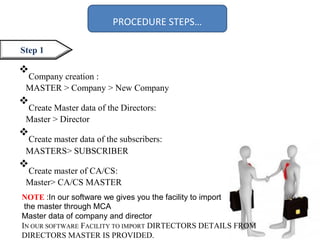

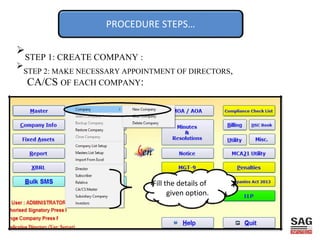

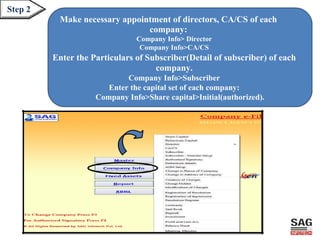

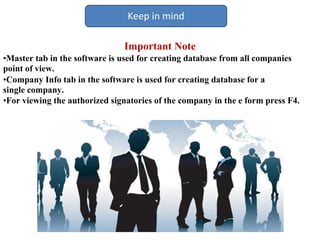

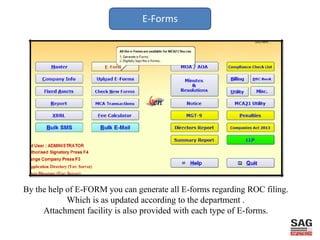

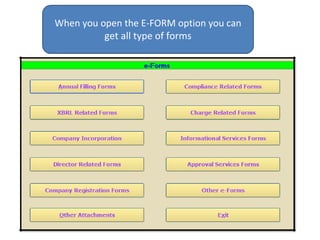

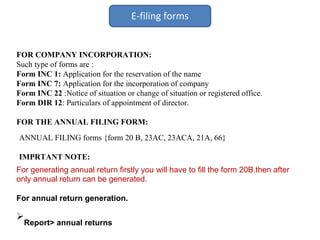

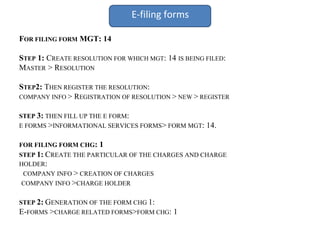

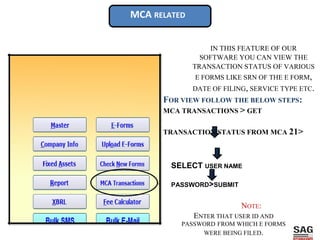

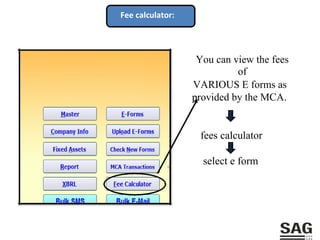

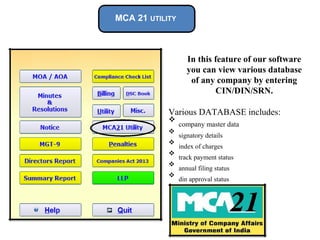

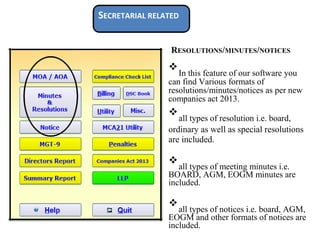

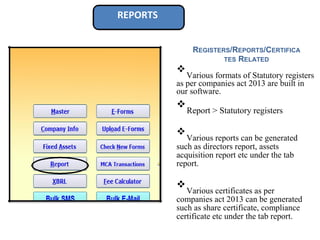

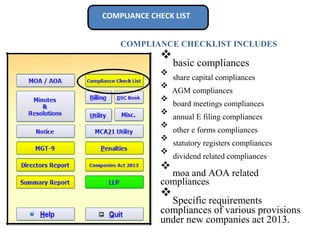

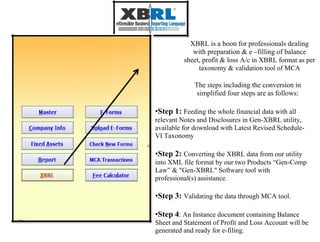

The document is a help manual outlining the basic features and procedures for using the company's law software. It details steps for creating company master data, managing e-forms for ROC filing, generating annual returns, and maintaining compliance checks related to the Companies Act 2013. Additionally, it includes guidance on utilizing features such as transaction status checks and XBRL formatting for financial data preparation.