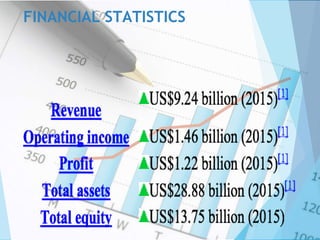

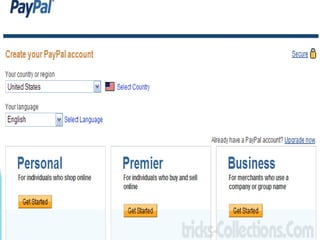

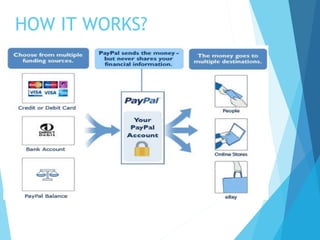

PayPal was established in 1998 and became a subsidiary of eBay in 2002. It operates a worldwide online payments system and had 173 million active users and $7.9 billion in revenue in 2015. PayPal allows users to send, receive, and hold funds in 26 currencies globally and transfer money electronically for online purchases, sales, donations, and sending funds internationally.