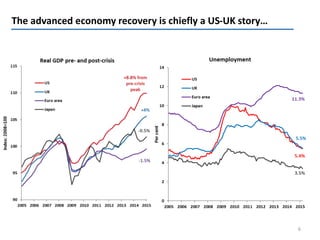

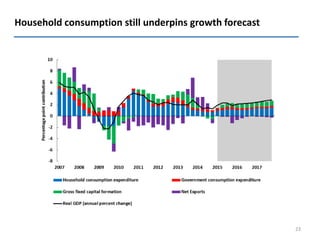

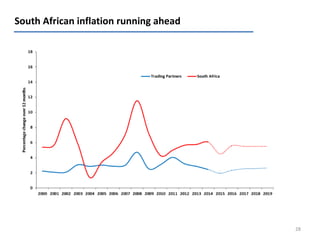

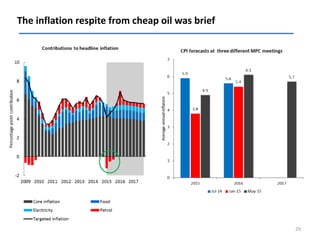

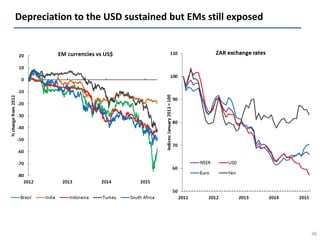

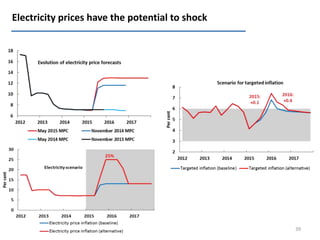

The document summarizes the June monetary policy review from the South African Reserve Bank. It notes that global economic conditions remain modest with advanced economies like the US and UK seeing better recovery while emerging markets weaken. In South Africa, growth forecasts are around 2% with a pickup expected later in the period. Inflation remains high around 6% due to factors like food and electricity prices, wage growth, and currency depreciation. Monetary policy remains on a gradual tightening path given elevated inflationary pressures and risks to inflation from various supply side factors.