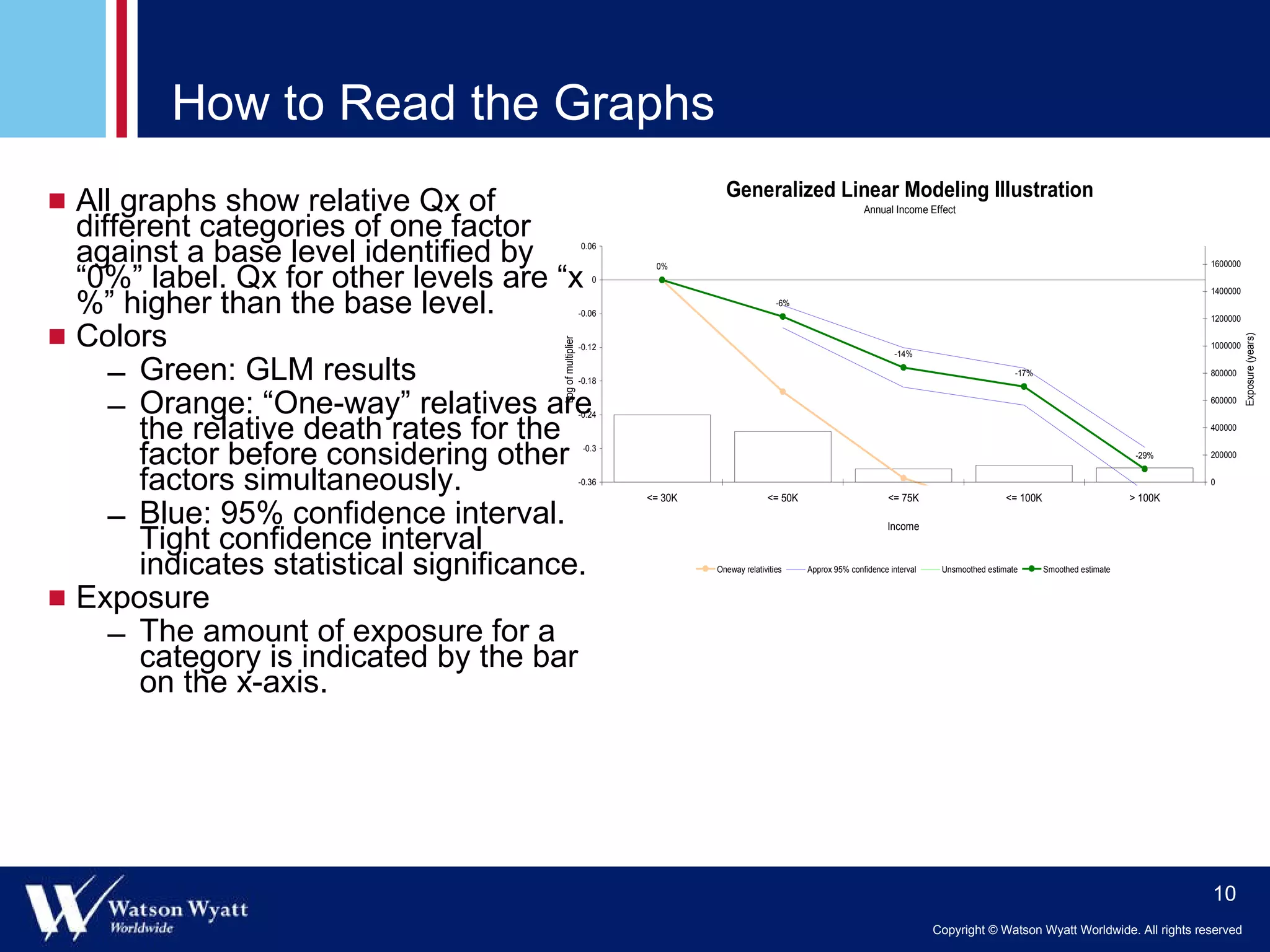

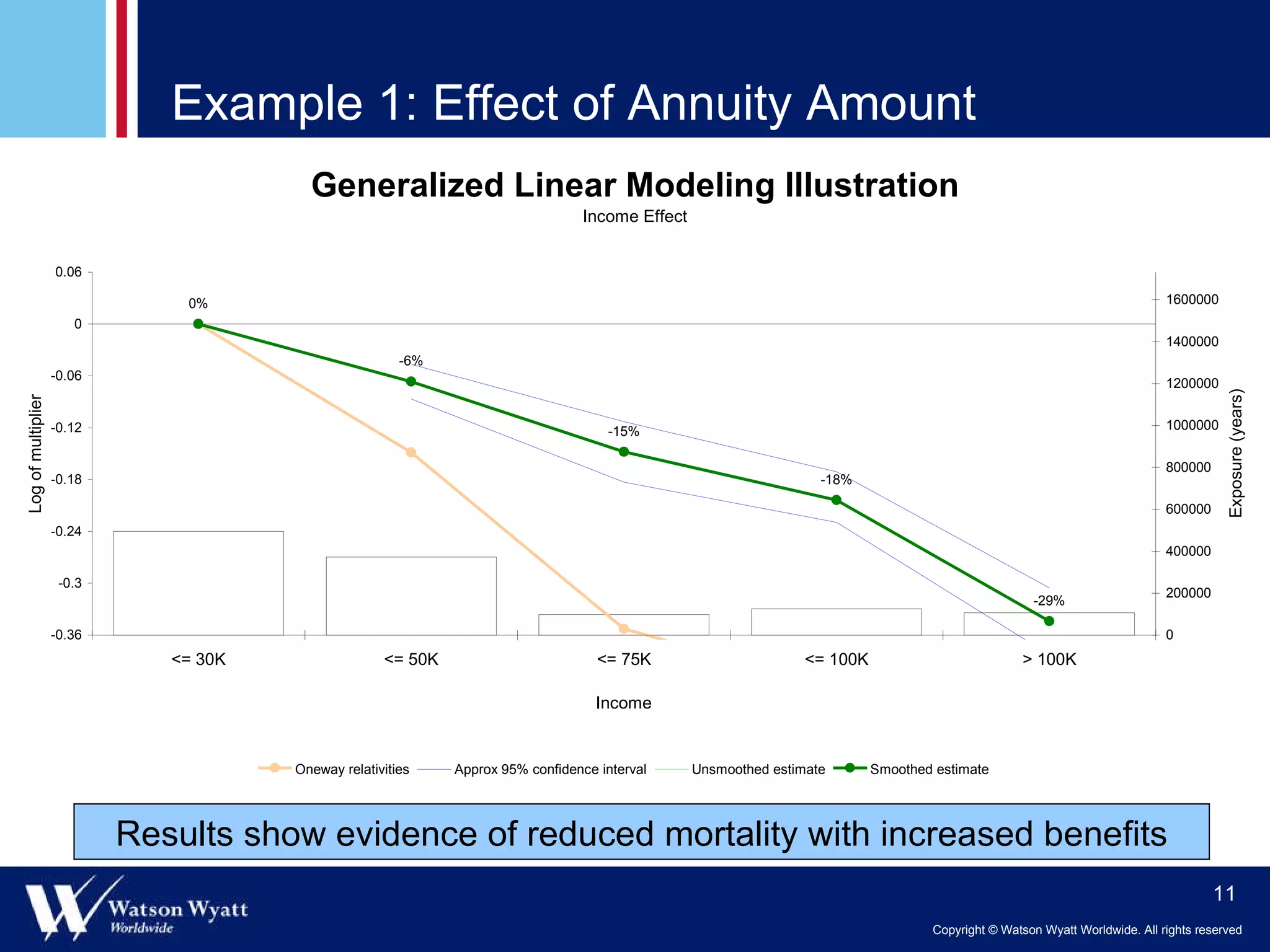

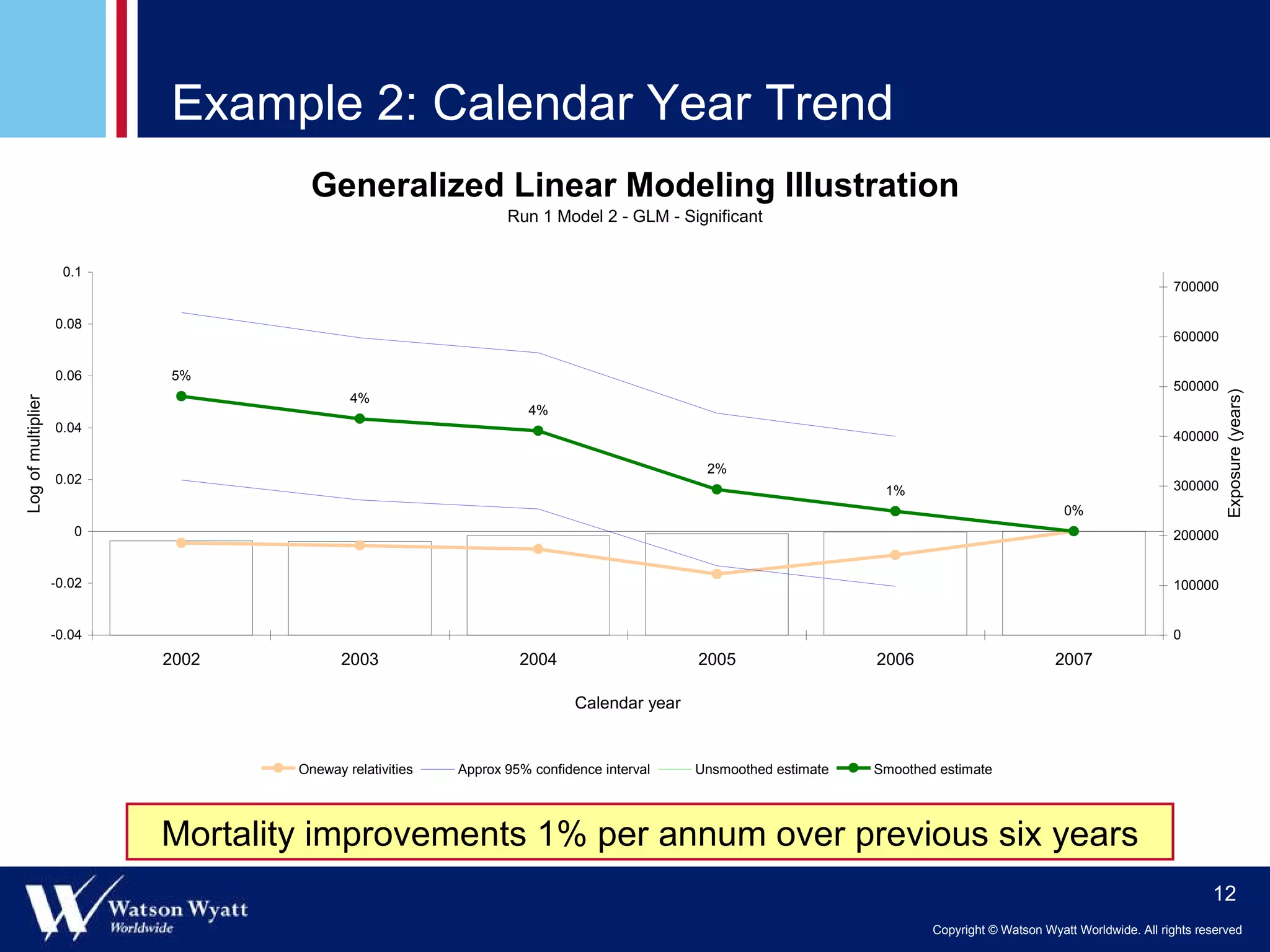

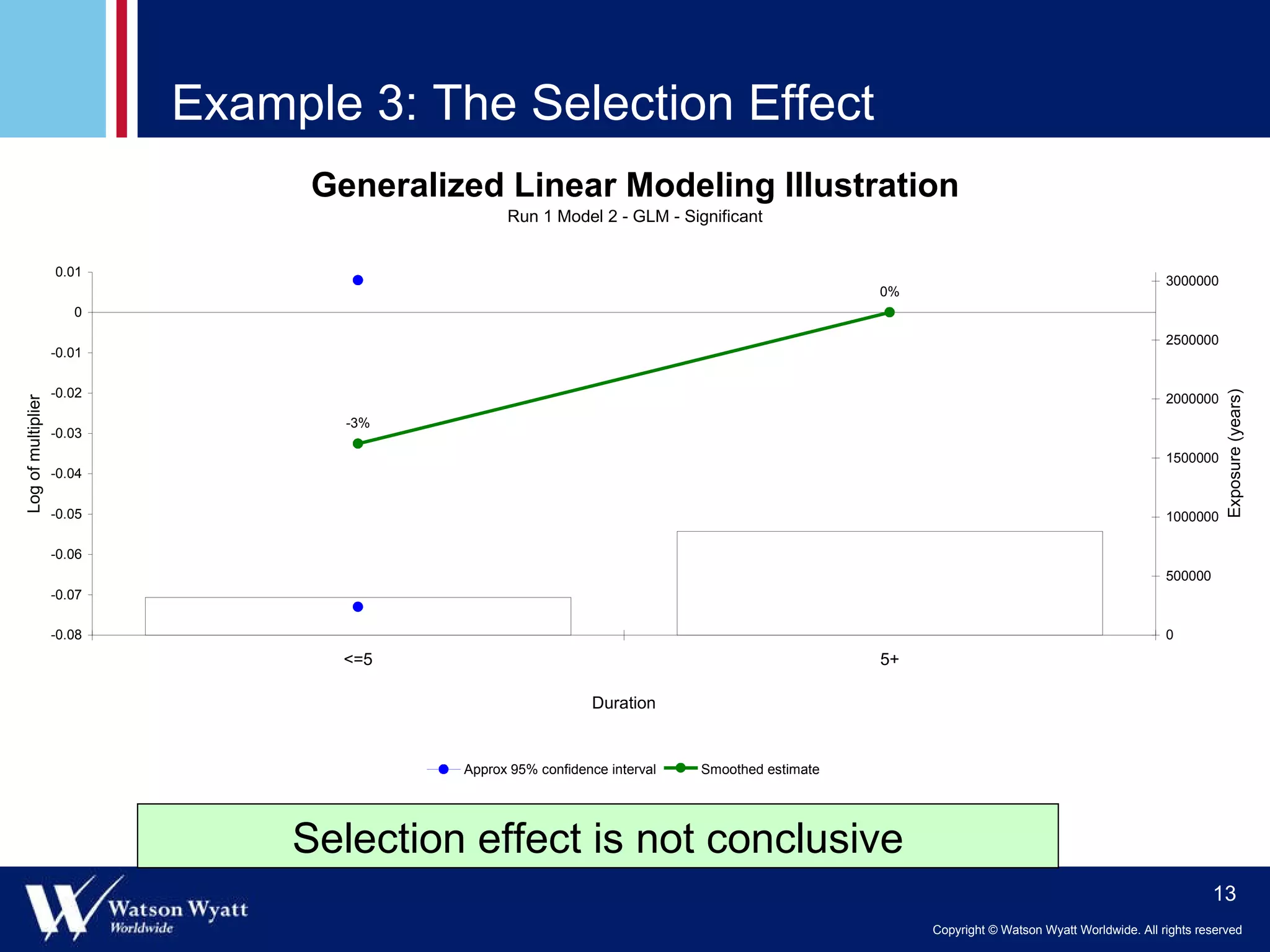

