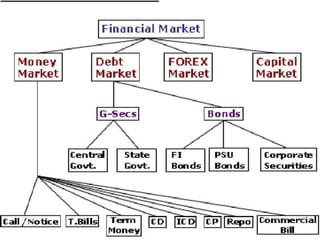

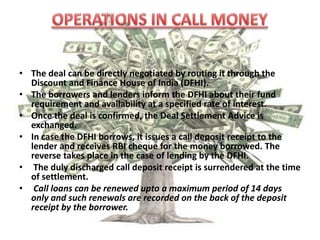

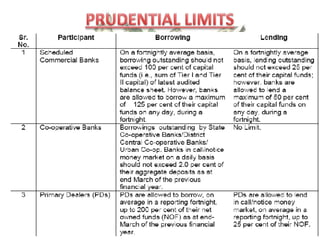

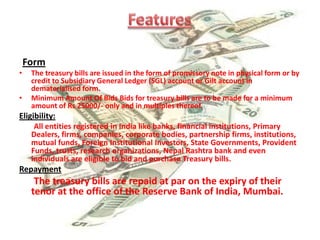

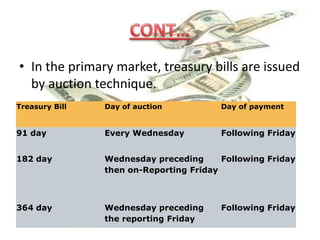

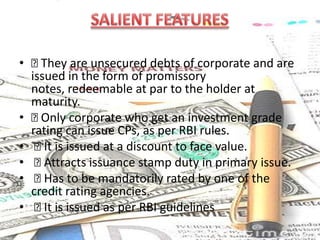

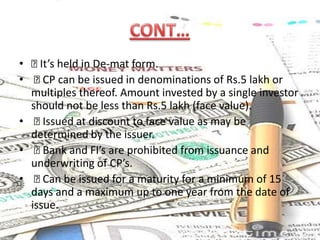

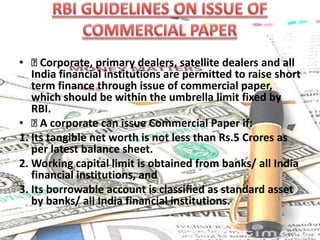

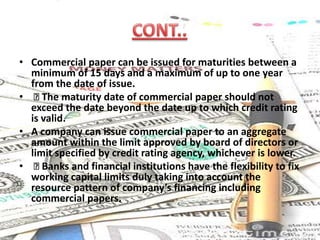

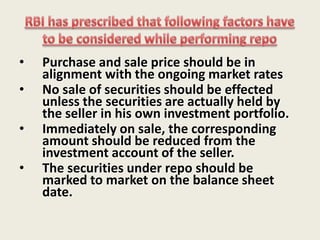

The document provides an overview of money market operations, including definitions and key concepts. It discusses the various participants in the money market such as commercial banks, corporations, pension funds, brokers/dealers, and government entities. It also describes the different sub-markets that make up the money market, including the call money market, commercial bills market, acceptance market, treasury bill market, and instruments like commercial paper, certificates of deposit, repos, money market funds. The objectives and importance of the money market for trade, industry, capital markets, and monetary policy are highlighted.