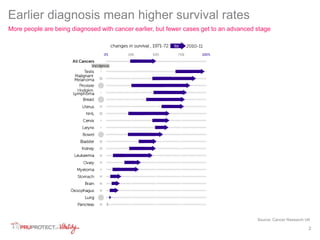

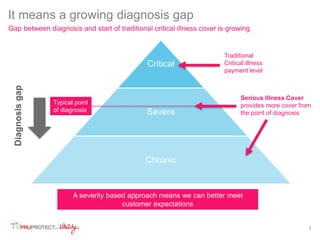

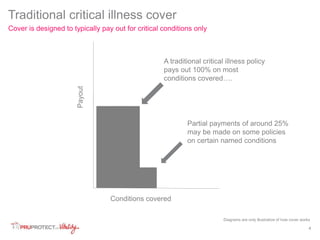

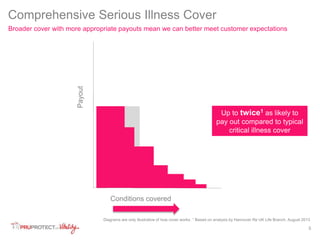

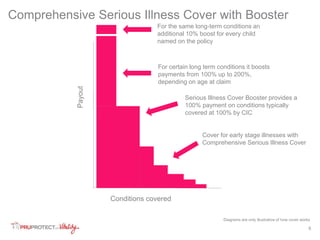

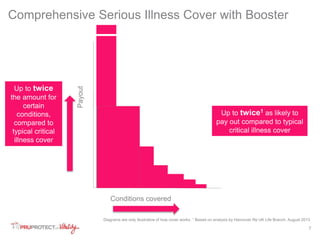

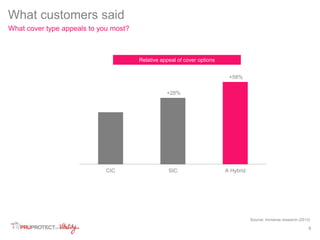

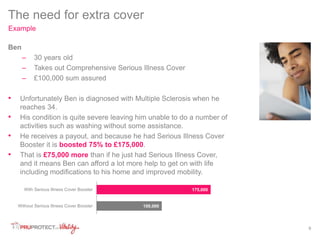

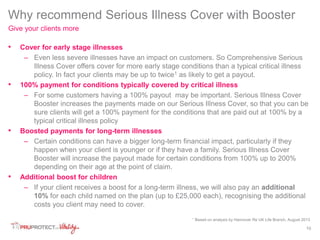

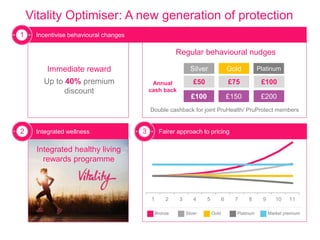

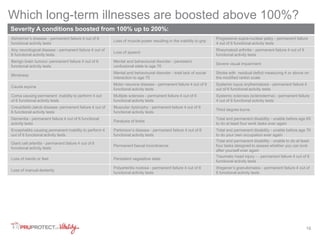

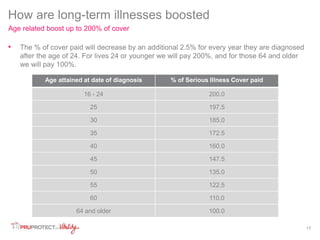

The document outlines the benefits of serious illness cover boosters, emphasizing their broader coverage and higher payout potential compared to traditional critical illness policies. Customers diagnosed with serious conditions can receive significantly larger payouts, which can be further increased by having children named on the policy. Overall, it seeks to provide enhanced financial support for those facing long-term illnesses, ensuring they meet their evolving needs more effectively.