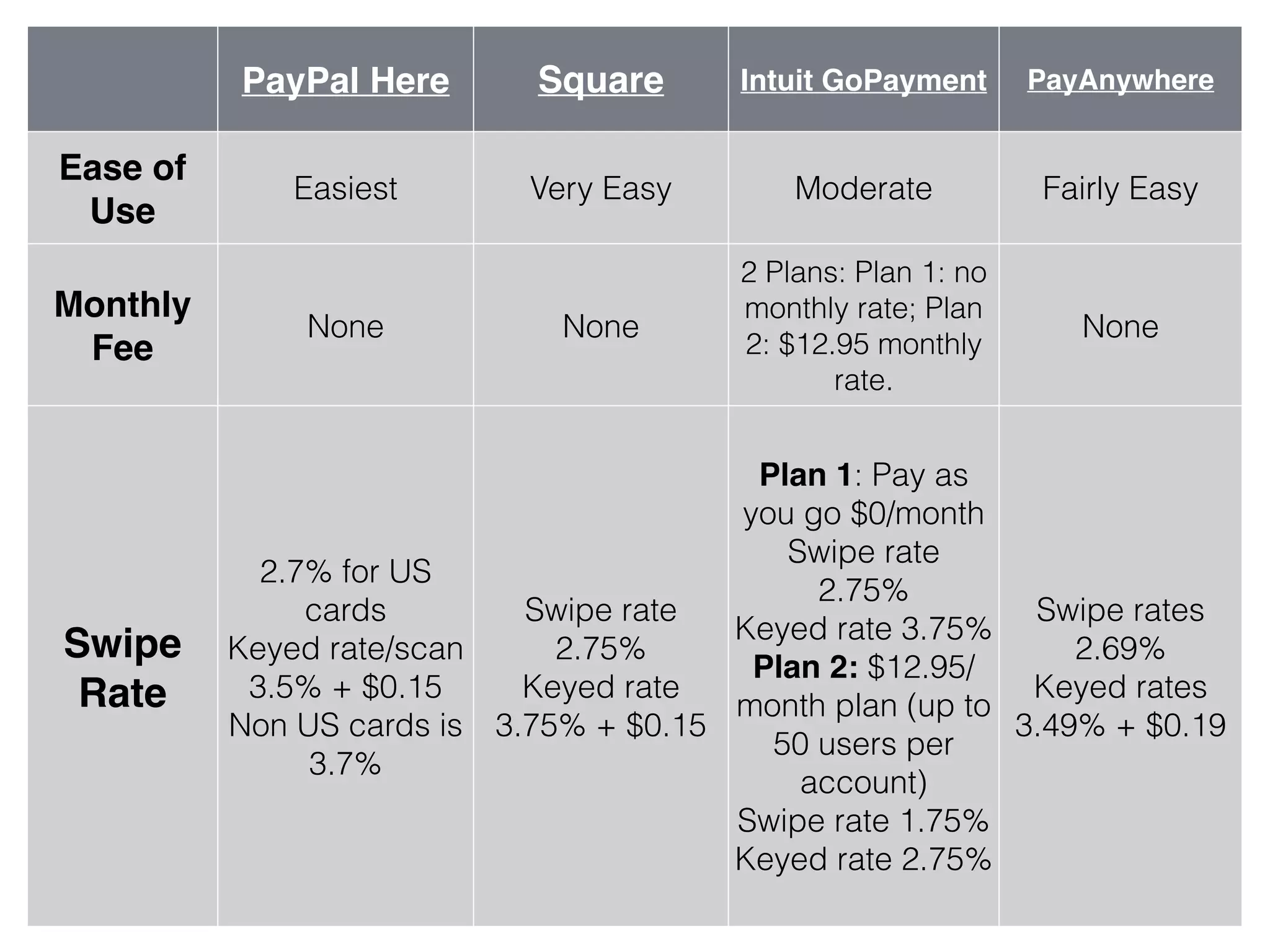

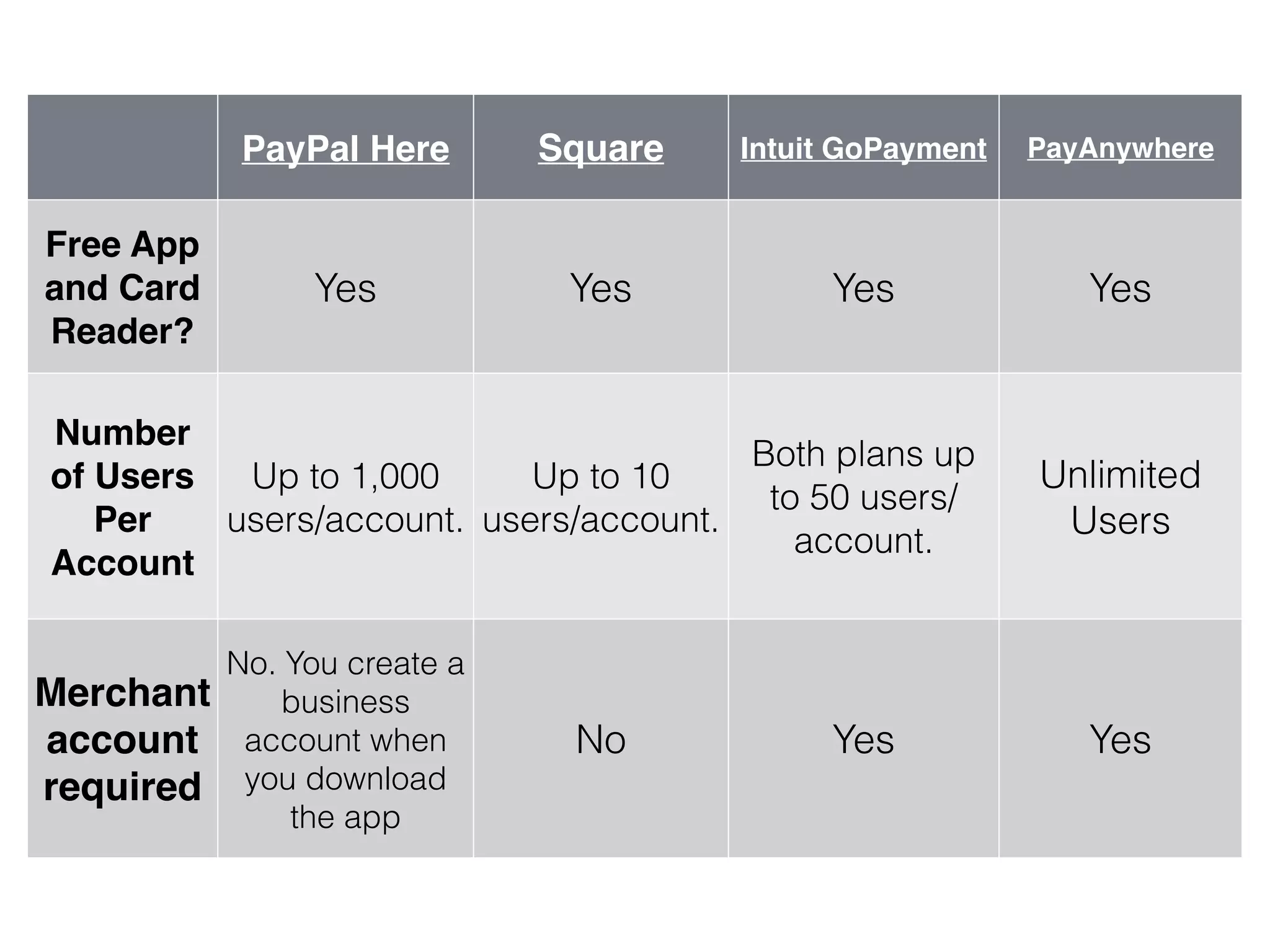

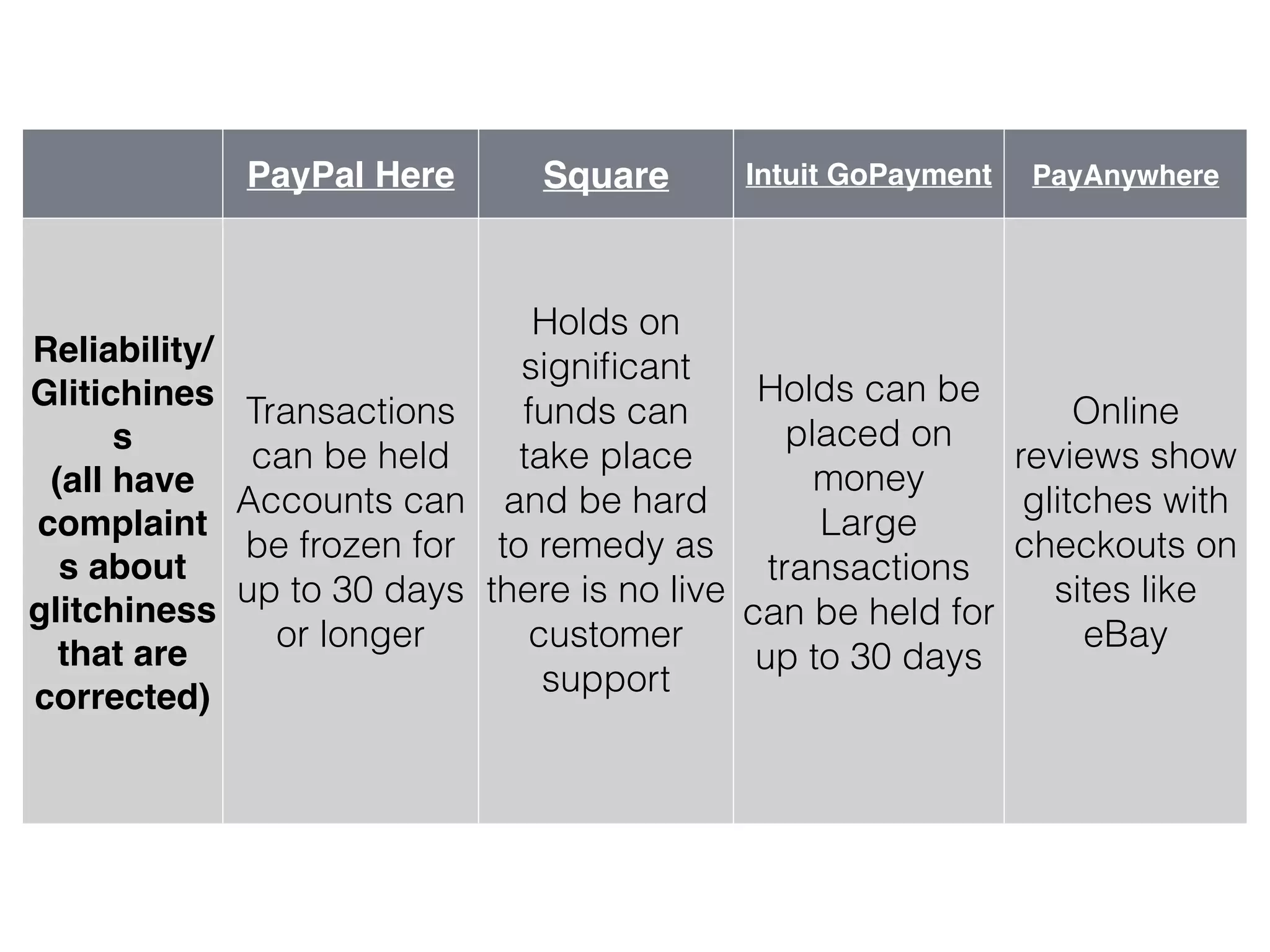

