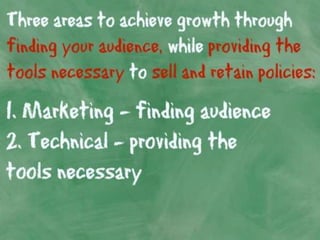

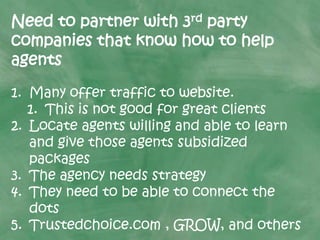

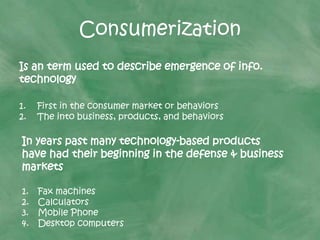

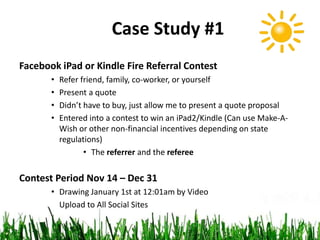

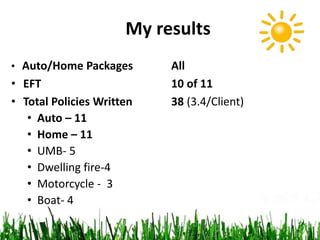

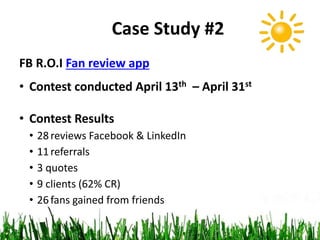

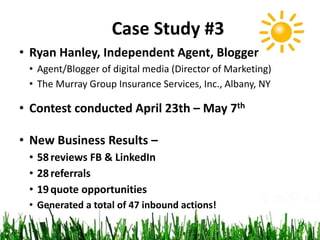

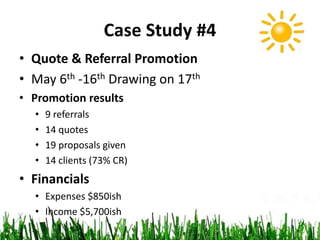

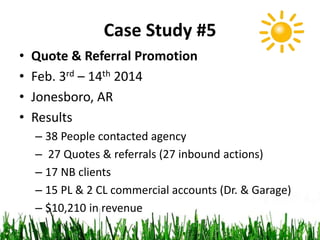

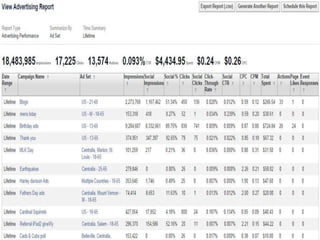

This document discusses how insurance agencies can leverage digital marketing and social media to grow their business. It provides examples of social media marketing campaigns run by independent insurance agents that generated new customers and significant revenue. Specifically, the document discusses how agents can create branded content, partner with third parties, and use tools like contests and reviews on Facebook and LinkedIn to find new leads and convert them into clients. Case studies show campaigns achieving customer acquisition costs as low as $76 and return on investment as high as 309%. The document advocates that 30-50% of an agency's business could come from digital marketing within the next 5-10 years.