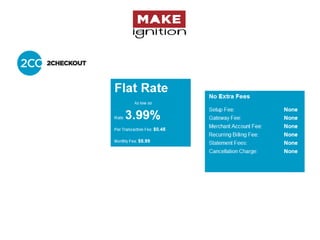

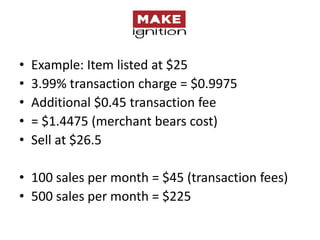

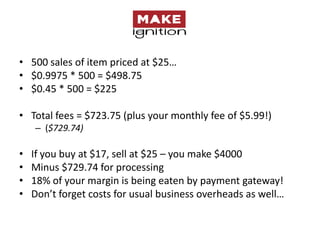

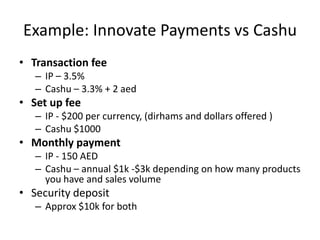

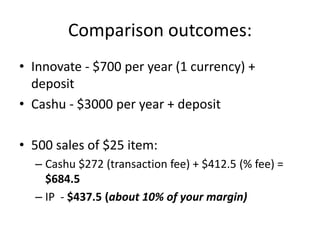

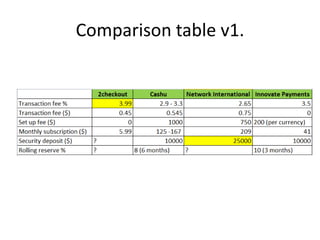

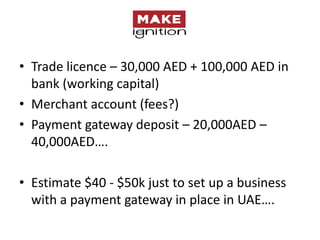

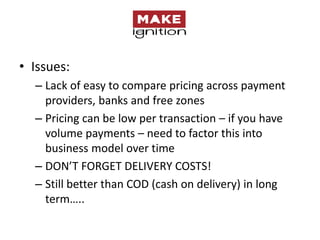

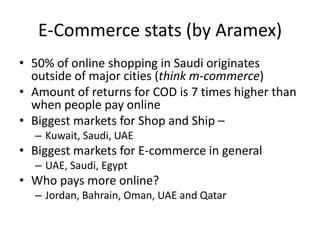

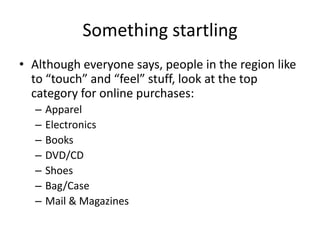

This document discusses payment gateway options for UAE startups. It provides information on providers like Cashu, InnovatePayments, 2Checkout, and Paypal. It also profiles Network International, the main provider for the UAE. Key points covered include payment gateway costs, example transaction fees, and comparisons of provider pricing. Overall issues addressed are the high upfront costs to set up an e-commerce business and process payments in the UAE.