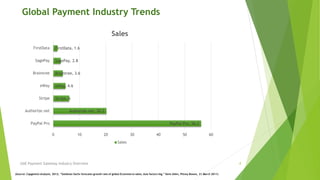

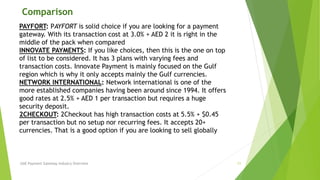

The document discusses payment gateway options for businesses in the United Arab Emirates. It provides an overview of the global payment industry trends of high growth. In the UAE, integrating local payment gateways requires businesses to be legitimate and pay setup and transaction fees. The document analyzes several payment gateway providers that are suitable options for the UAE market, comparing their transaction costs, fees, and currency acceptance. It concludes that 2Checkout may be the best initial option for new companies due to its lack of setup fees.