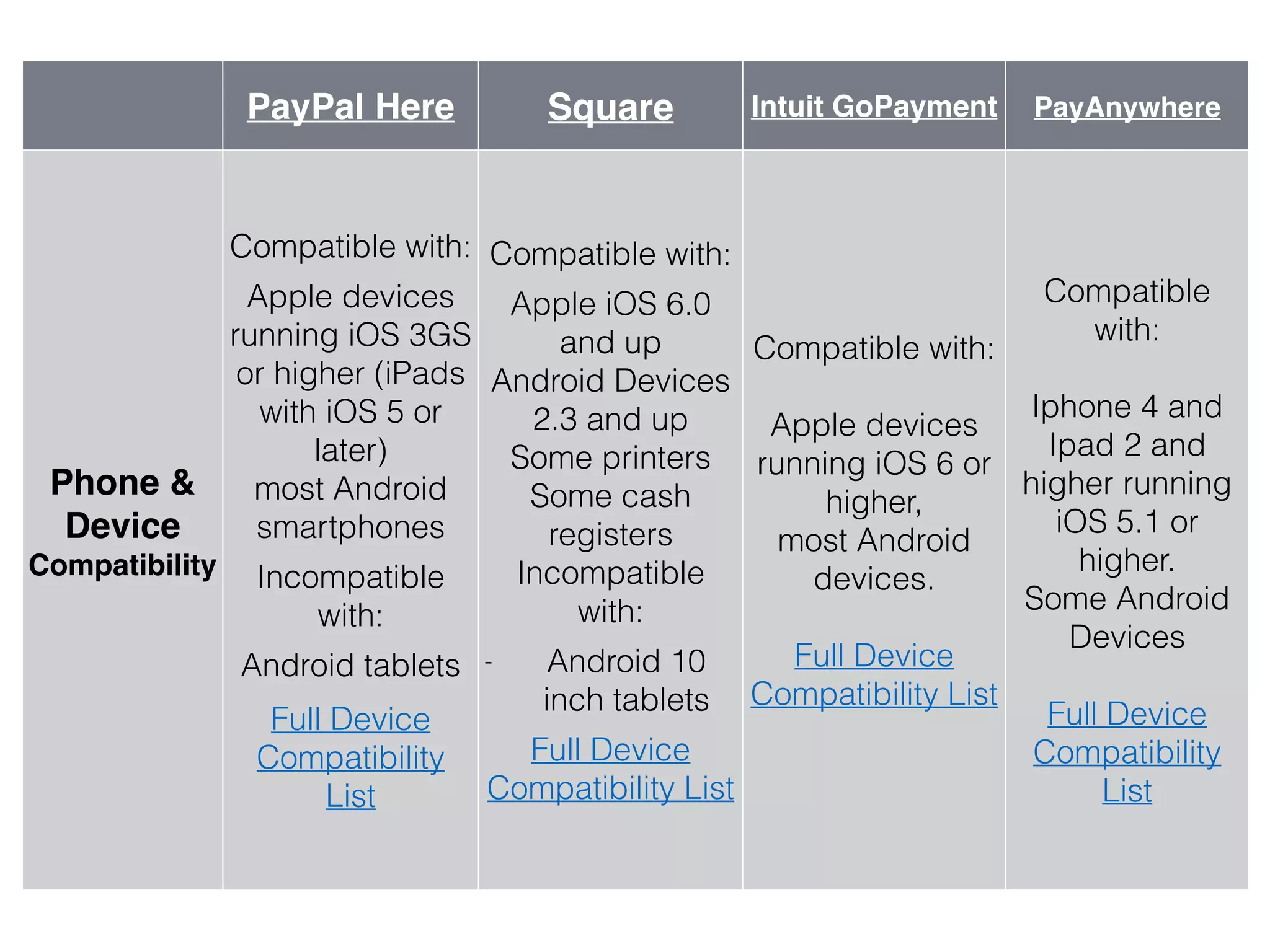

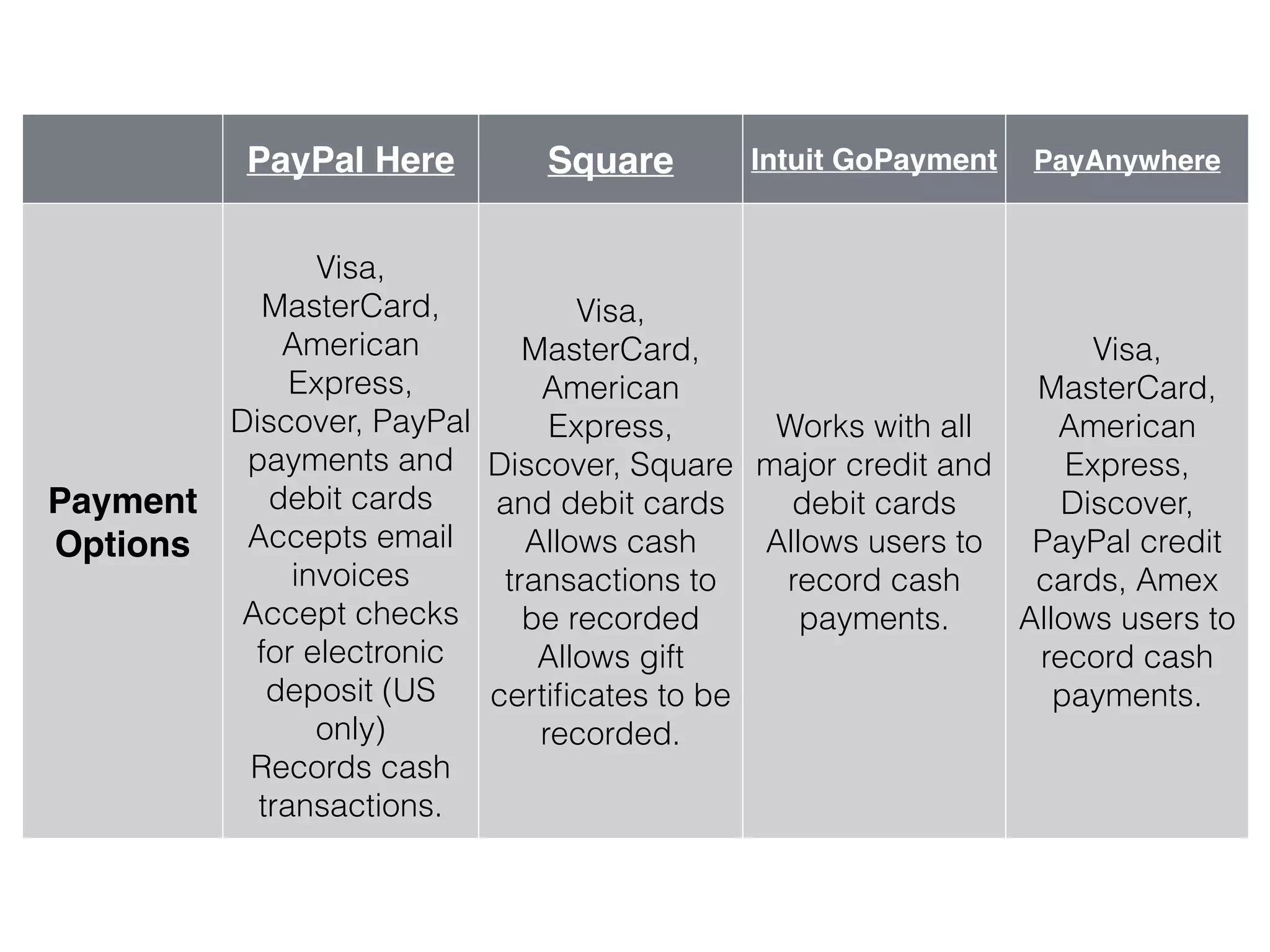

