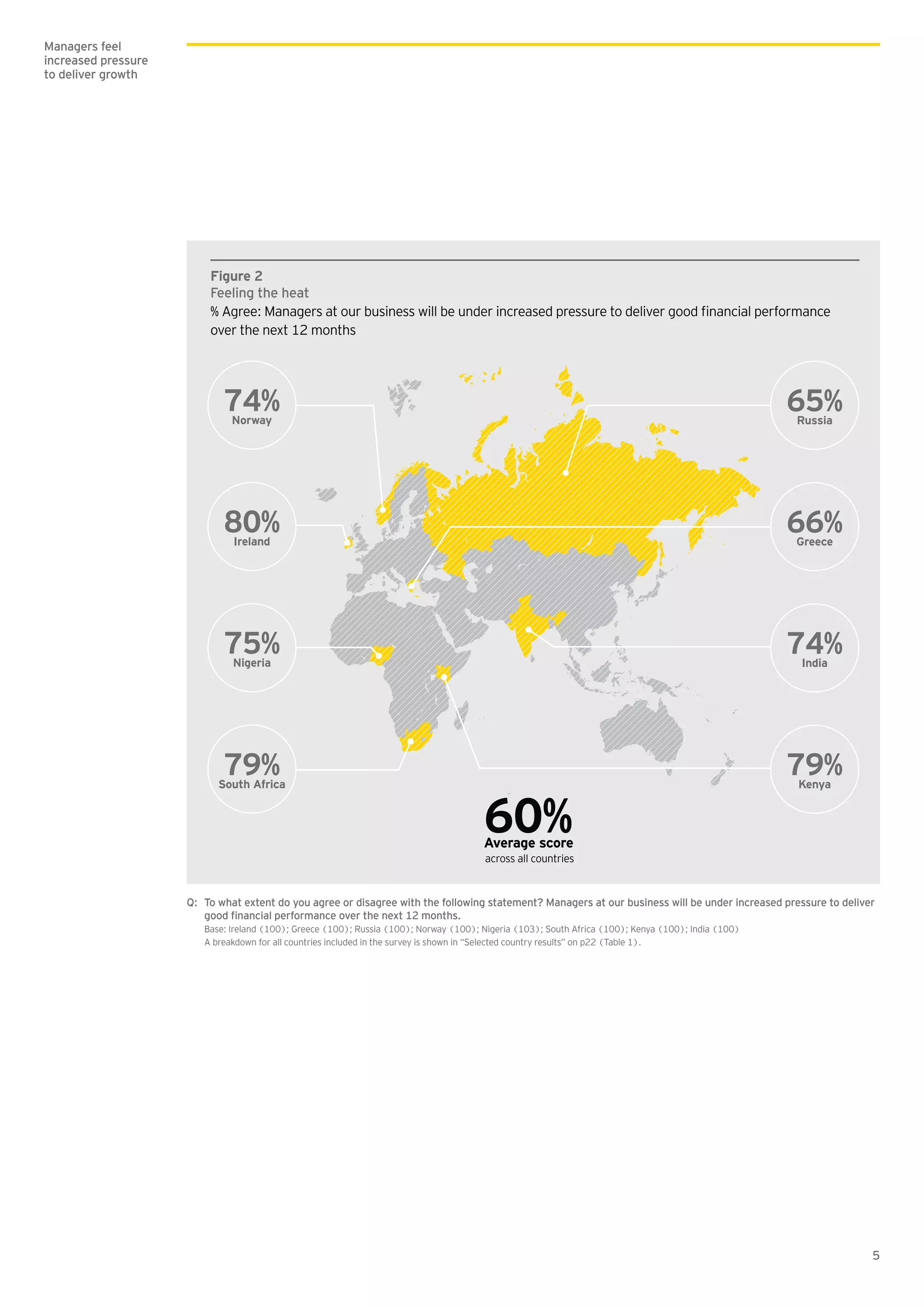

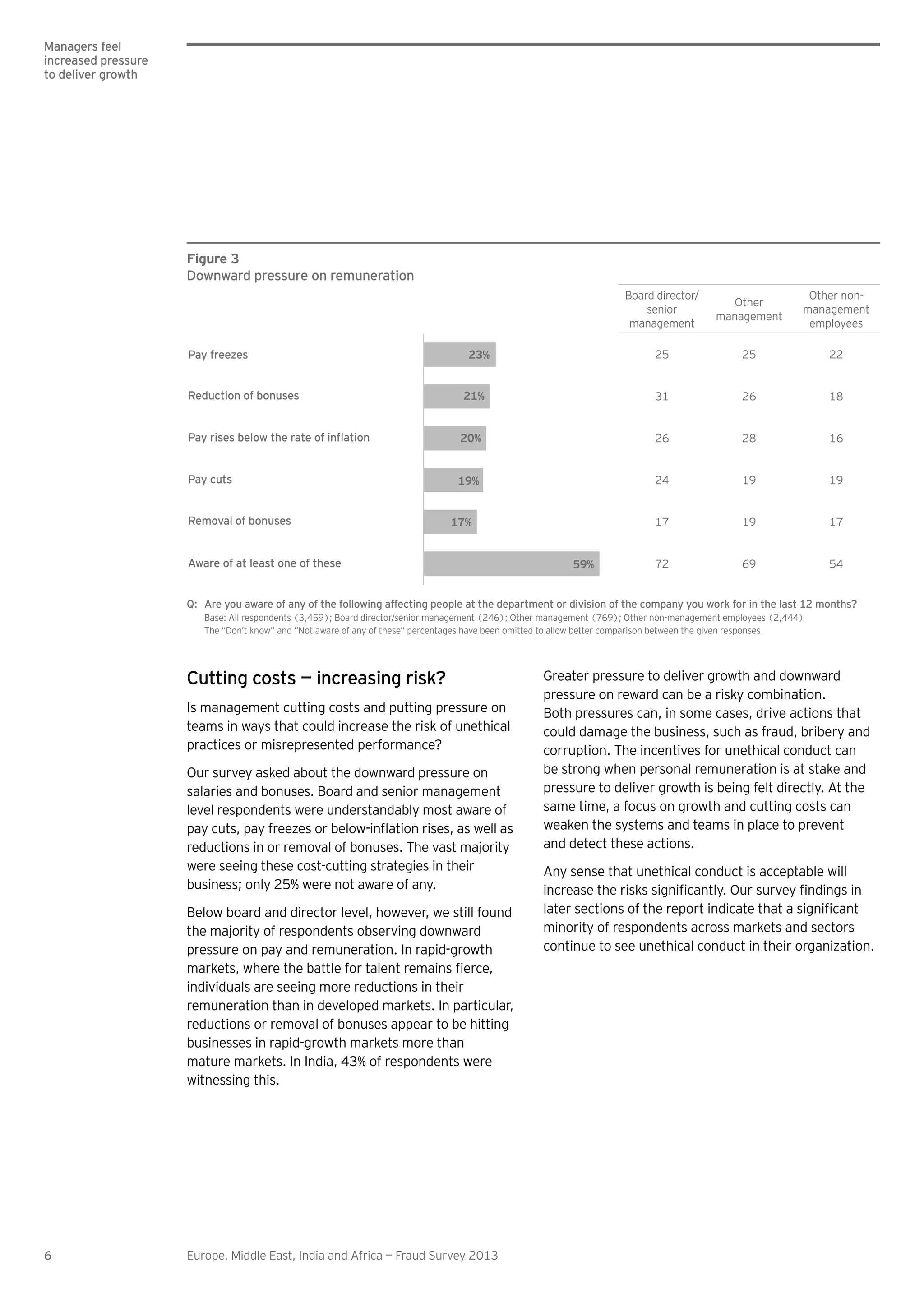

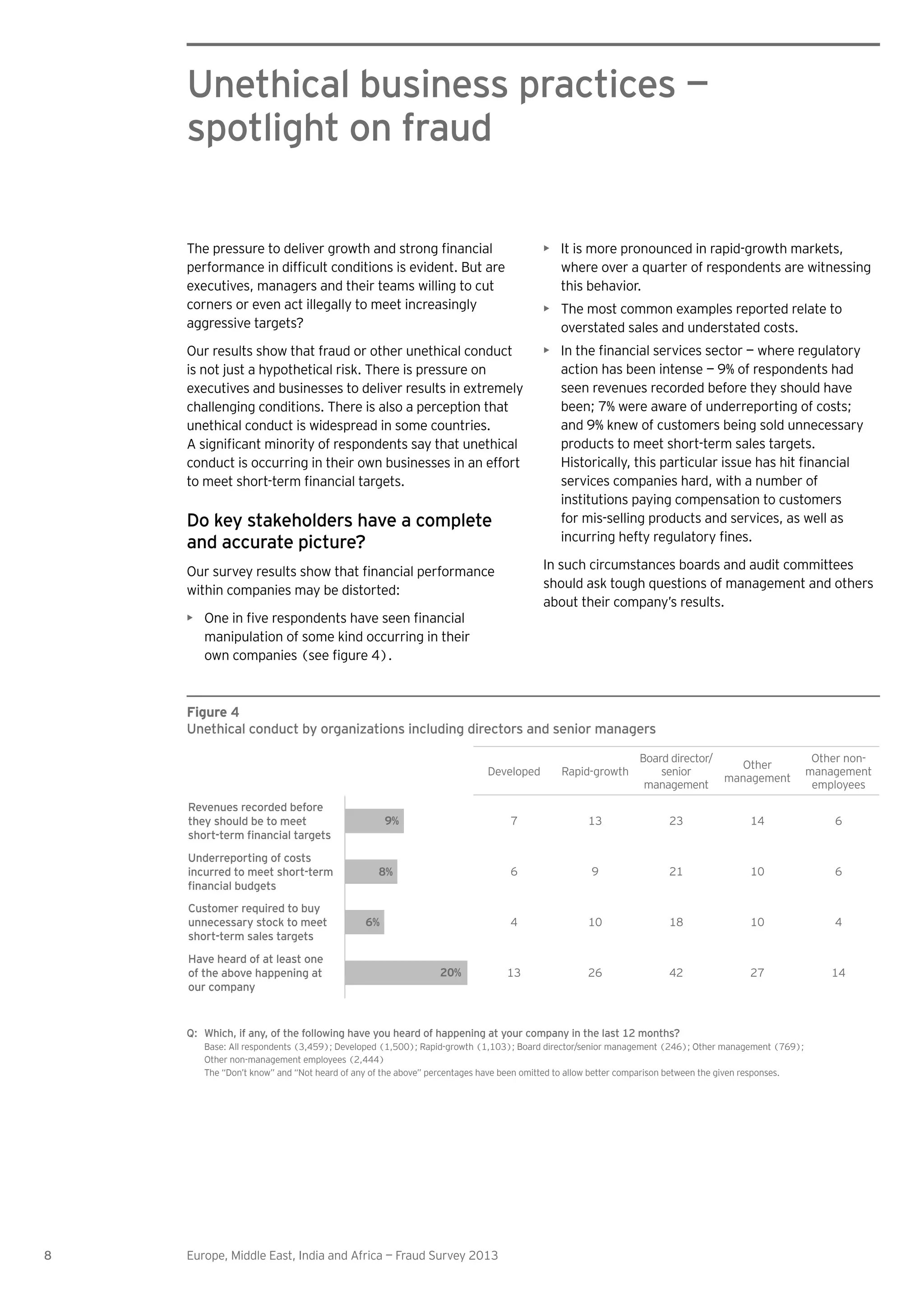

