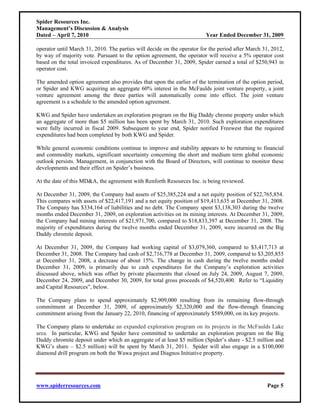

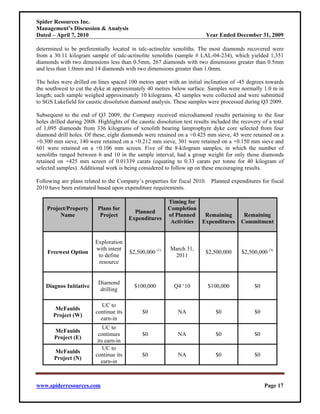

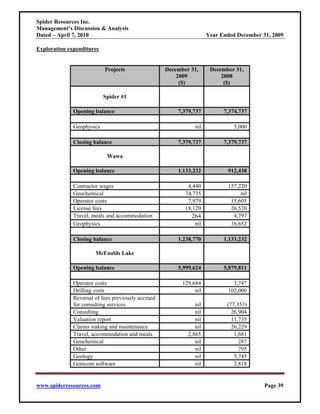

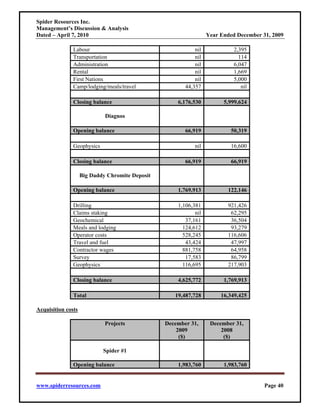

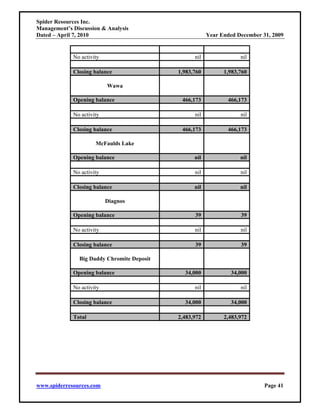

Spider Resources Inc. is a Canadian mineral exploration company focused on acquiring and developing properties containing valuable mineral deposits. In 2009, the company spent $3.1 million exploring its properties, primarily the Big Daddy chromite deposit. It has sufficient funds to continue exploration programs in 2010. The company amended an agreement regarding the Big Daddy property, allowing it to increase its ownership stake through additional exploration expenditures. Management aims to further develop Big Daddy and acquire new prospective properties.