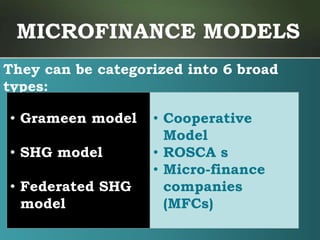

India hosts a diverse range of successful microfinance models, influenced by its geographical size, social and cultural diversity, and a robust NGO movement. The microfinance models include the Grameen model, Self Help Groups (SHGs), Federated SHGs, Credit Cooperative Unions, Rotating Savings and Credit Associations (ROSCAs), and Microfinance Companies, each with unique structures and mechanisms. These models have adapted traditional and innovative approaches to enhance credit flow to various economic sectors.