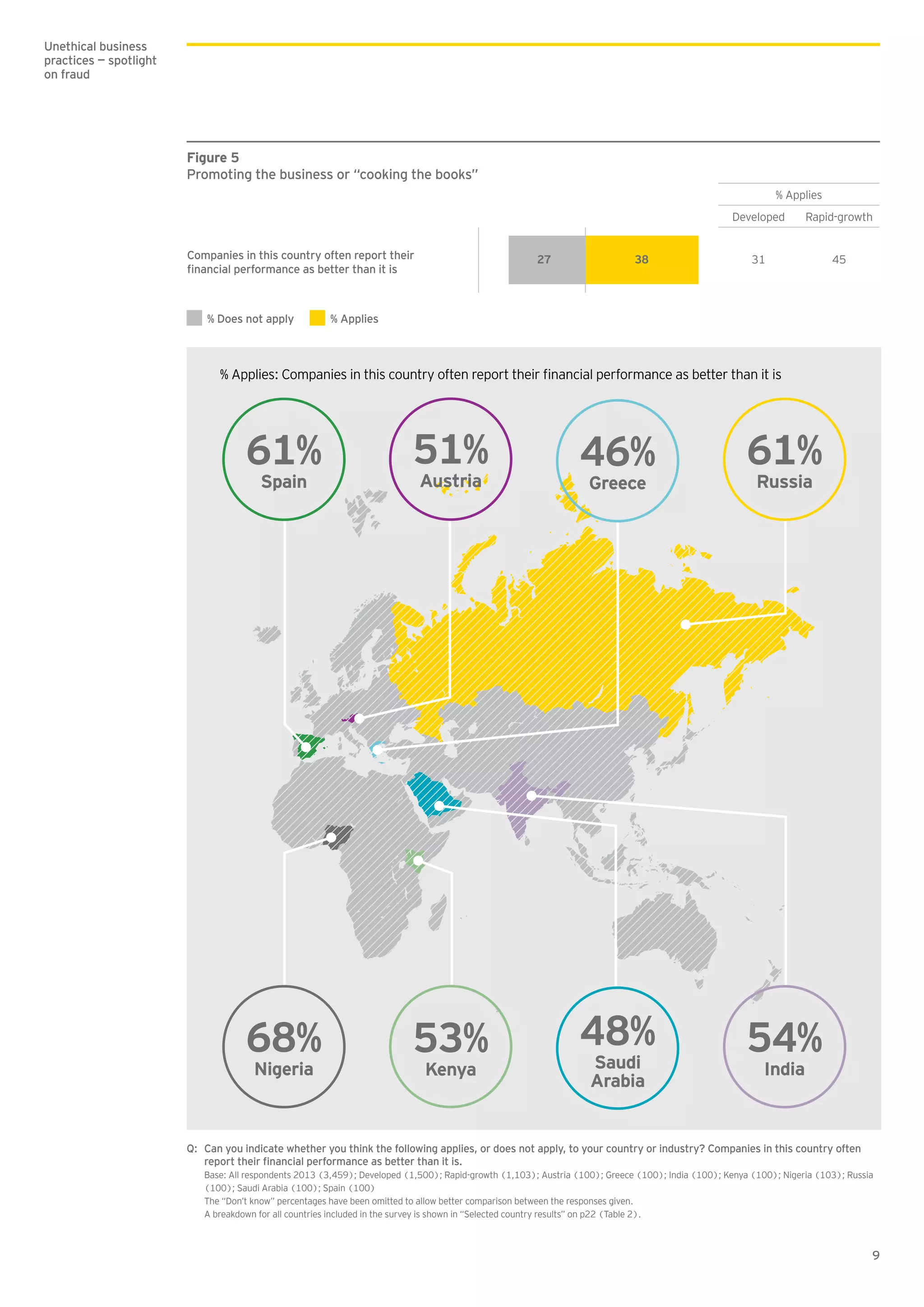

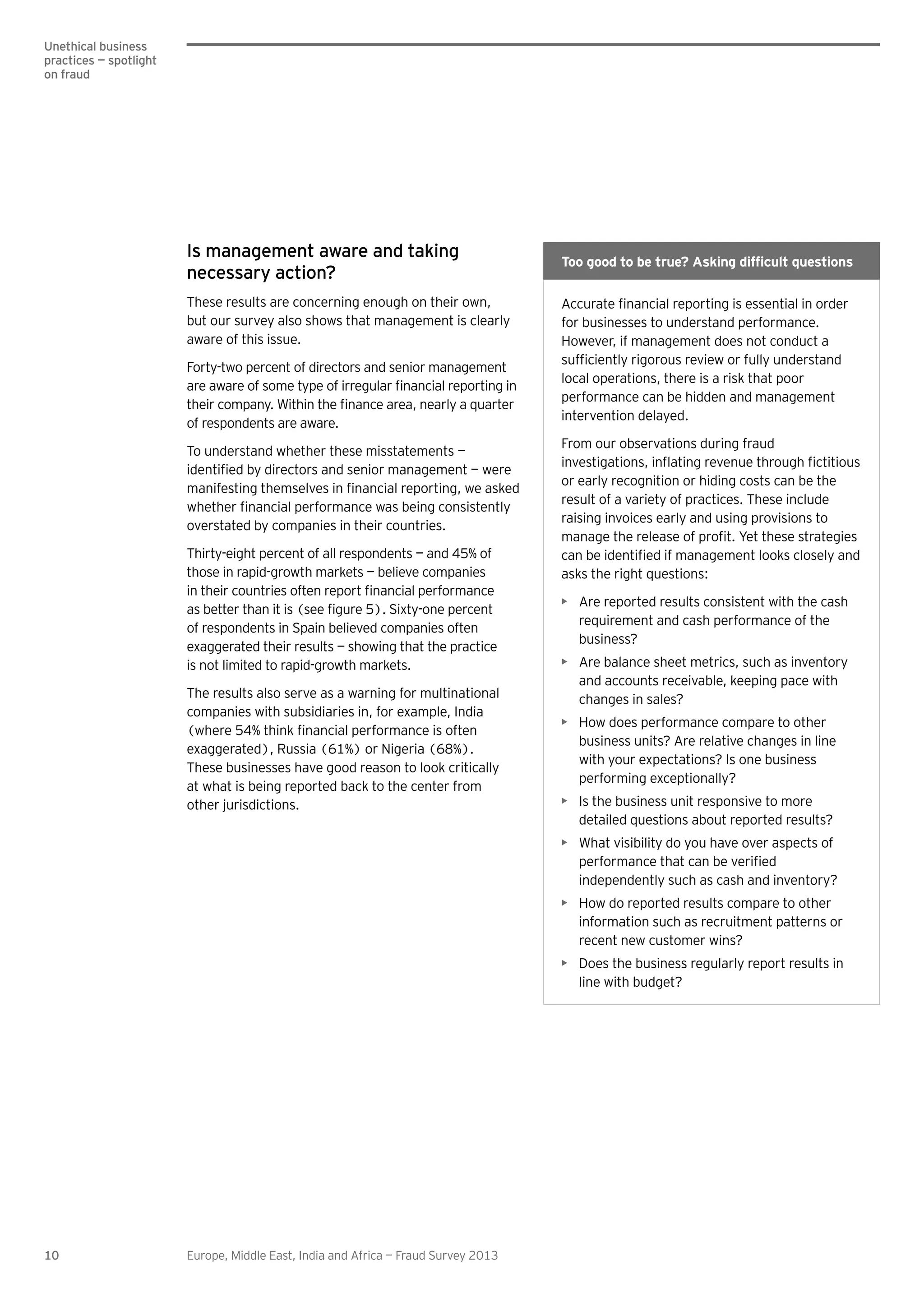

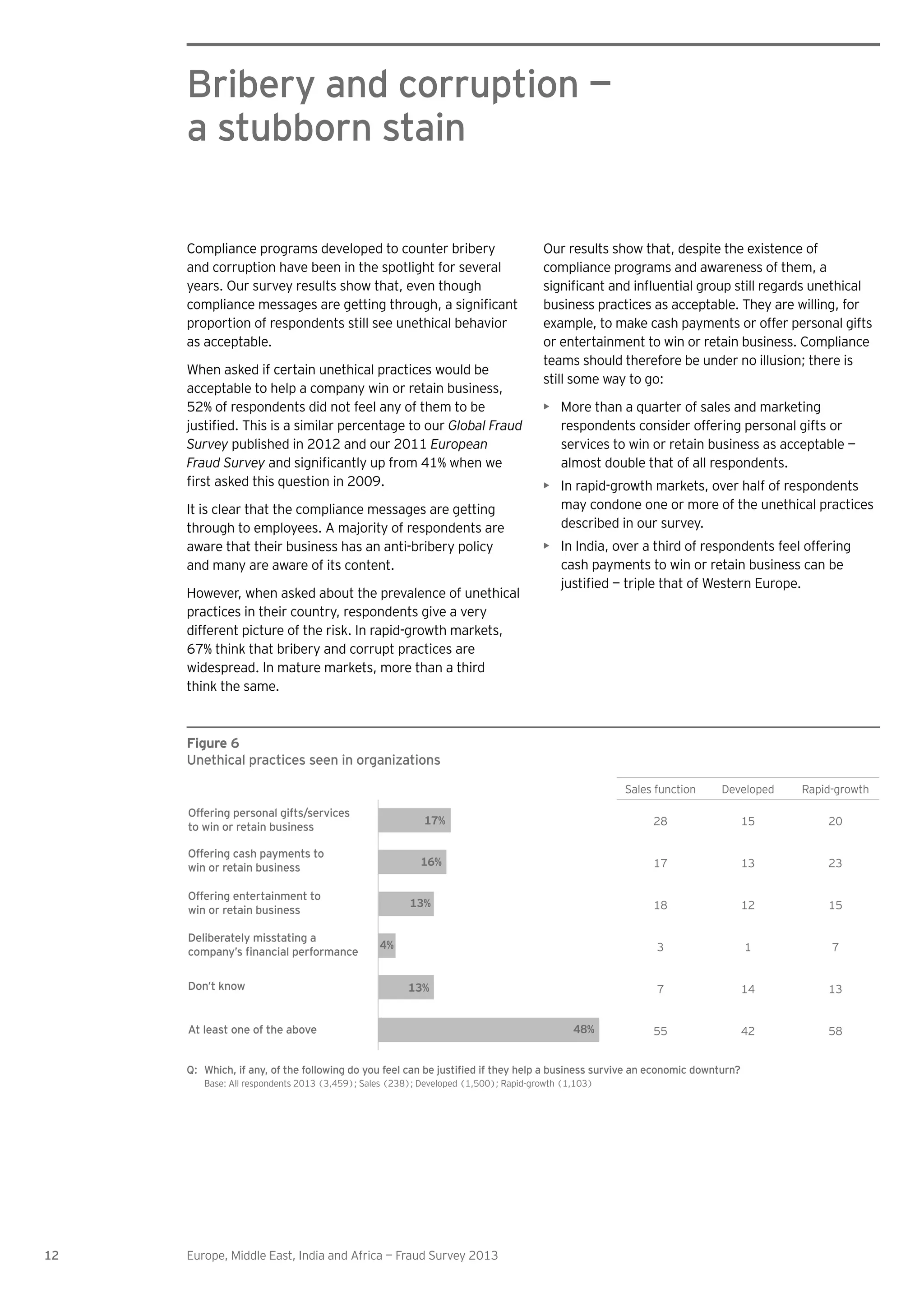

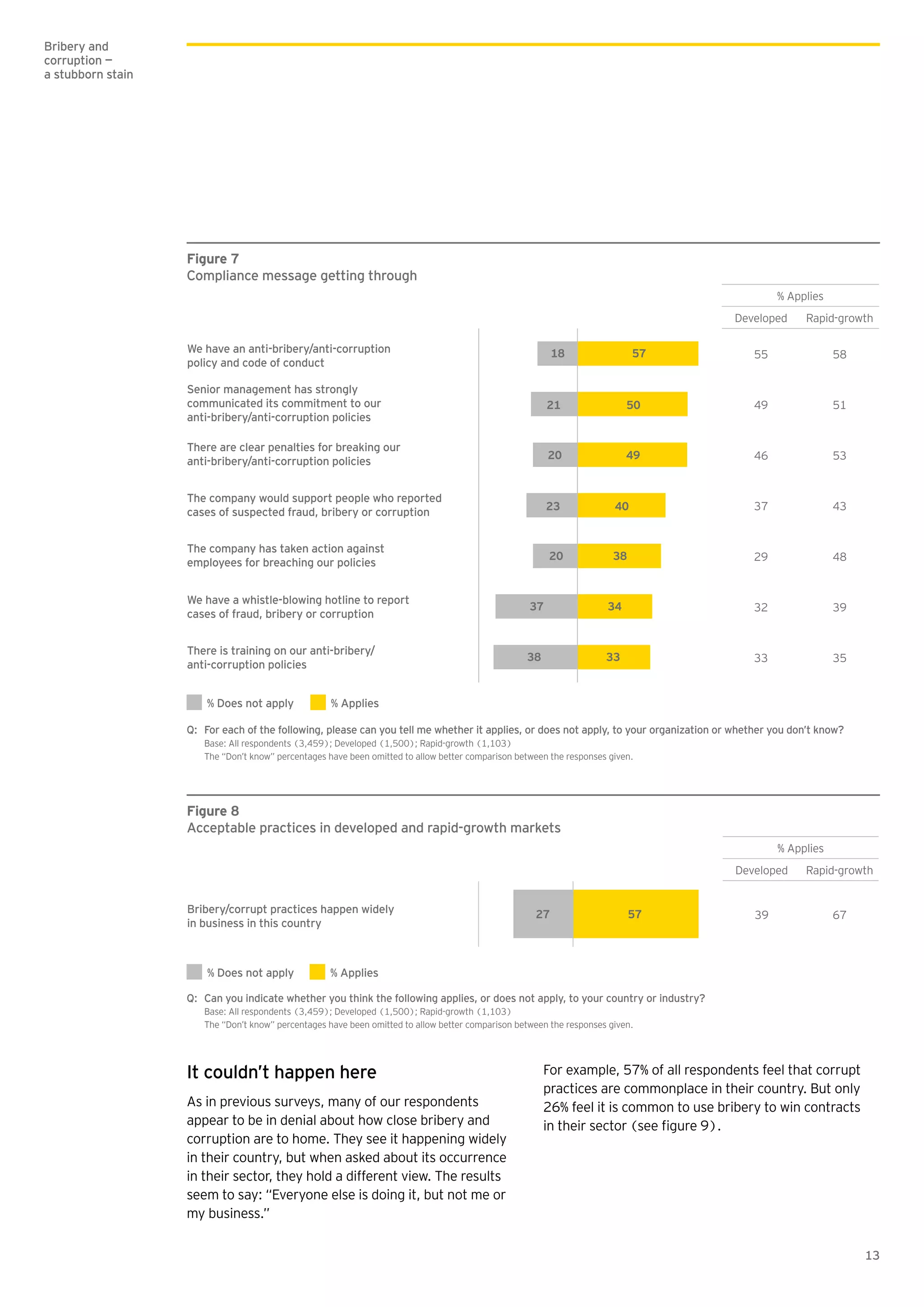

