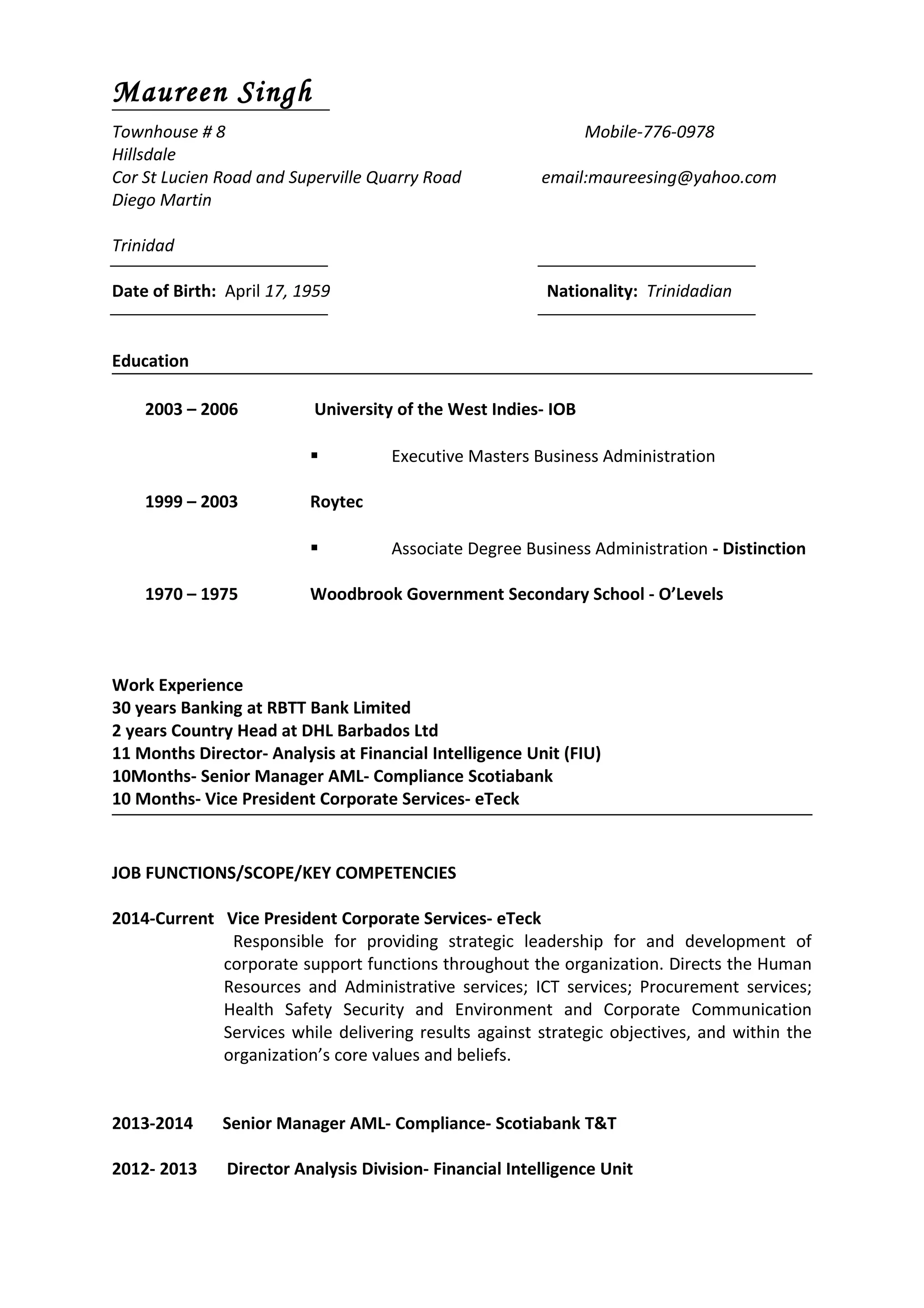

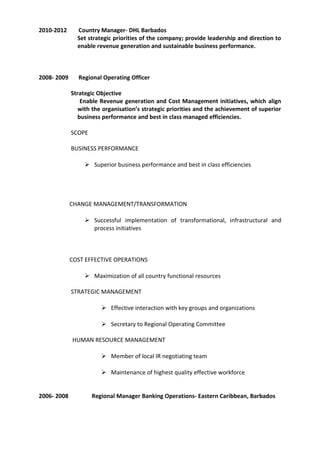

Maureen Singh is a Trinidadian national with over 30 years of experience in banking. She currently serves as the Vice President of Corporate Services at eTeck, where she provides strategic leadership for corporate support functions. Prior to this role, she held several senior management positions in banking and finance in Trinidad and Tobago and the Eastern Caribbean, including Country Manager at DHL Barbados and Director of Analysis at the Financial Intelligence Unit. She holds an Executive MBA from the University of the West Indies and an Associate's Degree in Business Administration.