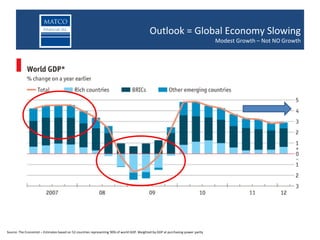

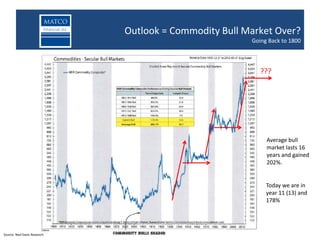

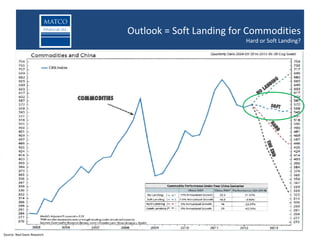

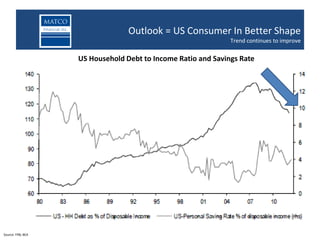

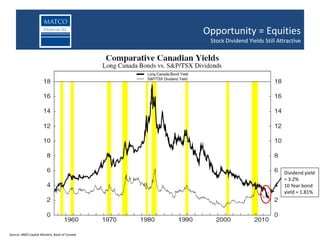

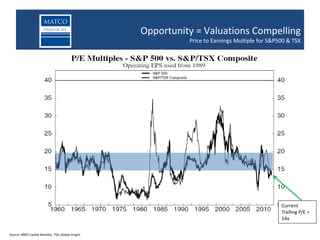

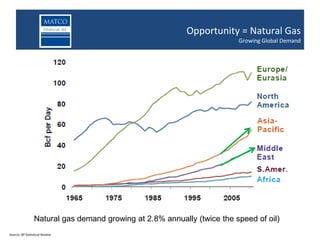

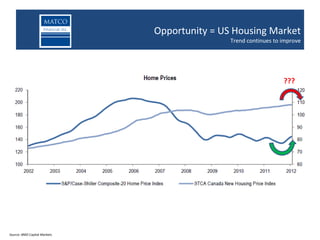

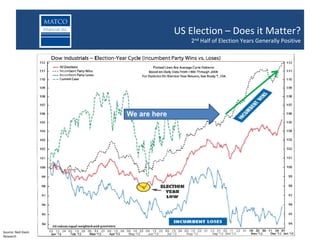

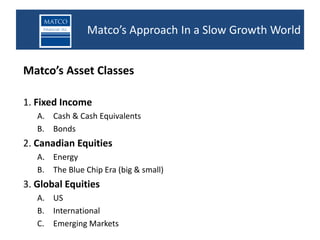

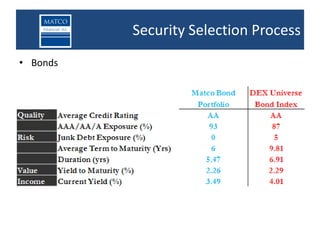

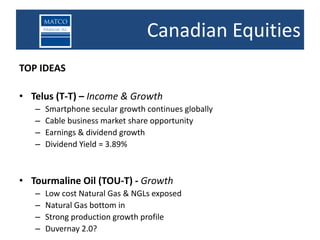

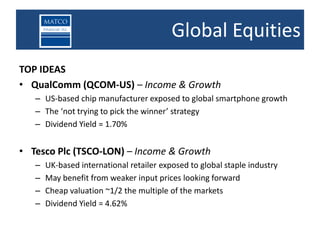

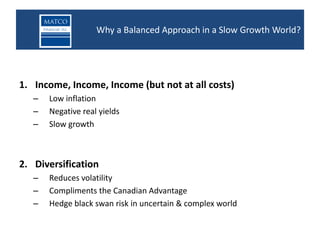

The document discusses opportunities in the junior oil and gas space in a slowing global economy. It notes that junior oil and gas companies have outperformed large caps over the past 25 years. While global growth is slowing, opportunities still exist for equities over bonds. Specific opportunities mentioned include natural gas, the recovering US economy, and attractive stock dividend yields compared to bond yields. The document advocates taking a cautious approach focused on risk management in this environment.