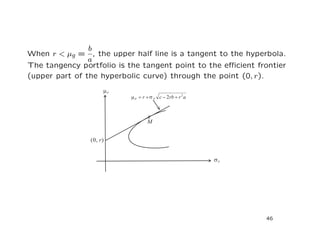

This document summarizes Markowitz's mean-variance portfolio theory and the two-fund theorem.

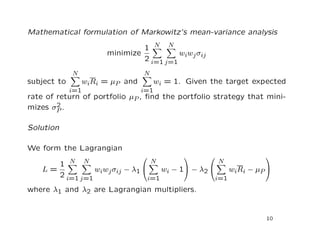

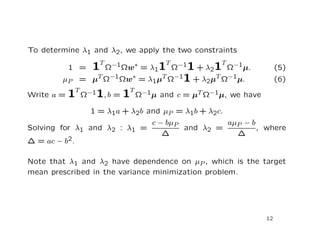

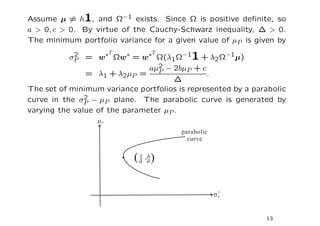

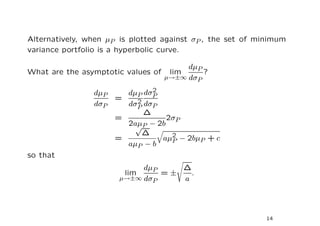

[1] Markowitz formulated the mean-variance model, which minimizes portfolio variance subject to a target expected return. The optimal weights are a function of the covariance matrix and target mean.

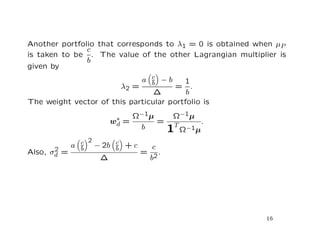

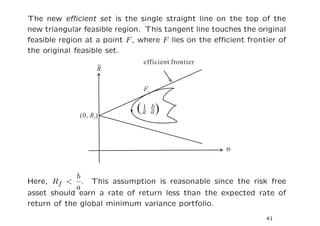

[2] The two-fund theorem states that any efficient portfolio can be replicated as a combination of two "fundamental" portfolios. Investors only need to invest in these two funds.

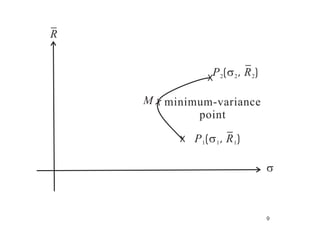

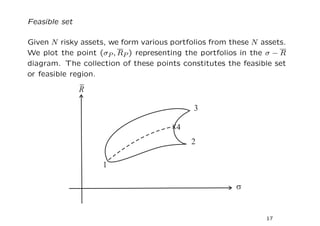

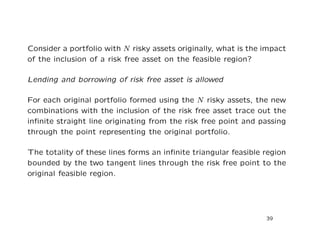

[3] The minimum variance set forms the left boundary of the feasible region in mean-variance space. Portfolios on this boundary are efficient funds.

![The first two moments of RP are

N N

µP = E[RP ] = E[wn Rn] = wnµn, where µn = Rn,

n=1 n=1

and

N N N N

2

σP = var(RP ) = wiwj cov(Ri, Rj ) = wiσij wj .

i=1 j=1 i=1 j=1

Let Ω denote the covariance matrix so that

2

σP = wT Ωw.

For example when n = 2, we have

σ11 σ12 w1 2 2 2 2

(w1 w2 ) = w1 σ1 + w1w2(σ12 + σ21) + w2 σ2 .

σ21 σ22 w2

3](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-3-320.jpg)

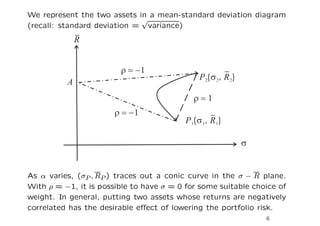

![In particular, when ρ = 1,

σP (α; ρ = 1) = (1 − α)2σ1 + 2α(1 − α)σ1σ2 + α2σ2

2 2

= (1 − α)σ1 + ασ2.

This is the straight line joining P1(σ1, R1) and P2(σ2, R2).

When ρ = −1, we have

σP (α; ρ = −1) = [(1 − α)σ1 − ασ2]2 = |(1 − α)σ1 − ασ2|.

When α is small (close to zero), the corresponding point is close to

P1(σ1, R1). The line AP1 corresponds to

σP (α; ρ = −1) = (1 − α)σ1 − ασ2.

σ1

The point A (with zero σ) corresponds to α = .

σ1 + σ2

σ1

The quantity (1 − α)σ1 − ασ2 remains positive until α = .

σ1 + σ2

σ1

When α > , the locus traces out the upper line AP2.

σ1 + σ2

7](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-7-320.jpg)

![In general,

u v 2 2

cov(RP , RP ) = (1 − u)(1 − v)σg + uvσd + [u(1 − v) + v(1 − u)]σgd

(1 − u)(1 − v) uvc u + v − 2uv

= + 2 +

a b a

1 uv∆

= + 2

.

a ab

In particular,

cov(Rg , RP ) = wT ΩwP =

1Ω−1ΩwP 1

= = var(Rg )

g

a a

for any portfolio wP .

For any Portfolio u, we can find another Portfolio v such that these

two portfolios are uncorrelated. This can be done by setting

1 uv∆

+ 2

= 0.

a ab

32](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-32-320.jpg)

![mean-variance analysis ⇔ maximum expected utility criterion

based on quadratic utility

Suppose that a portfolio has a random wealth value of y. Using the

expected utility criterion, we evaluate the portfolio using

b 2

E[U (y)] = E ay − y

2

b

= aE[y] − E[y 2]

2

b 2 b

= aE[y] − (E[y]) − var(y).

2 2

Note that we choose the range of the quadratic utility function such

b

that aE[y] − (E[y])2 is increasing in E[y]. Maximizing E[y] for a

2

given var(y) or minimizing var(y) for a given E[y] is equivalent to

maximizing E[U (y)].

34](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-34-320.jpg)

![Normal Returns

When all returns are normal random variables, the mean-variance

criterion is also equivalent to the expected utility approach for any

risk-averse utility function.

To deduce this, select a utility function U . Consider a random

wealth variable y that is a normal random variable with mean value

M and standard deviation σ. Since the probability distribution is

completely defined by M and σ, it follows that the expected utility

is a function of M and σ. If U is risk averse, then

∂f ∂f

E[U (y)] = f (M, σ), with >0 and < 0.

∂M ∂σ

35](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-35-320.jpg)

![Now, the proportion of wealth invested in the risk free asset is

N

1− wi .

i=1

Modified Lagrangian formulation

2

σP 1

minimize = wT Ωw

2 2

subject to wT µ + (1 − wT 1)r = µP .

1 T

Define the Lagrangian: L = w Ωw + λ[µP − r − (µ − r1)T w]

2

N

∂L

= σij wj − λ(µ − r1) = 0, i = 1, 2, · · · , N (1)

∂wi j=1

∂L

=0 giving (µ − r1)T w = µP − r. (2)

∂λ

43](https://image.slidesharecdn.com/meanvariance-120318115445-phpapp02/85/Mean-variance-43-320.jpg)