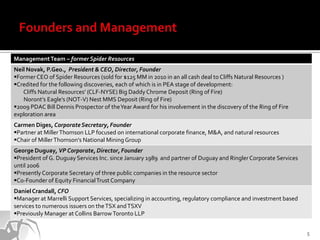

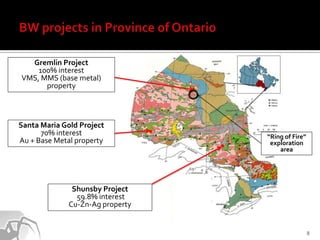

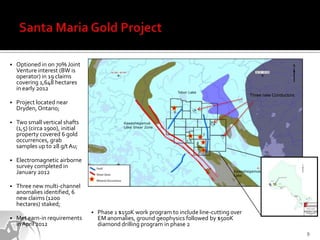

Black Widow Resources Inc. is a mining exploration company focused on acquiring and developing projects to enhance shareholder value, with a particular interest in gold and base metal prospects in Ontario. The company emphasizes its management's strong track record in mineral discoveries and outlines its short and long-term business plans for portfolio expansion and project development. The document also includes cautionary forward-looking statements regarding the inherent risks and uncertainties in mineral exploration and projected outcomes.