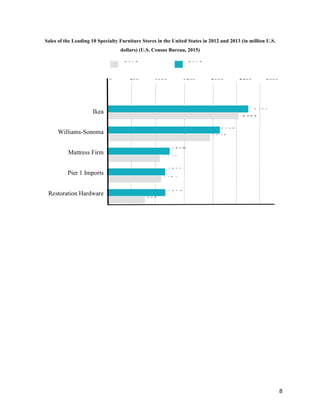

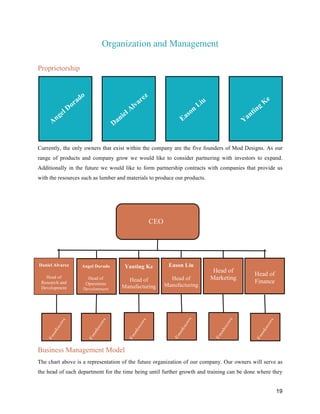

This document appears to be a business plan for a company called MOD Designs that produces customizable, multi-functional furniture pieces designed for small urban living spaces. The business plan outlines MOD Designs' mission, vision, values, target market of young adults living in studio apartments in cities, product details, competition, management structure, marketing strategy, and financial projections. The core product is a furniture set that converts between a couch, chairs, coffee table, dining table, bench seats, and bed to efficiently utilize limited space.