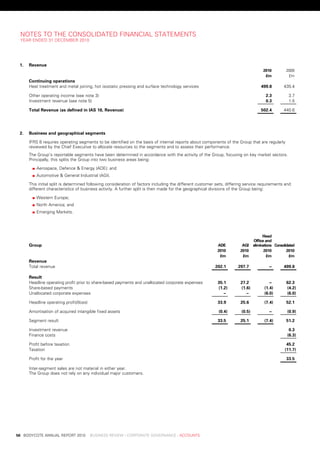

This document is Bodycote's 2010 annual report. It summarizes the company's financial highlights for 2010 including revenue increasing to £499.8 million and headline operating profit increasing to £52.1 million. It also provides an overview of Bodycote's business which involves providing thermal processing services through its global network of facilities serving industries such as aerospace, defense, automotive, and general industrial.

![paGe title in Here [delete iF not required]

our Global networK

[paGe title line 2 iF required]

aerospace & defence power Generation oil & Gas automotive Civil eng, agriculture, rail & Marine

overview

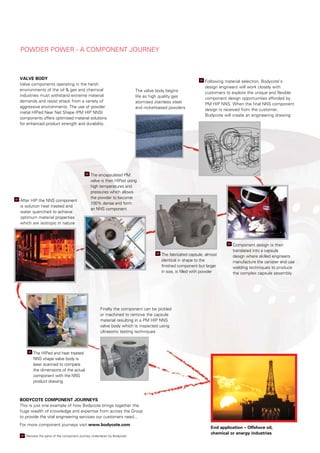

as the only truly global provider of subcontract thermal processing

services, bodycote is able to offer a significant advantage to its

customers. through an international network of plants, bodycote can

effectively utilise a wealth of knowledge, experience and specialist

expertise to deliver quality service when and where it is needed.

the network operates from 173 facilities, with customers able to

benefit from bodycote’s comprehensive range of services from

multiple locations. Customers know that if their business expands,

bodycote will have the capability to meet their needs. they know

that if they were to broaden their manufacturing footprint, bodycote

would be able to assist them. they know that they can obtain the

same process to the same quality standards from multiple locations.

north ameriCa

such a large network brings economies of scale, with technology

bodycote has 39 facilities in north america, concentrated where

developed at one location being available globally if the market

manufacturing and technical industries are located.

requires it.

the network includes five specialist operations, four offering Hip,

the bodycote network has a wealth of technical accreditations,

and the other offering surface technology. Hip capacity has recently

some industry or customer specific, others more general. individual

been expanded to ensure that bodycote is best positioned to satisfy

operations concentrate on the accreditations suited to their market.

its customers’ needs as the economic climate continues to improve.

although bodycote is headquartered in the uK, 89% of the Group’s

low pressure carburising capability has been similarly expanded.

revenue is derived outside the uK. with facilities in 26 countries,

this energy efficient technology can, for example, enable automotive

bodycote is truly global.

manufacturers to produce 7- and 8-speed automatic transmissions of

modest weight and compact dimensions, which assist in the quest

for lower emissions.

group revenue By market seCtor revenue By market seCtor – north ameriCa

aerospace & defence aerospace & defence

energy energy

automotive automotive

Civil eng, agriculture, rail & Marine Civil eng, agriculture, rail & Marine

other General industrial other General industrial

6 bodyCote annual report 2010 business review : Corporate GovernanCe : aCCounts](https://image.slidesharecdn.com/bc-ar2010-0-120111005242-phpapp02/85/My-cool-new-Slideshow2-8-320.jpg)

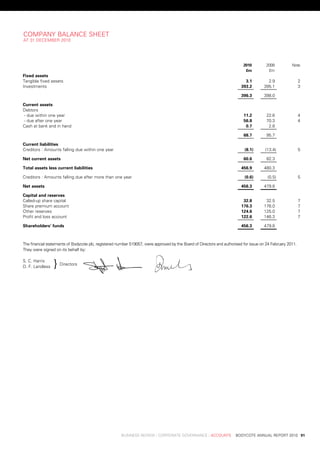

![paGe title in Here [delete iF not required]

[paGe title line 2 iF required]

tooling Consumer product electronics & telecoms Medical & environmental Mining

western europe emerging markets

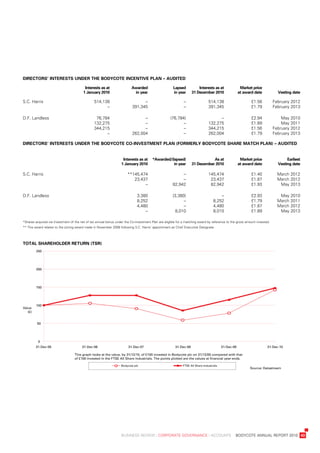

bodycote has 104 facilities in western europe including seven bodycote has 30 facilities in emerging geographies including

Hip plants and seven dedicated surface technology facilities. two dedicated surface technology plants, one each in singapore

the important French, German and scandinavian markets are and dubai. bodycote is the number one thermal processing provider

particularly well served with 28, 19 and 18 facilities respectively. in both brazil and eastern europe and is number two in China.

recent capacity extensions include expanded facilities aimed at these markets have a special emphasis in the Group’s growth

the needs of the wind energy market. strategy for the future.

Hip capacity has been significantly enhanced to meet customers’

growing needs for this service.

revenue By market seCtor – western europe revenue By market seCtor – emerging markets

aerospace & defence aerospace & defence

energy energy

automotive automotive

Civil eng, agriculture, rail & Marine Civil eng, agriculture, rail & Marine

other General industrial other General industrial

business review : Corporate GovernanCe : aCCounts bodyCote annual report 2010 7](https://image.slidesharecdn.com/bc-ar2010-0-120111005242-phpapp02/85/My-cool-new-Slideshow2-9-320.jpg)