Mf0011 & mergers & acquisitions

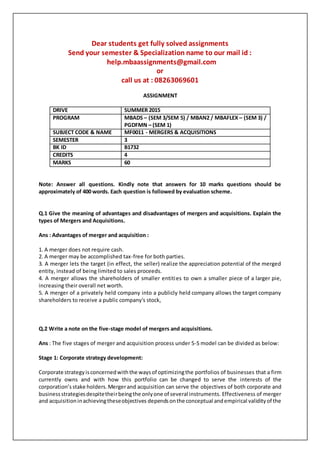

- 1. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601 ASSIGNMENT DRIVE SUMMER 2015 PROGRAM MBADS – (SEM 3/SEM 5) / MBAN2 / MBAFLEX – (SEM 3) / PGDFMN – (SEM 1) SUBJECT CODE & NAME MF0011 - MERGERS & ACQUISITIONS SEMESTER 3 BK ID B1732 CREDITS 4 MARKS 60 Note: Answer all questions. Kindly note that answers for 10 marks questions should be approximately of 400 words. Each question is followed by evaluation scheme. Q.1 Give the meaning of advantages and disadvantages of mergers and acquisitions. Explain the types of Mergers and Acquisitions. Ans : Advantages of merger and acquisition : 1. A merger does not require cash. 2. A merger may be accomplished tax-free for both parties. 3. A merger lets the target (in effect, the seller) realize the appreciation potential of the merged entity, instead of being limited to sales proceeds. 4. A merger allows the shareholders of smaller entities to own a smaller piece of a larger pie, increasing their overall net worth. 5. A merger of a privately held company into a publicly held company allows the target company shareholders to receive a public company's stock, Q.2 Write a note on the five-stage model of mergers and acquisitions. Ans : The five stages of merger and acquisition process under 5-S model can be divided as below: Stage 1: Corporate strategy development: Corporate strategyisconcernedwiththe waysof optimizingthe portfolios of businesses that a firm currently owns and with how this portfolio can be changed to serve the interests of the corporation’sstake holders.Mergerand acquisition can serve the objectives of both corporate and businessstrategiesdespitetheirbeingthe onlyone of several instruments. Effectiveness of merger and acquisitioninachievingtheseobjectives dependsonthe conceptual andempirical validityof the

- 2. modelsuponwhichthe corporate strategyisbased.Givenanappropriate corporate strategy model, mergers and acquisition is likely to fail to deliver sustainable competitive advantage. Stage 2: Organizing for acquisitions: One of the major reasons for the observed failure of many acquisitions may be that firms lack the organizational resources and capabilities for making Q.3 What do you understand by creating synergy? Give the prerequisites for the creation of synergy. Describe the important forces contributing to mergers and acquisitions. 5 5 Ans : Creating synergy : Synergy is a buzzword that managers and HR pros like to bandy around; sometimes they get it and sometimes they really don’t have a clue. In short, synergy happens in the workplace when two or more people workingtogetherproduce abetteroutcome thanif theydid it alone. It is not a touchy- feelyconcept, but instead is a practical approach to getting results – and it’s not all that difficult to create. Mergers and acquisitions are made with the goal of improving the company's financial performance forthe shareholders.Two businesses can merge to form one company that is capable of producing more revenue than either could have been able to independently. Prerequisites for the creation of synergy : Q.4 Demerger results in the transfer by a company of one or more of its undertakings to another company. Give the meaning of demerger. What are the characteristics of demerger? Explain the structure of demerger with an example. Ans : Introduction of demerger : A demerger is a form of corporate restructuring in which the entity's business operations are segregated into one or more components. It is the converse of a merger or acquisition. A demergercantake place througha spin-off bydistributedortransferringthe sharesinasubsidiary holding the business to company shareholders carrying out the demerger. The demerger can also occur by transferring the relevant business to a new company or business to which then that company'sshareholdersare issuedsharesof. Demergerscanbe undertakenforvariousbusinessand non-business reasons, such as government Q.5 Explain Employee Stock Ownership Plans (ESOP). Write down the rules of ESOP and types of ESOP. Ans : Introduction of ESOP : An employee stockownershipplan(ESOP) isanemployee-ownerschemethat provides a company's workforce with an ownership interest in the company. In an ESOP, companies provide their

- 3. employeeswithstockownership,oftenatnoup-frontcostto the employees.ESOPshares,however, are part of employees' compensation for work performed. Shares are allocated to employees and may be heldinan ESOPtrust until the employeeretiresor leaves the company. The shares are then sold. Key rules of ESOP : 1. An ESOP is a kind of employee benefit plan, similar in some ways to a profit-sharing plan. In an ESOP, a company sets up a trust fund, into which it Q.6 Explain the factors in Post-merger Integration. Write down the five rules of Integration Process. Ans : Factors in Post-merger Integration : There are many factors which require attention of the management and tend to widen its role in post-merger integration. A list of such factors is give below in brief: 1. Legal obligation: Fulfilmentof legal obligationbecomesessential inpost-mergerintegration.Suchobligationsdepend uponthe size of the company,debtstructure andcontrollingregulations,distribution channels, and dealernet-work,suppliers’relationsetc.Inall orsome of these caseslegal documentationwould be involved. Dear students get fully solved assignments Send your semester & Specialization name to our mail id : help.mbaassignments@gmail.com or call us at : 08263069601