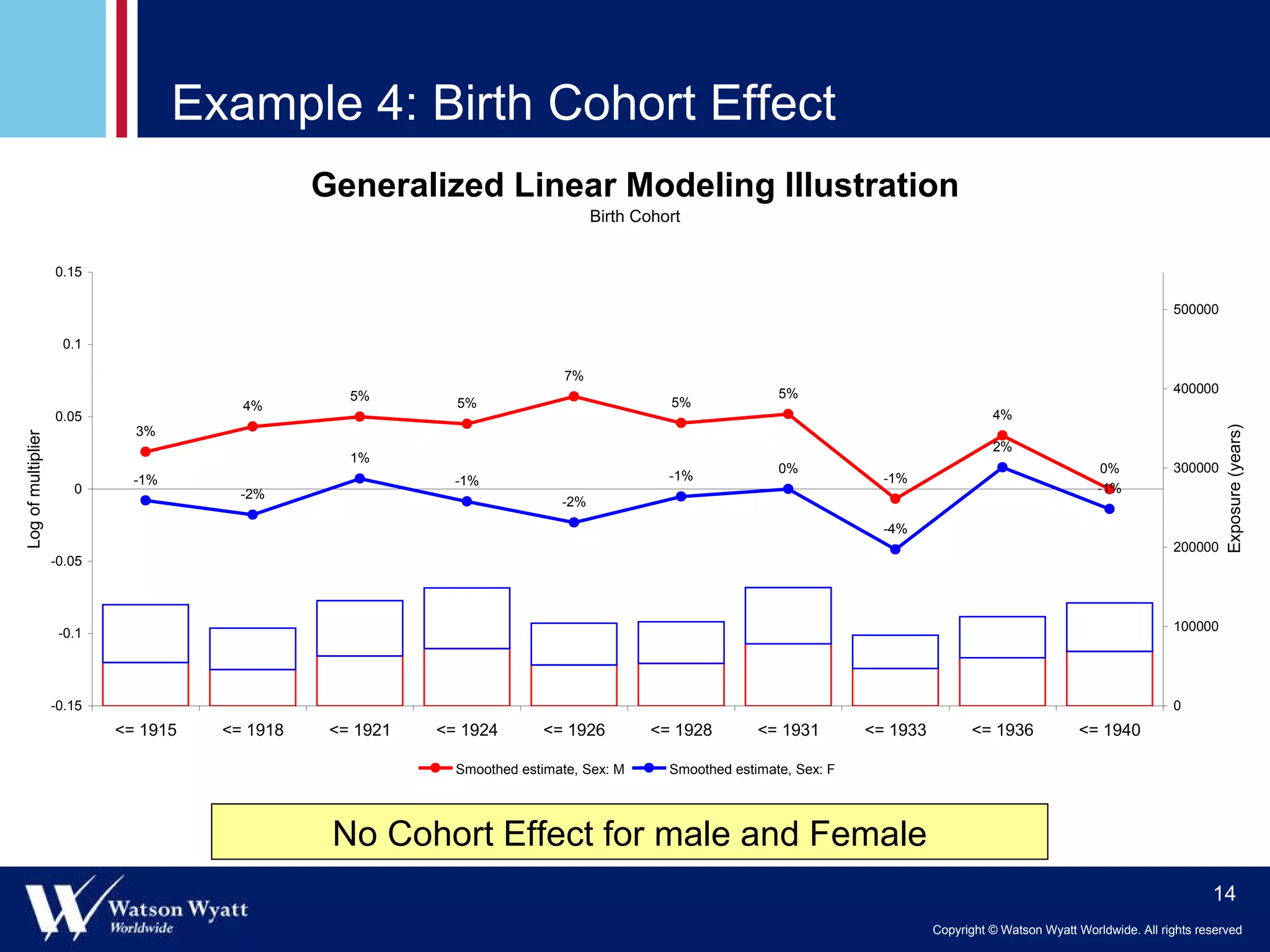

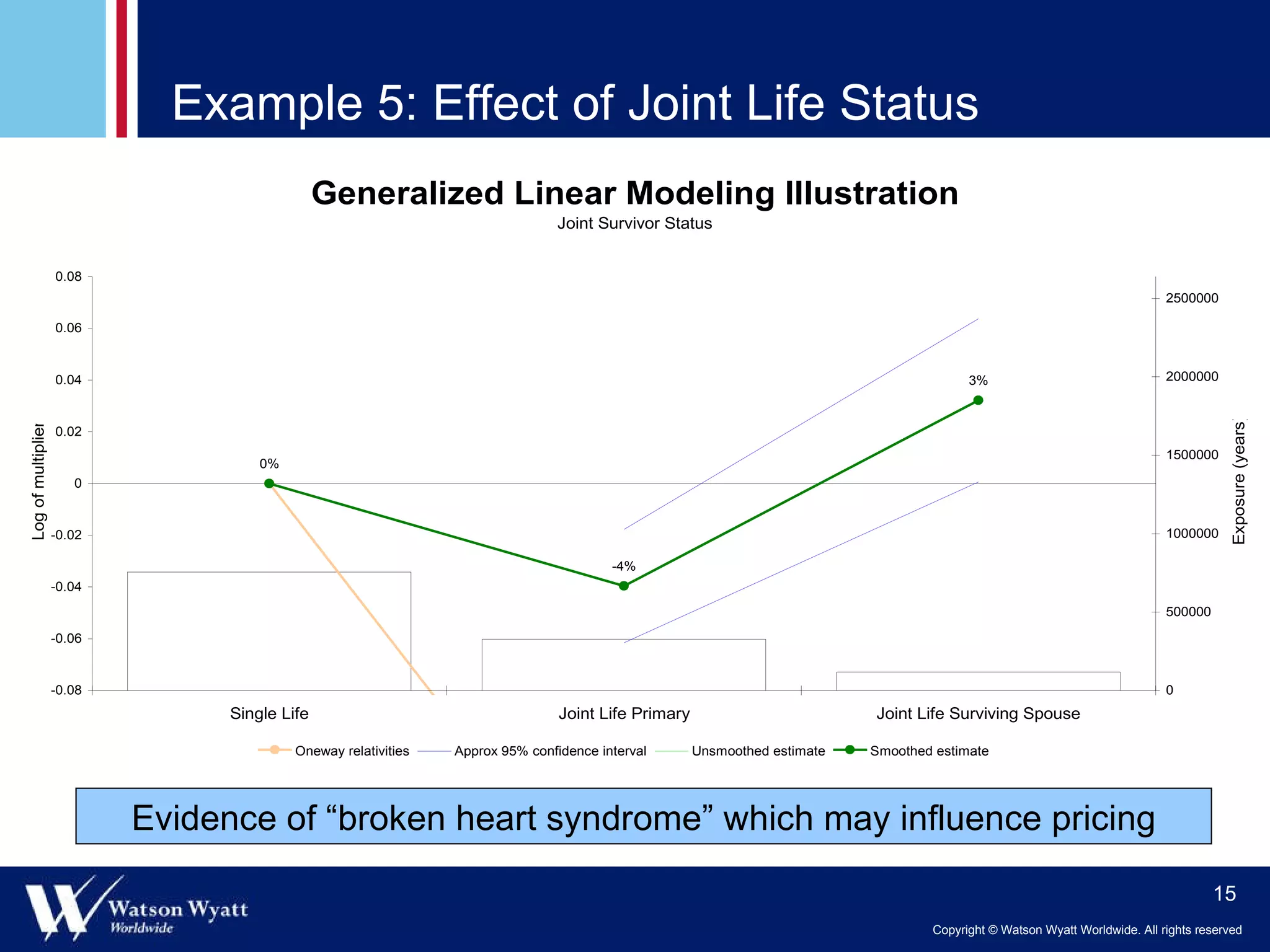

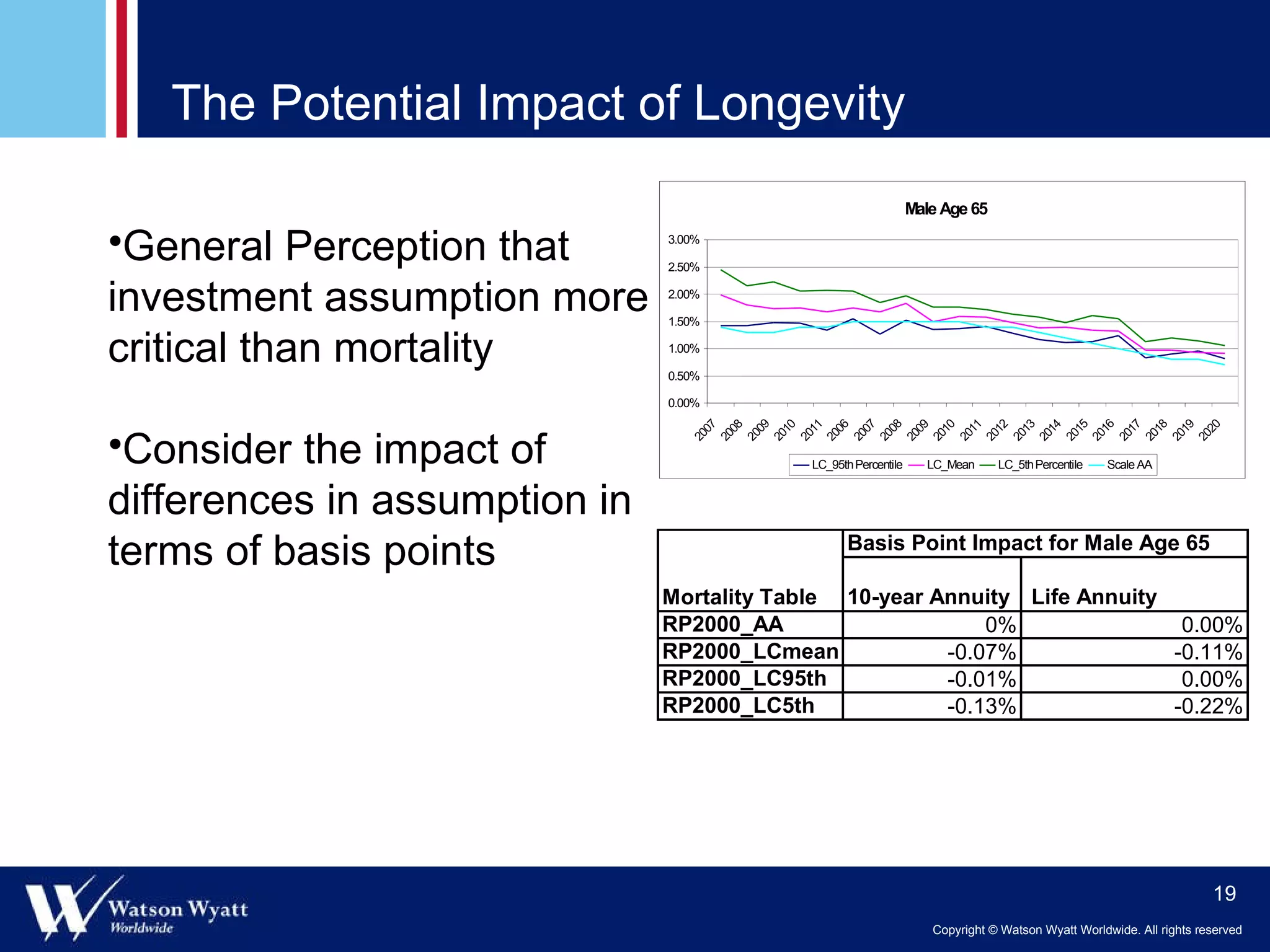

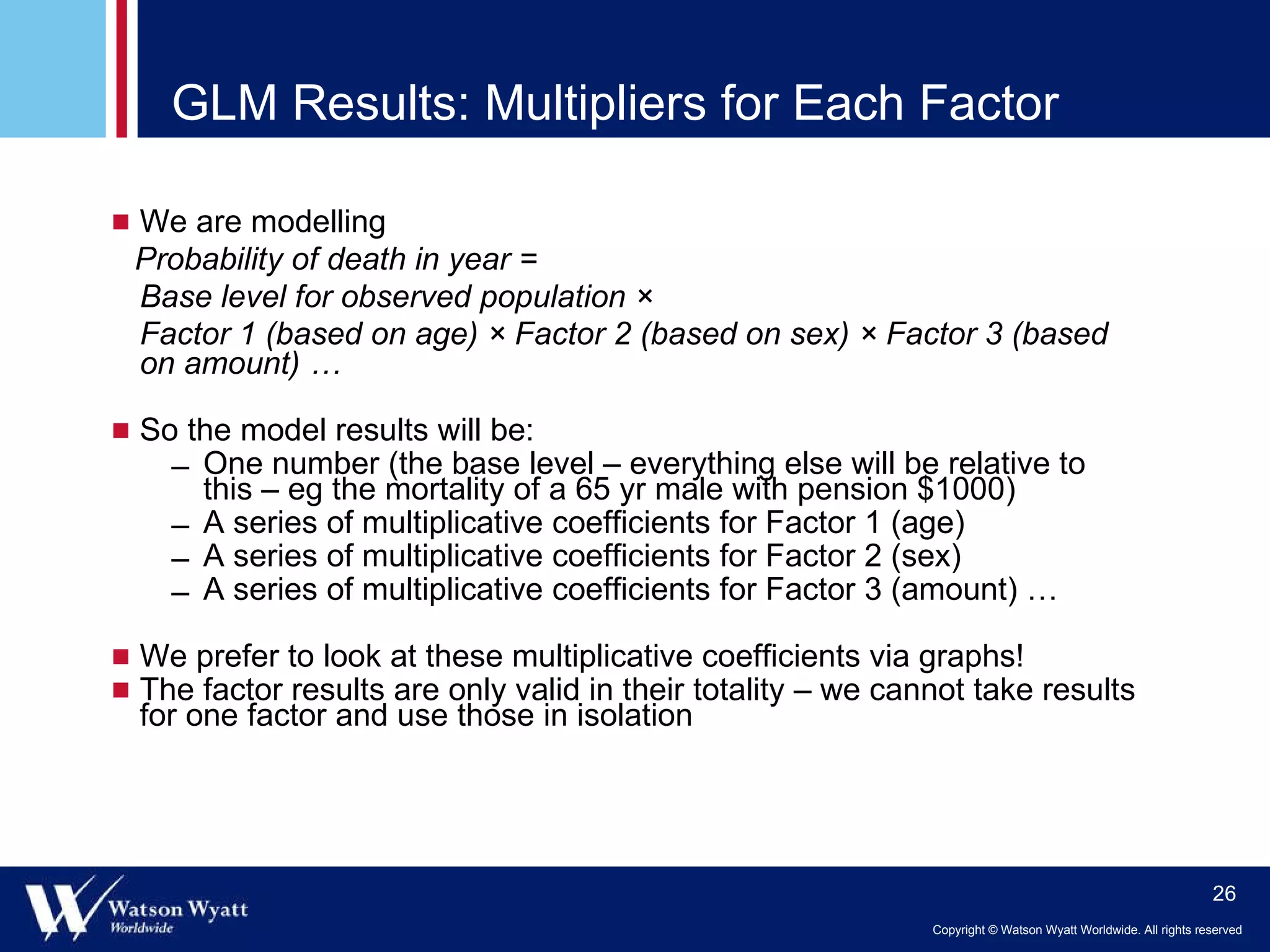

