Embed presentation

Download to read offline

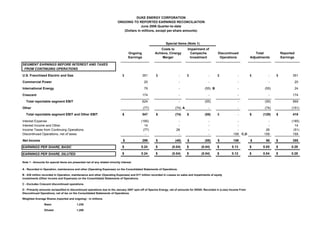

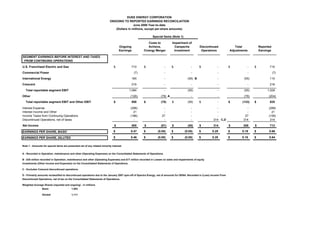

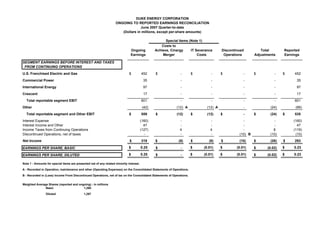

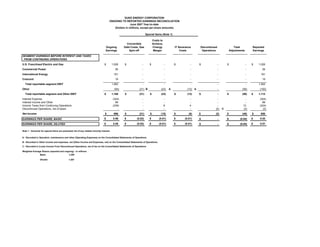

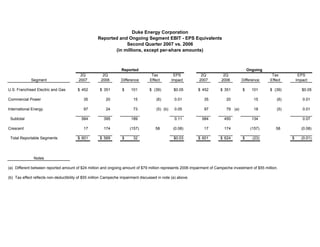

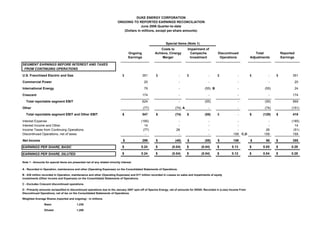

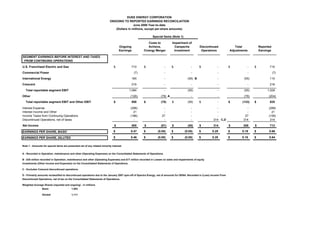

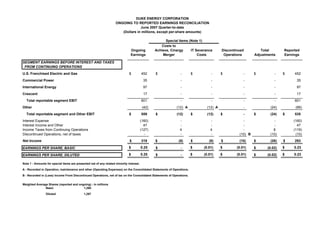

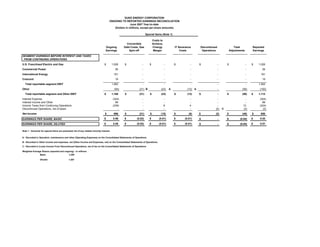

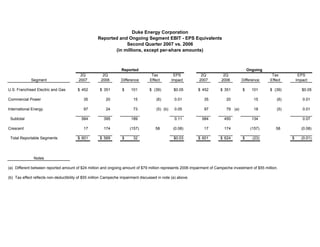

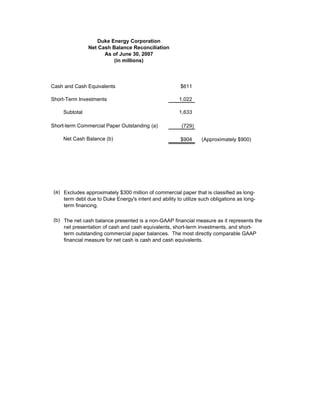

Duke Energy Corporation provided reconciliations of non-GAAP financial measures (ongoing earnings) to the most directly comparable GAAP measures (reported earnings) for the second quarter and first half of 2006 and 2007. Special items were excluded from ongoing earnings and included in total adjustments to reconcile to reported earnings. Management believes special items will not recur regularly.