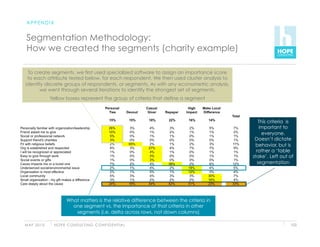

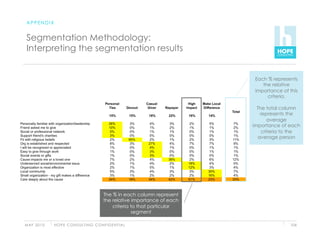

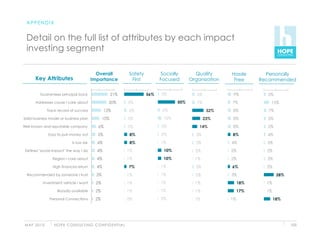

This document provides an introduction and context for the Money for Good project report. The project aimed to understand US consumer preferences and demand for impact investments and charitable donations. A survey of 4,000 individuals was conducted, with half having household incomes over $300k. The survey explored how nonprofits can obtain more donations, how donations can go to top-performing nonprofits, and the potential for impact investing. Key terms are defined, and the project team is described. The report will summarize findings and recommendations based on research into donor and investor behaviors and preferences.

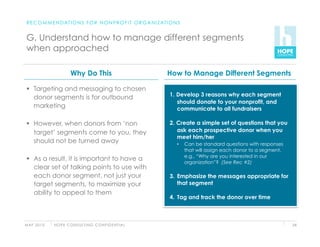

![R E C O M M E N D AT I O N S F O R N O N P R O F I T O R G A N I Z AT I O N S

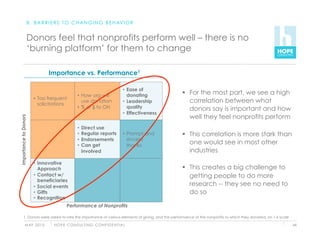

D. Develop simple, consistent outbound marketing

that appeals to target segments

Why Do This Some Ideas…

Donors give for different reasons, and Create outbound marketing approach

thus respond to different appeals that appeals to target segments, i.e.,

• Channels for communication and asks

Donors want simple information, and • Look and feel of website and images

• Consistency in all messages

are not willing to do a lot of research

Communicate a few, simple messages

While many donors want general

• Simple story that appeals to 1-2 segments

performance information, and want • Supported by a few key metrics

to know how their gift will be used,

different segments have different

Create brief summaries / asks for

“hooks” that will inspire them to give

donors, nuanced by target segment

• E.g., a hospital could focus on:

a) appealing to the families of current When you donate to [org name], 99 cents out of

and past patients; every dollar go to help the end beneficiaries…

b) how they benefit the local community Do you remember the great times you had at ___

c) their quality vs. other hospitals University? Well, now we need your help…

M AY 2 0 1 0 H O P E C O N S U LT I N G C O N F I D E N T I A L 31](https://image.slidesharecdn.com/moneyforgood-110119153901-phpapp02/85/Money-for-Good-32-320.jpg)

![R E C O M M E N D AT I O N S F O R N O N P R O F I T O R G A N I Z AT I O N S

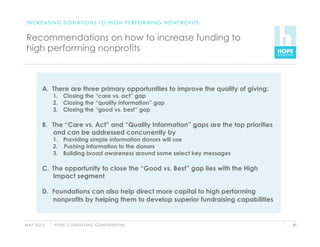

E. Prioritize investments based on what will drive donor

behavior

Why Do This How to Prioritize Investments

We measured the importance of various traits

Nonprofits should only invest where it

for the sector as a whole (see pages 17 - 18);

will change behavior – and should not nonprofits could survey their donors to see how

invest where it won’t they perform on each of those dimensions

1.0

Nonprofits need to understand what Unsatisfied needs

0.9

donors want and how donors feel that

0.8

the nonprofit performs on those criteria

0.7

• Nonprofits can attract more donors by

Importance

improving on ‘unsatisfied needs’ 0.6

• Nonprofits can save time and money by 0.5

cutting back on areas of over-investment 0.4

0.3

Requires being strict – “Will changing 0.2

what we do here really cause donors to 0.1 Areas of potential

over-investment

[no longer] give to us?” 0.0

0.0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0

Performance

M AY 2 0 1 0 H O P E C O N S U LT I N G C O N F I D E N T I A L 32](https://image.slidesharecdn.com/moneyforgood-110119153901-phpapp02/85/Money-for-Good-33-320.jpg)