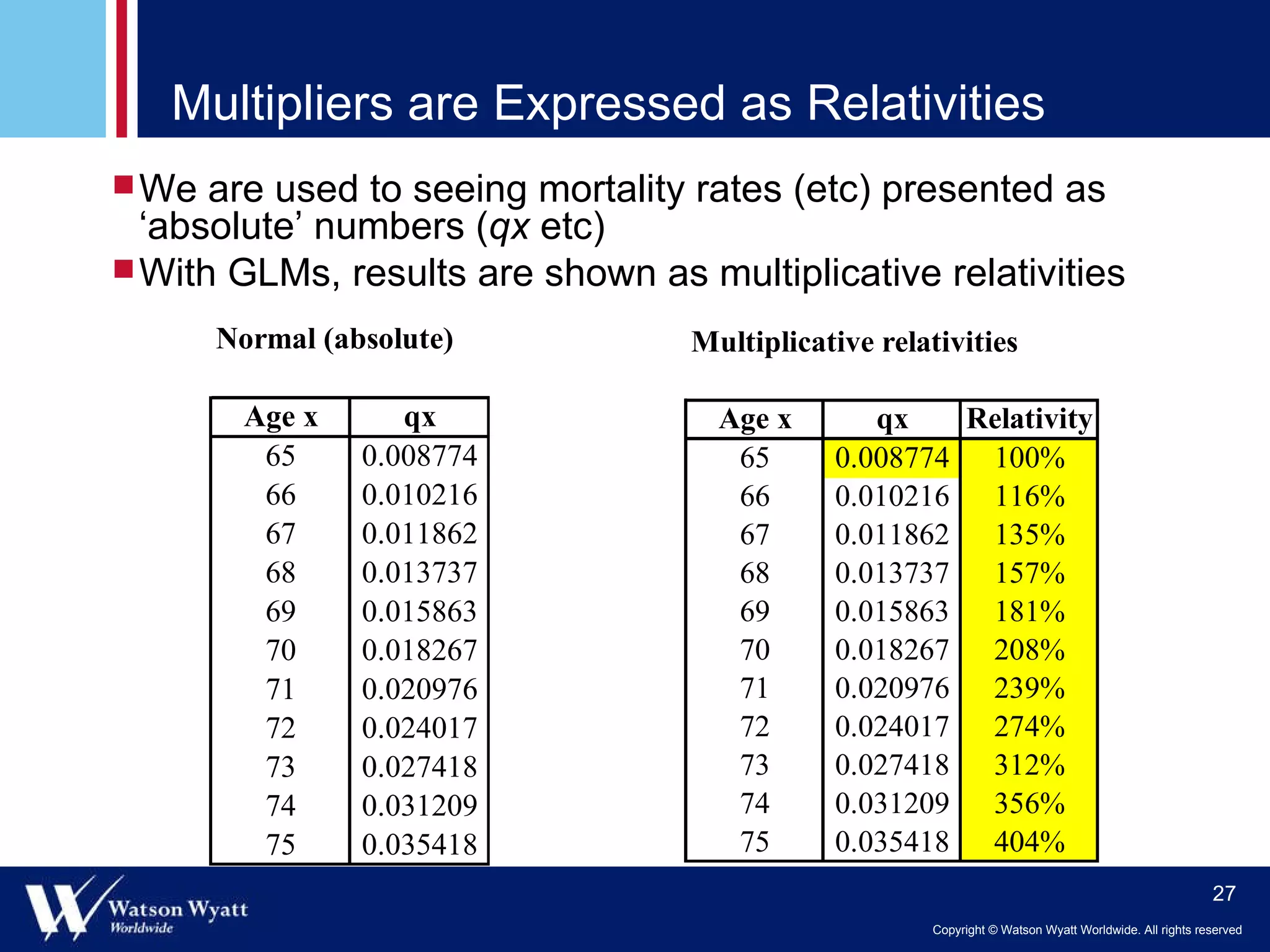

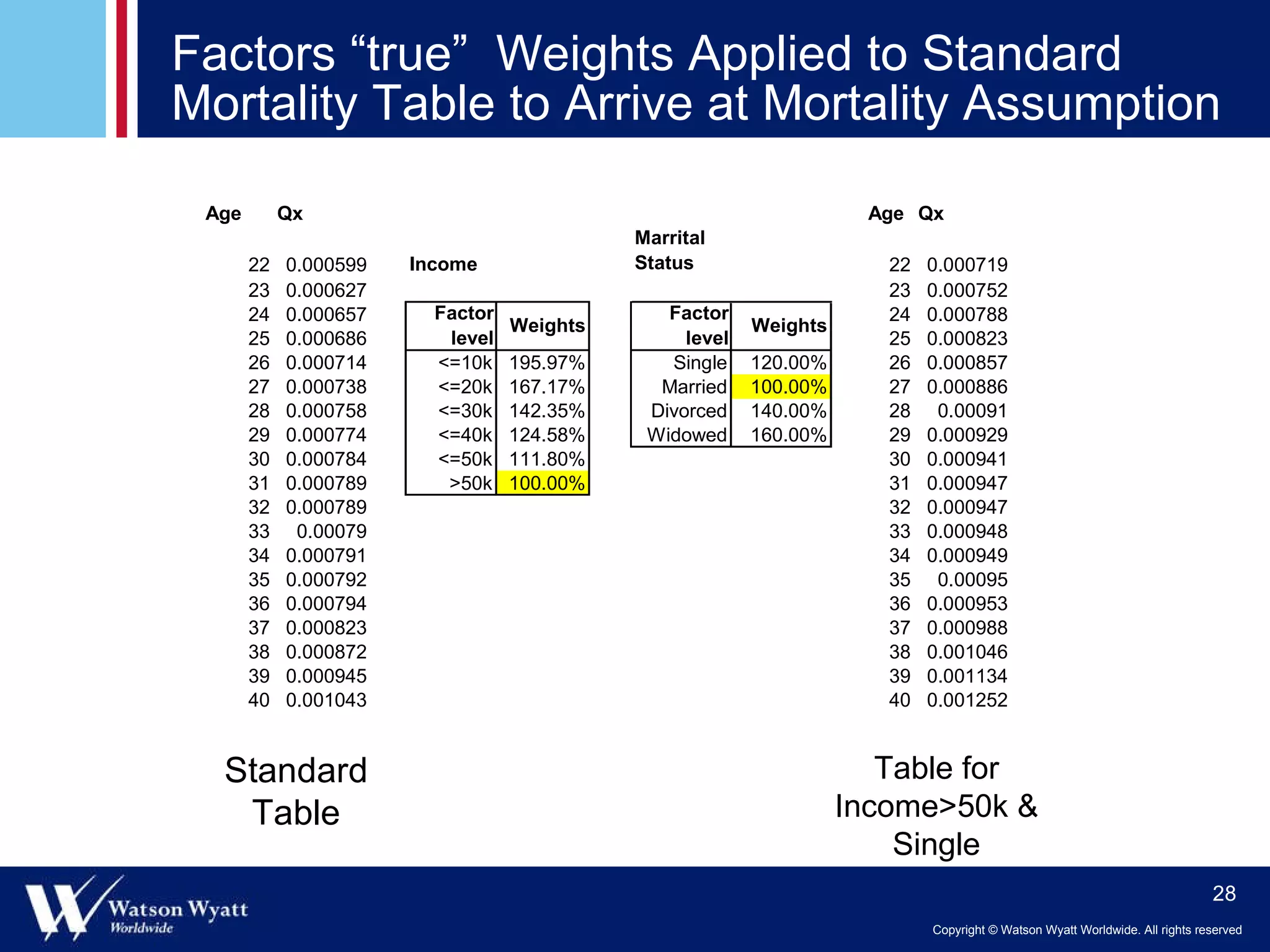

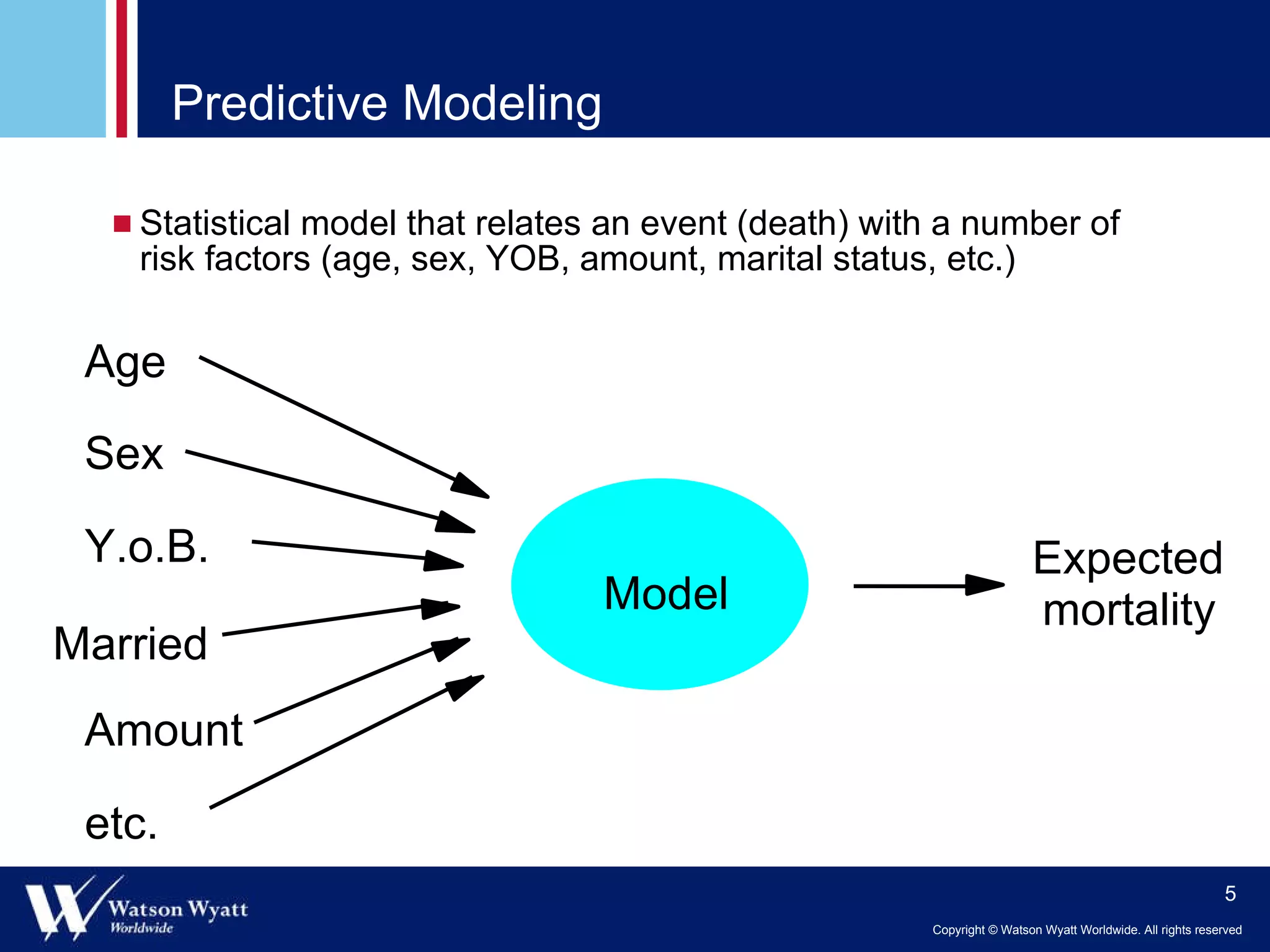

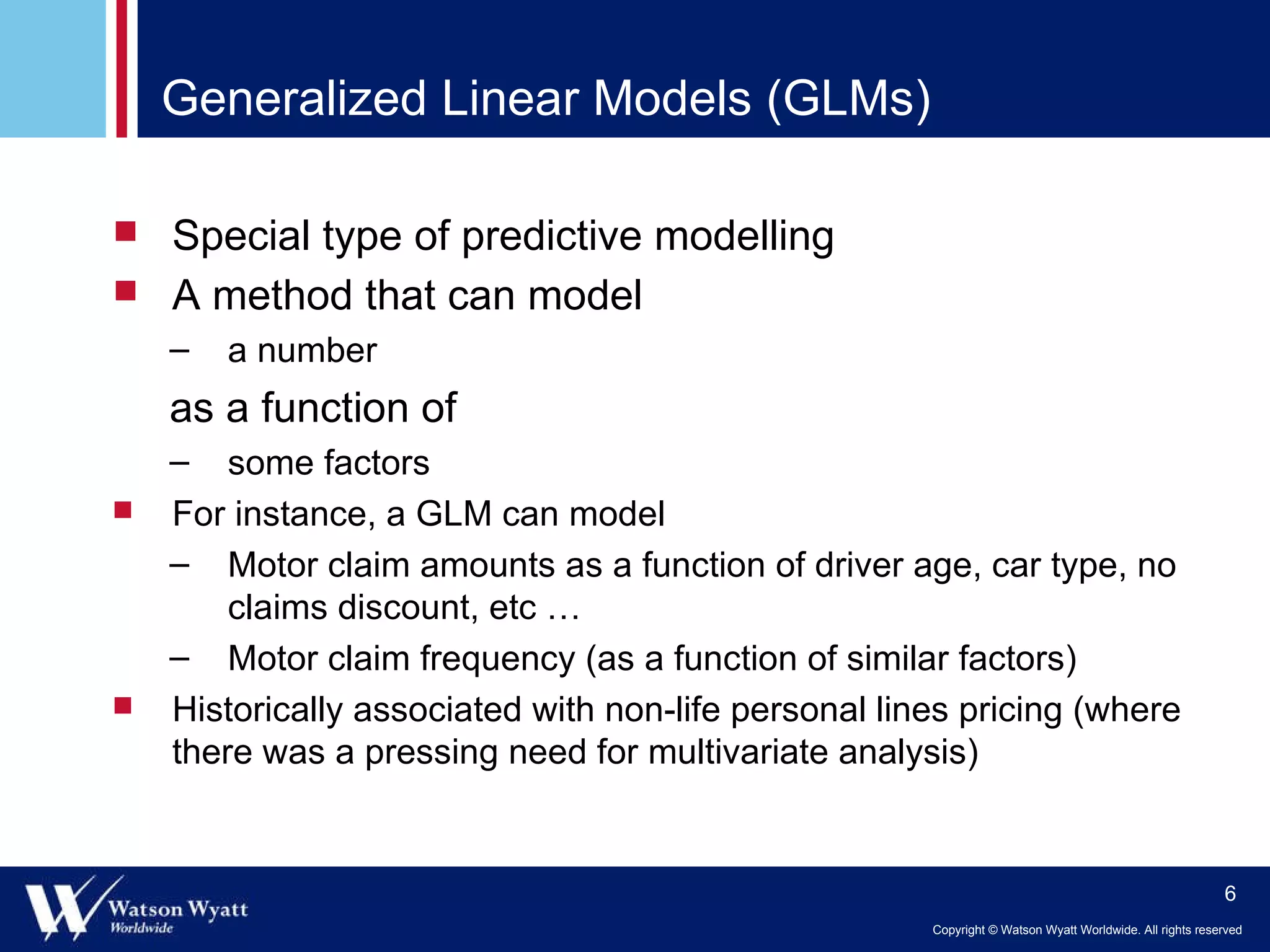

The document summarizes a presentation on modeling annuitant mortality using generalized linear models (GLMs). It discusses measuring current mortality experience, developing mortality improvement trends, and examples of GLM analyses showing the effects of factors like annuity amount, calendar year, joint life status, and birth cohort on mortality. Predictive modeling techniques from property and casualty are applied to better understand the "true" influence of multiple risk factors on mortality simultaneously.

![E[ Y ] = = g ( X ) -1 Observed thing (data) Some function (user defined) Some matrix based on data (user defined) as per linear models Parameters to be estimated (the answer!) Generalised linear models](https://image.slidesharecdn.com/mortalitypdsymposium2008-12833892716557-phpapp01/75/Mortality-Product-Development-Symposium-2008-7-2048.jpg)