Embed presentation

Download to read offline

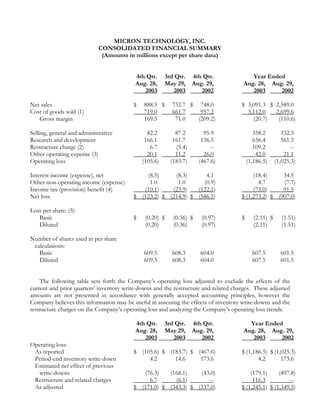

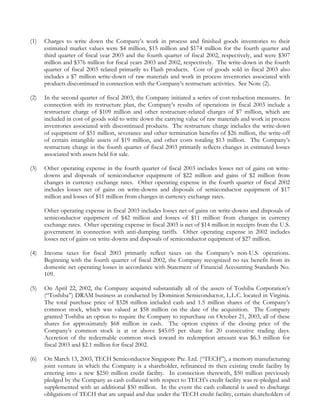

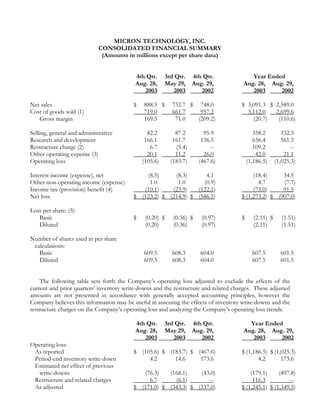

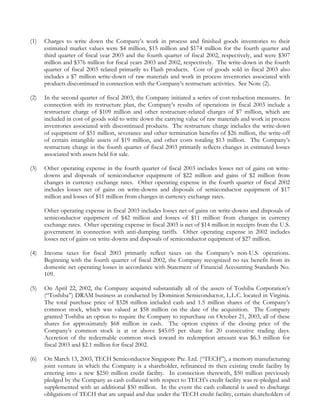

Micron Technology reported financial results for its fourth quarter and fiscal year 2003. For the fourth quarter, Micron reported a net loss of $123 million compared to a net loss of $215 million in the previous quarter. For the fiscal year, Micron reported a net loss of $1.273 billion. Micron also announced that Intel Corporation invested $450 million in Micron in exchange for stock rights, strengthening the relationship and business alignment between the two companies.