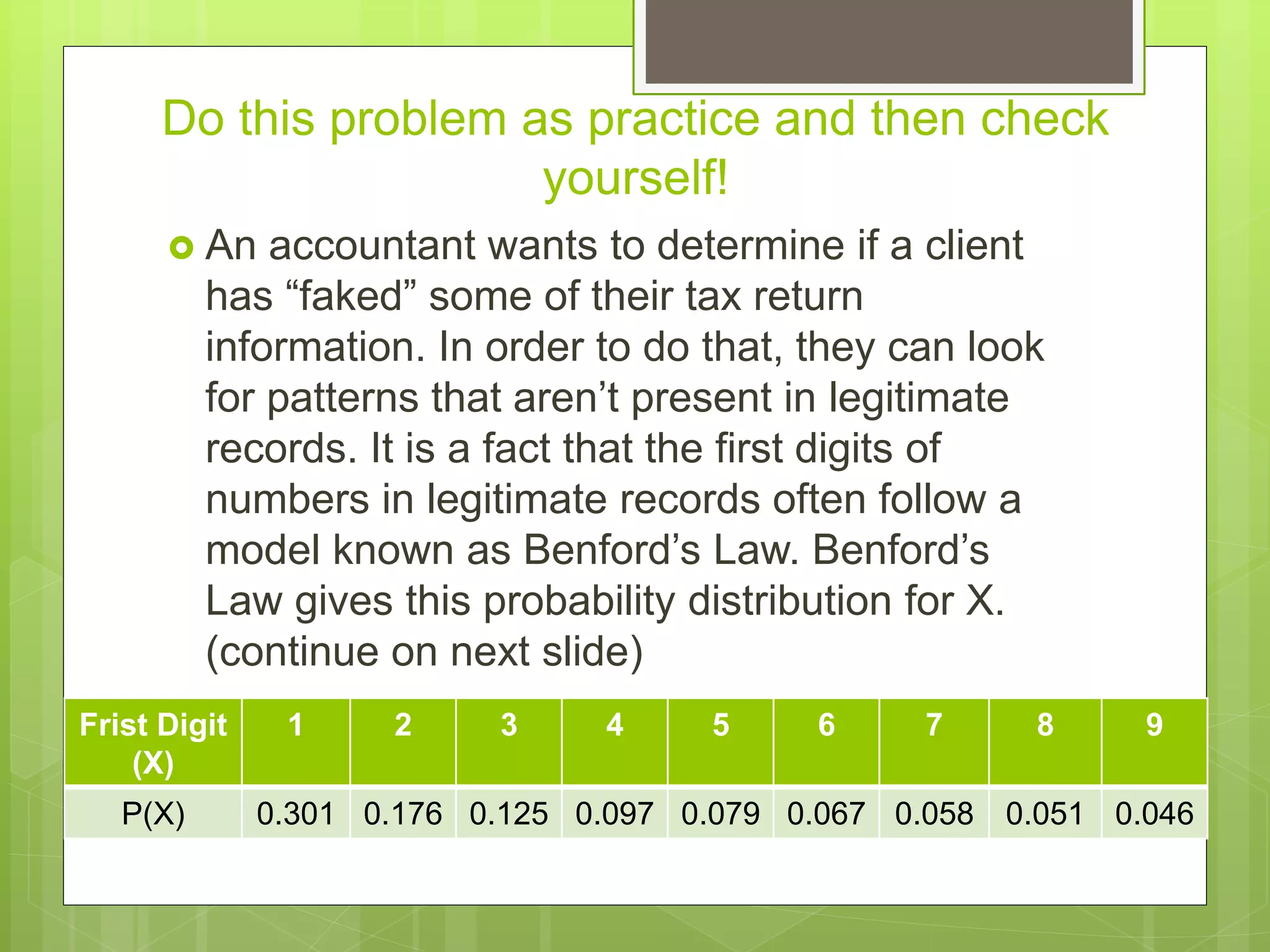

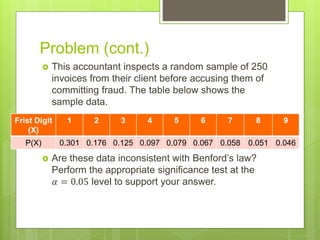

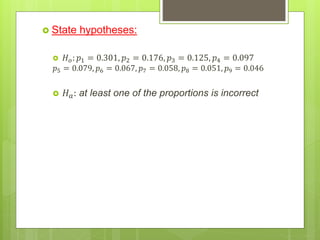

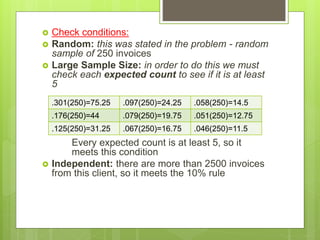

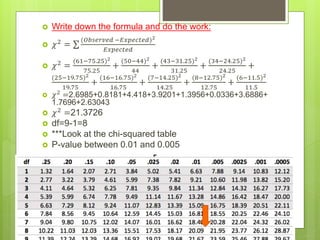

The document describes how an accountant wants to determine if a client has falsified tax information by looking for patterns in invoices. The accountant inspects a random sample of 250 invoices and compares the frequencies of first digits to the probabilities predicted by Benford's Law using a chi-squared test. The results show a p-value between 0.01 and 0.005, below the significance level of 0.05. Therefore, the accountant can conclude the invoices are inconsistent with Benford's Law and suspect fraudulent activity.