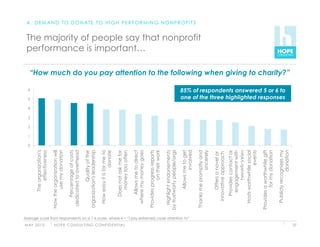

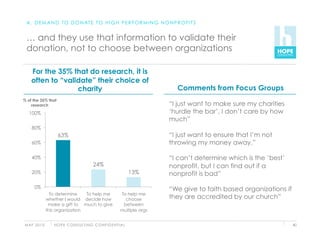

![A . D E M A N D T O D O N AT E T O H I G H P E R F O R M I N G N O N P R O F I T S

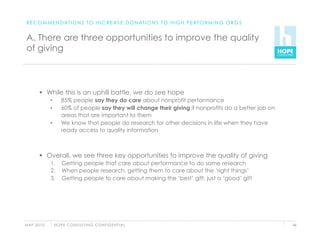

… However, very few people spend any time looking

into it…

People say they care about nonprofit

performance, but few look into it Comments from Focus Groups

% of all

Respondents “Giving to charity should be the easy

100%

thing in my life”

85%

80% “I don’t want to spend the time to do

research”

60%

“With known nonprofits, unless there is

40% 35% a scandal, you assume they are doing

well with your money”

20%

“[Third party validation]…would be

0% another layer of effort for me. I would

State that Do research on any have to figure out whether the rating

performance is "very gift

important" (1) company is reputable or trustworthy”

1. % responding 5 or 6 on a 1-6 scale, where 6 = “I pay extremely close attention to”

M AY 2 0 1 0 H O P E C O N S U LT I N G C O N F I D E N T I A L 38](https://image.slidesharecdn.com/moneyforgood-110119153901-phpapp02/85/Money-for-Good-39-320.jpg)

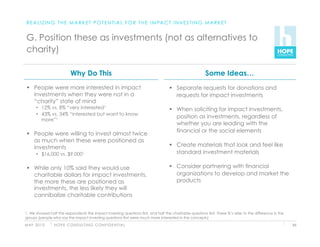

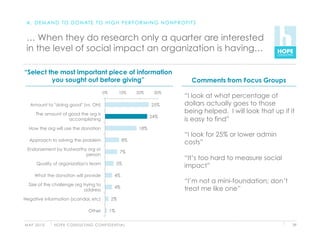

![R E A L I Z I N G T H E M A R K E T P O T E N T I A L F O R T H E I M PA C T I N V E S T I N G M A R K E T

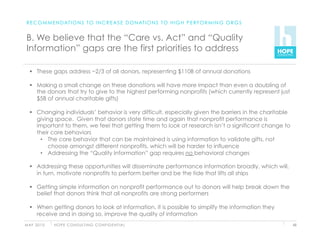

F. Make opportunities accessible to investors

Why Do This Some Ideas…

Many impact investment options for Work with large financial institutions (e.g,.

investors are in socially-focused venture Fidelity) to structure and/or offer impact

capital funds that have high minimum investments through their platform

investments Address barriers facing financial advisors,

• Well above the $25,000 “threshold” given their importance to investors and the

• Limits ability to reach majority of market

fact that only 20% ever raise proactively1

How important are the following factors in preventing

Investors stated that “Don’t know where to fund managers from doing [impact investing]1

find” was the second most important barrier 0 1 2 3 4 5

Lack of explicit client demand

Making these available at established Lack of knowledge of staff

financial institutions will help address the Concerns over legal/performance issues

“newness” concerns, and appeal directly to Research / resource constraints

one of the top three segments: “Quality Incentive structure for portfolo managers

Organization” Incentive structure for biz dev staff

Short timeframe to evaluate mgr perf

Tracking error limits or index mandates

Lack of extra fees for doing "extra" work

1. “Investment Consultants and Responsible Investments”, Social Investment Forum Foundation, December 2009

M AY 2 0 1 0 H O P E C O N S U LT I N G C O N F I D E N T I A L 85](https://image.slidesharecdn.com/moneyforgood-110119153901-phpapp02/85/Money-for-Good-86-320.jpg)