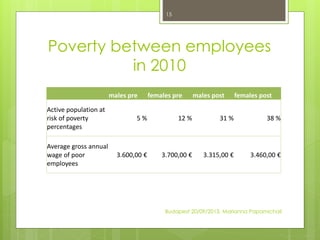

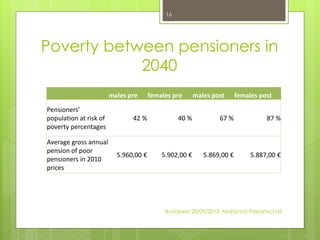

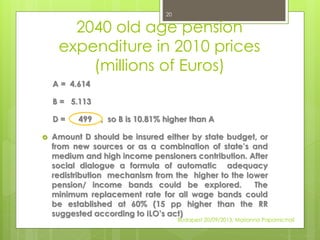

The document discusses measuring the adequacy and sustainability of social protection systems. It notes that adequacy measurements need to consider both poverty issues and sustainability. Representative replacement ratios weighted for different population groups are proposed to better capture adequacy. An example method is outlined to quantify additional funding needed to alleviate poverty among pensioners in 2040 and propose an automatic redistribution mechanism from higher to lower income pensioners. The document concludes that adequacy and sustainability measurements need to be further developed and should focus on both income and ensuring adequate protections.