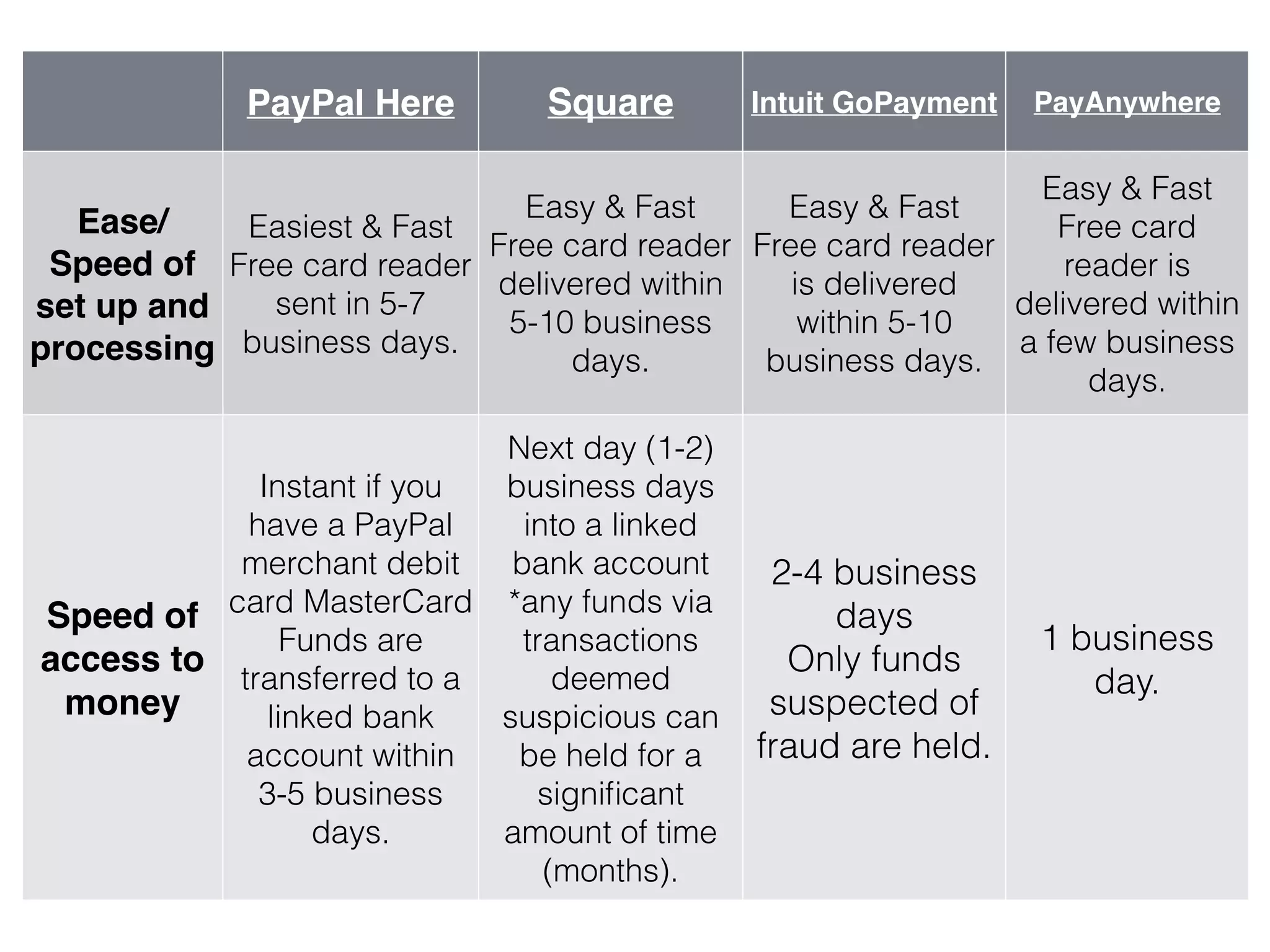

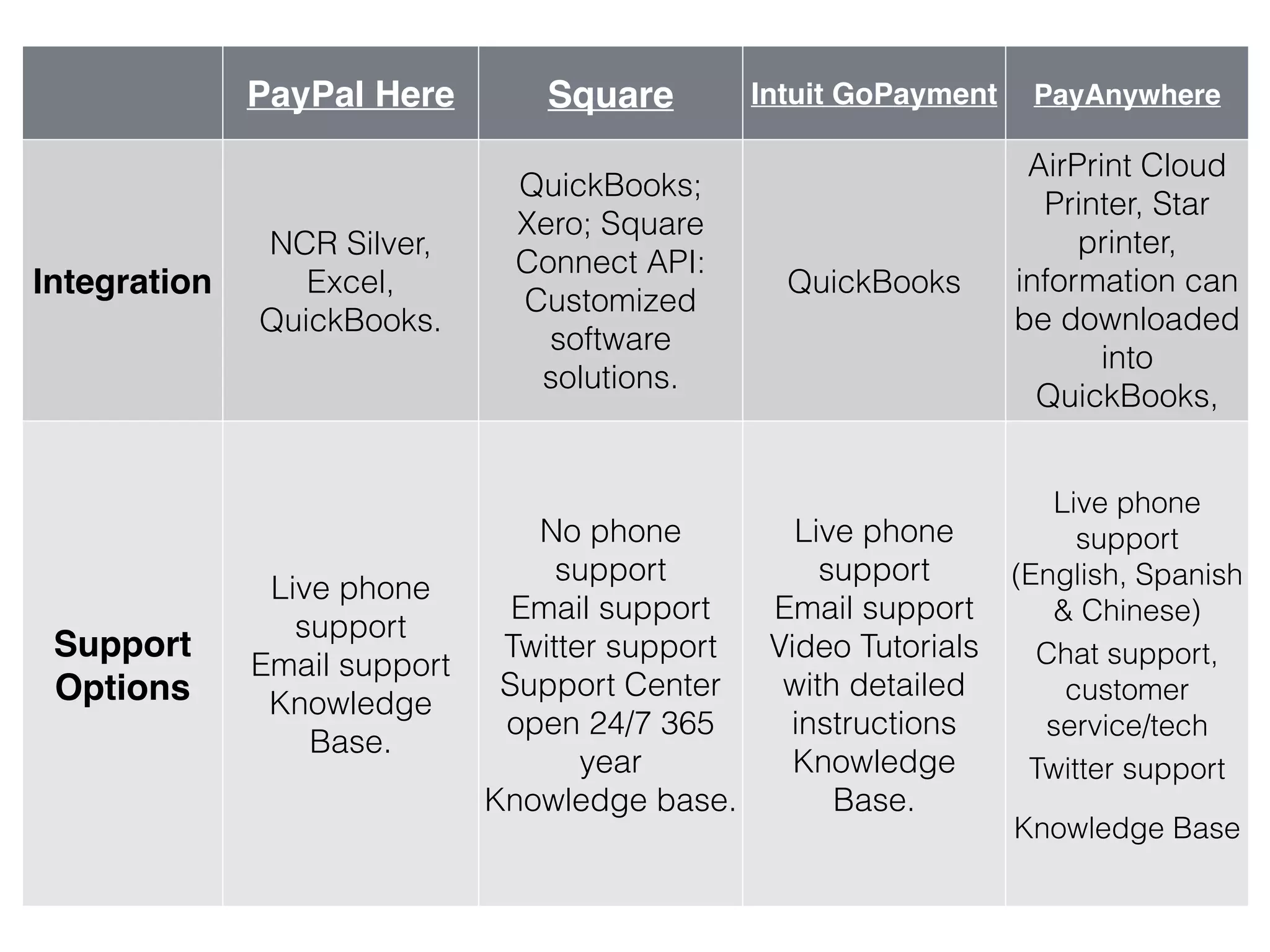

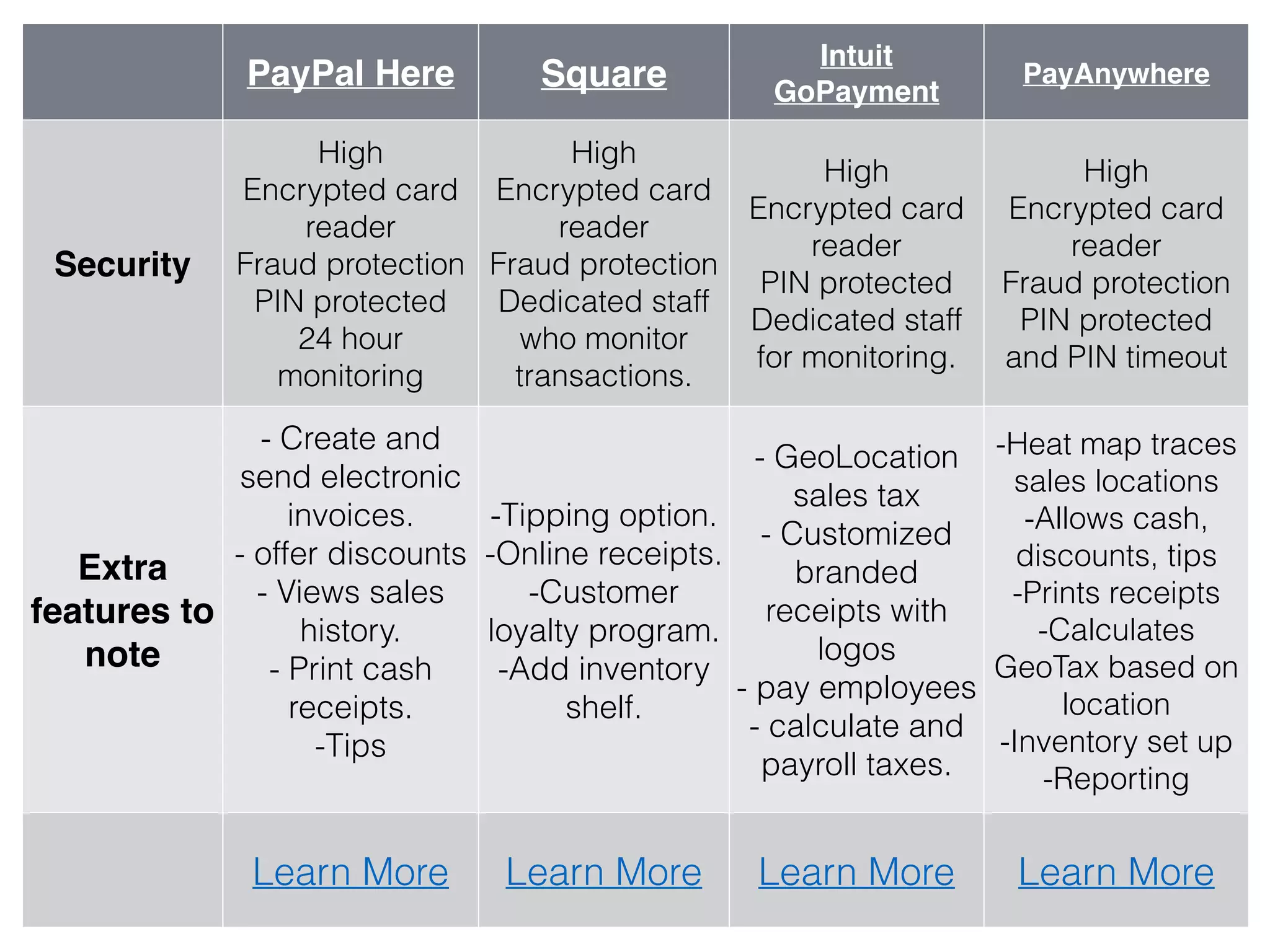