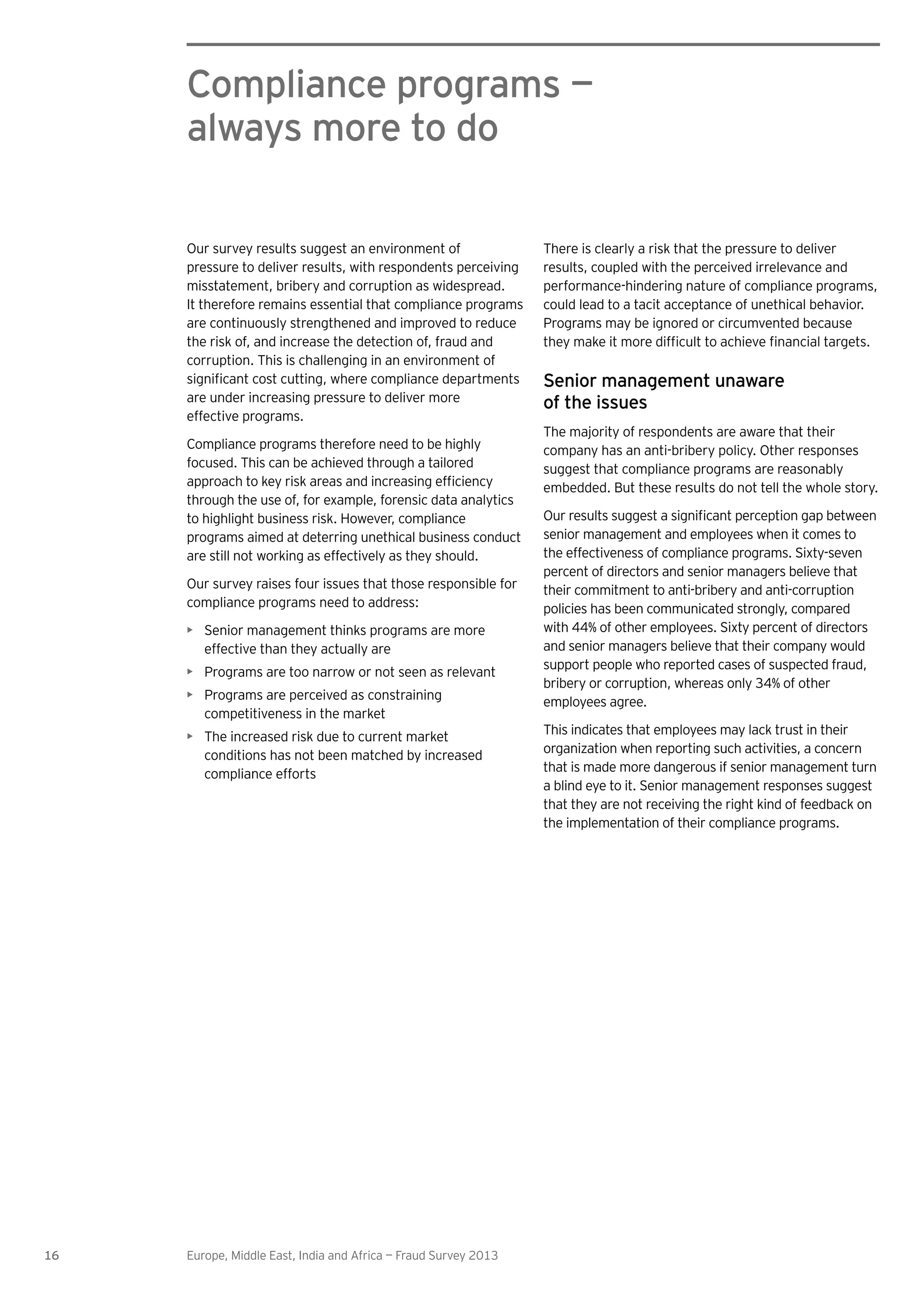

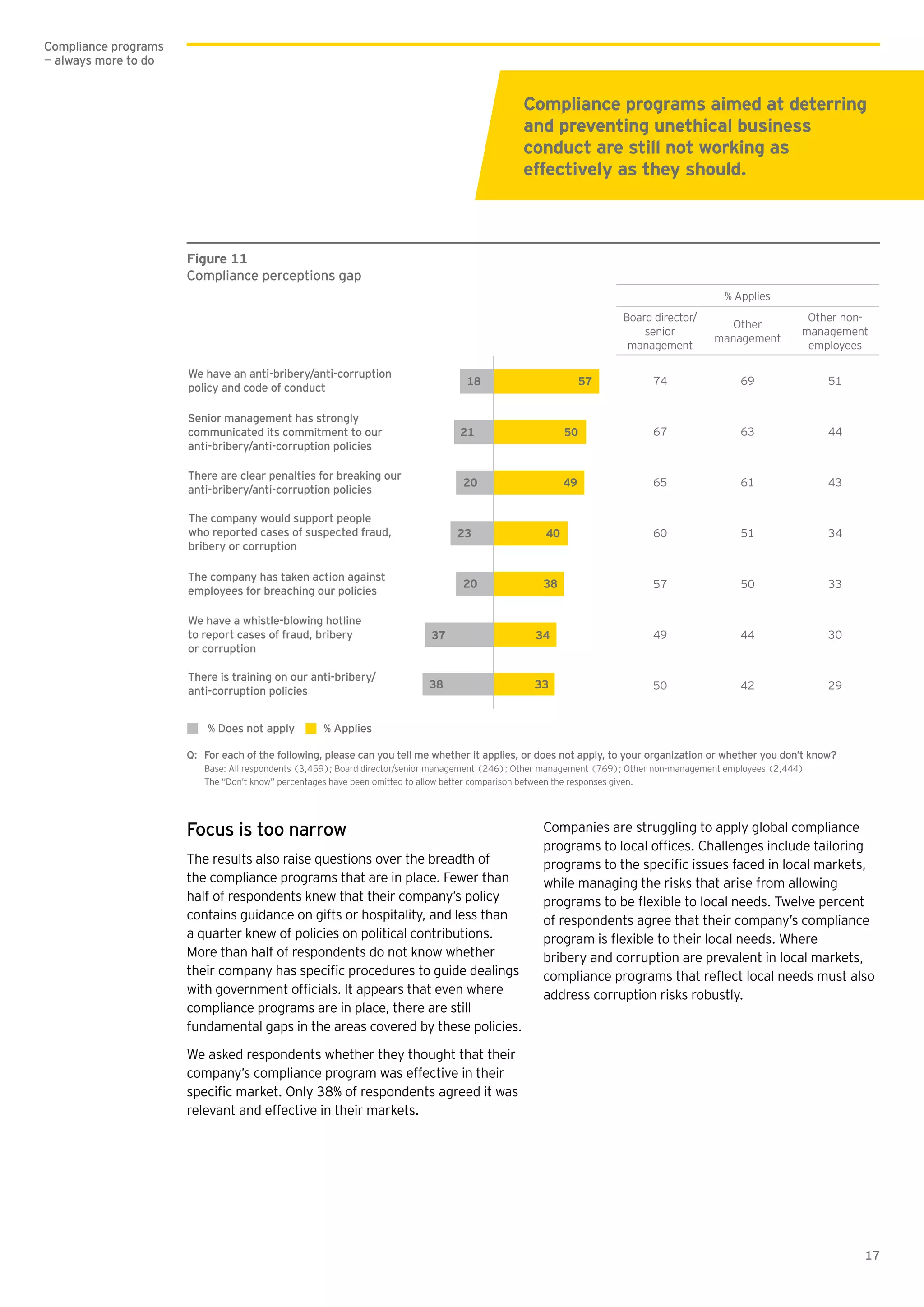

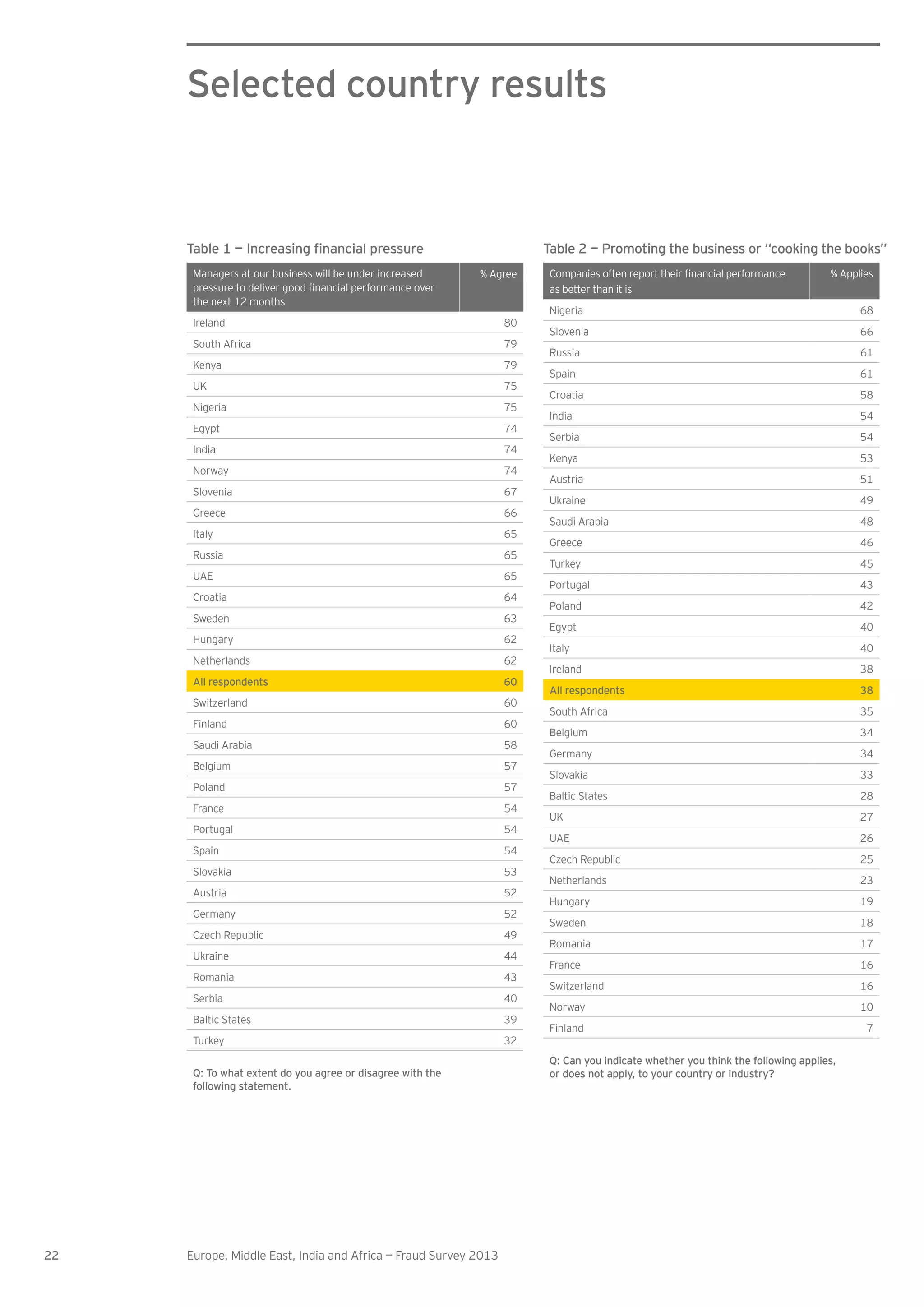

