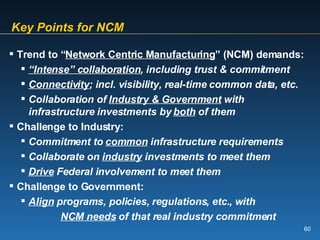

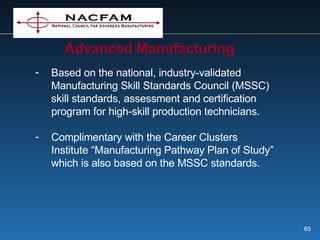

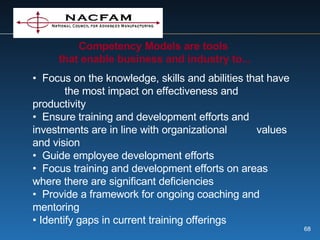

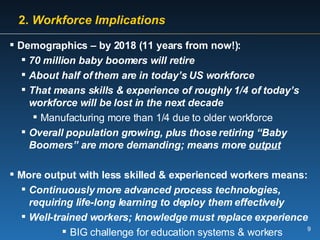

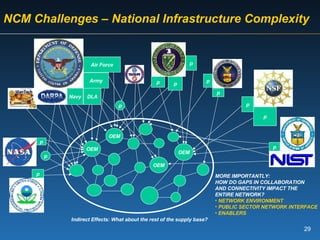

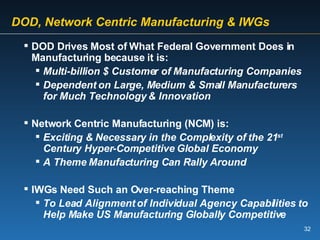

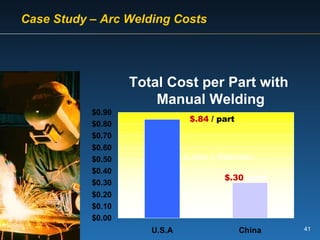

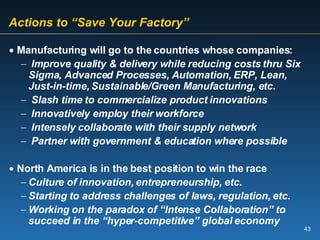

The document, presented by Eric Mittelstadt, discusses the current status and future challenges of U.S. manufacturing, highlighting the importance of innovation, productivity, and network-centric manufacturing in a competitive global landscape. It emphasizes the implications of a retiring workforce and the need for continuous skill development in science, technology, engineering, and math (STEM) to meet these challenges. Key recommendations include collaboration across industry, government, and education to foster a more adaptable and skilled manufacturing workforce.

![Regarding the National Council for Advanced Manufacturing (NACFAM) Please contact: Eric Mittelstadt, CEO Phone: 202-429-2220 ext. 4; Fax: 202-429-2422 E-mail: [email_address] For More Information:](https://image.slidesharecdn.com/maximize-minnesota-eric-mittelstadt-1196796825919088-4/85/Maximize-Minnesota-Eric-Mittelstadt-46-320.jpg)