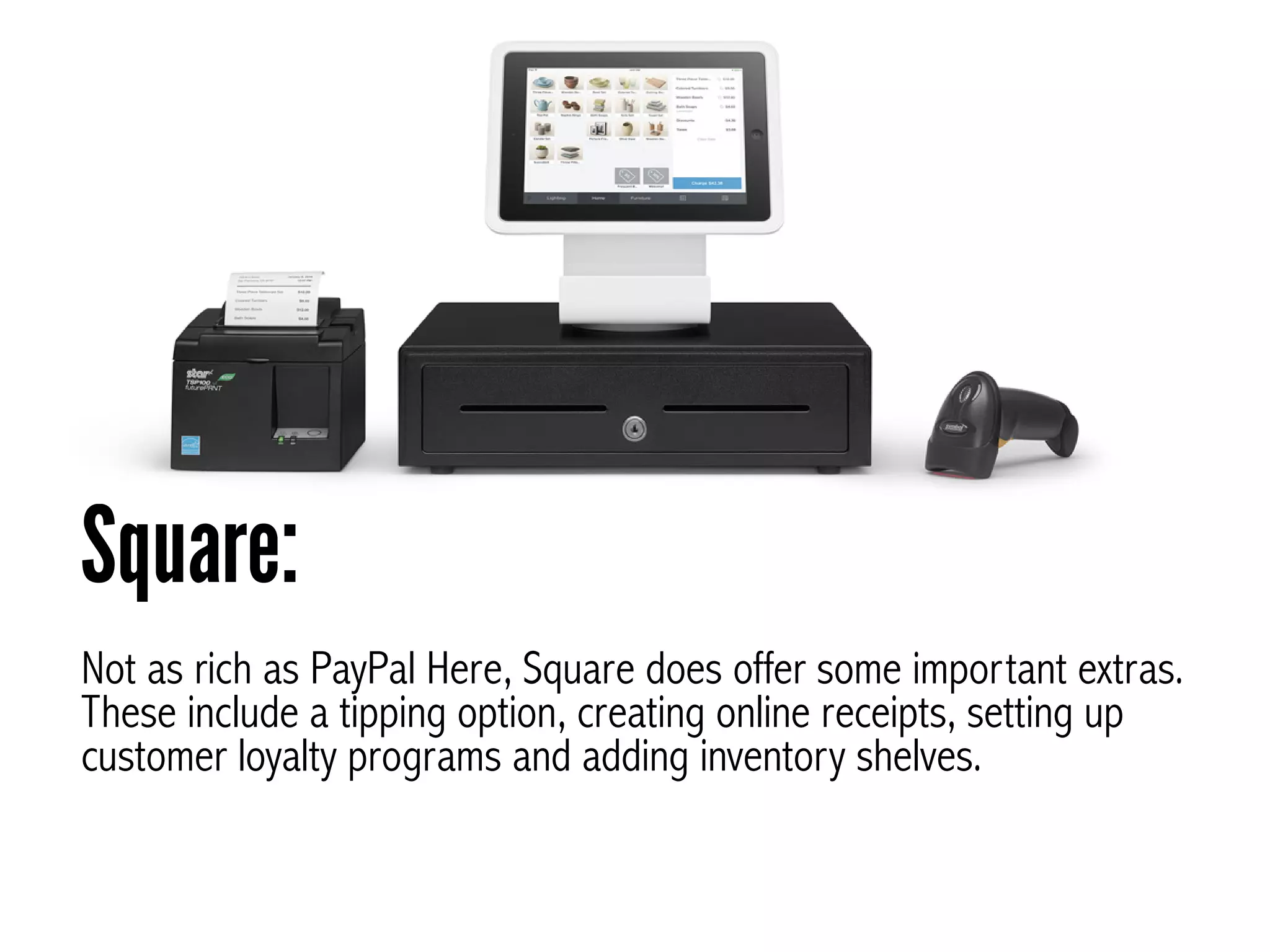

The document compares various mobile payment processing solutions for small businesses, highlighting PayPal Here as the top choice due to its ease of use, quick setup, and competitive rates. Other options discussed include Square, Intuit GoPayment, and PayAnywhere, each with specific features, pricing structures, and device compatibility. Overall, while all providers have their pros and cons, PayPal Here stands out for its low costs and extensive feature set despite some drawbacks related to fund holding procedures.