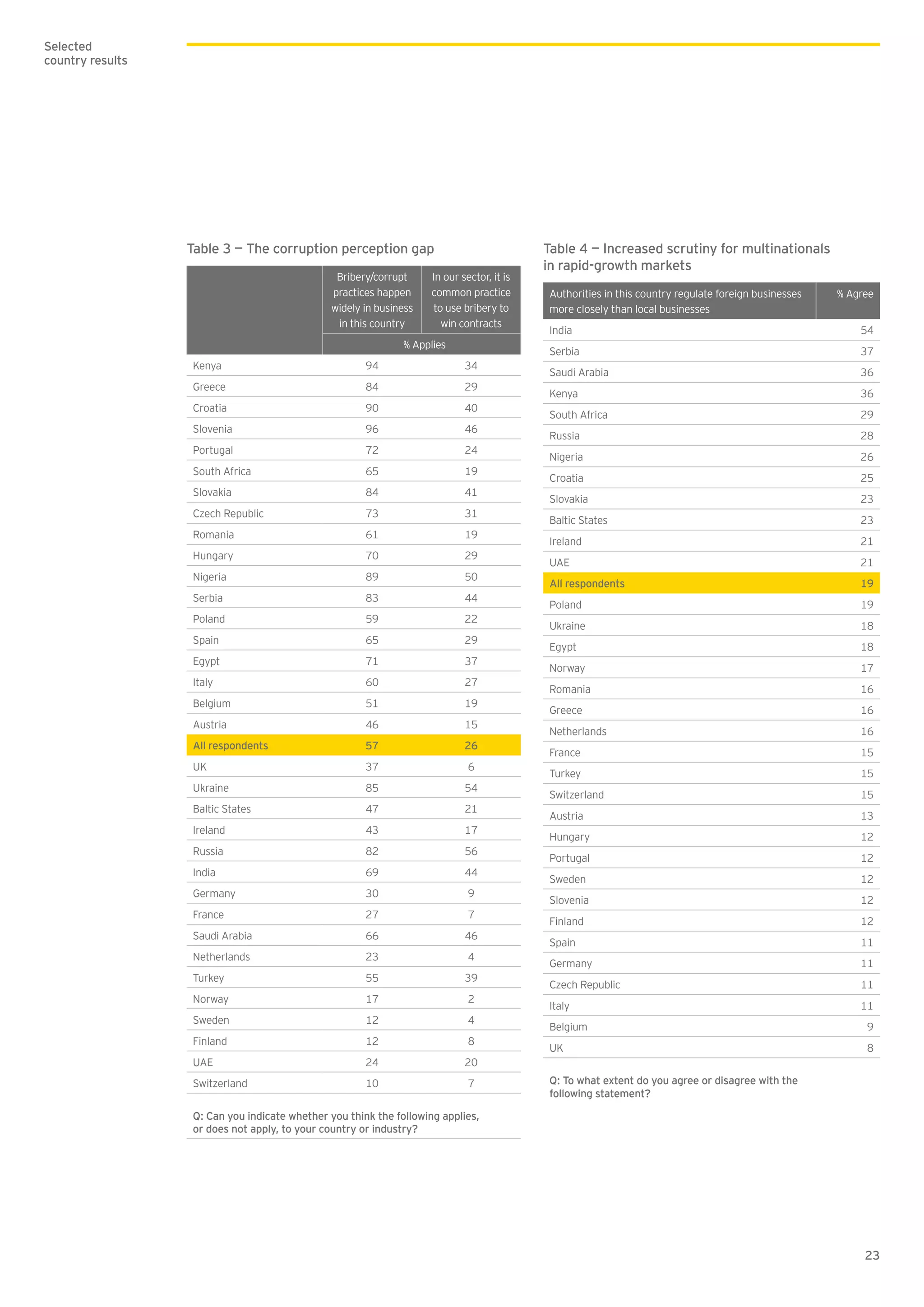

Management feels increased pressure to deliver growth in challenging market conditions. This pressure, combined with downward pressure on salaries and bonuses, increases the risk of unethical conduct like fraud. The survey found evidence that some companies are engaging in practices like overstating revenues and underreporting costs. While compliance programs have made progress, they may not be as effective as management thinks, and some employees feel such programs harm competitiveness. Businesses must own the problem of fraud risk, ensure compliance is relevant to all employees, and continue asking questions to effectively manage this ongoing challenge.