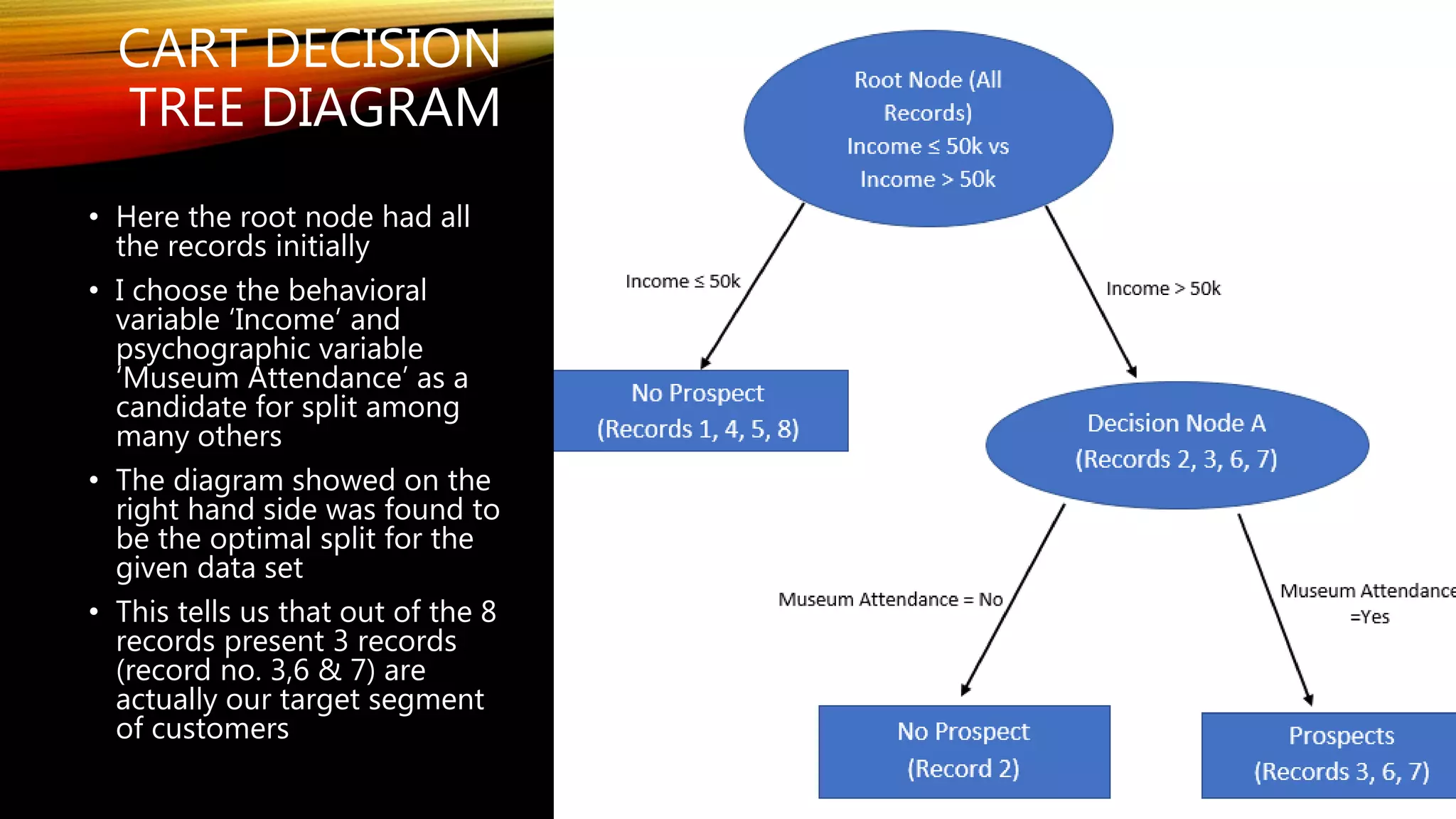

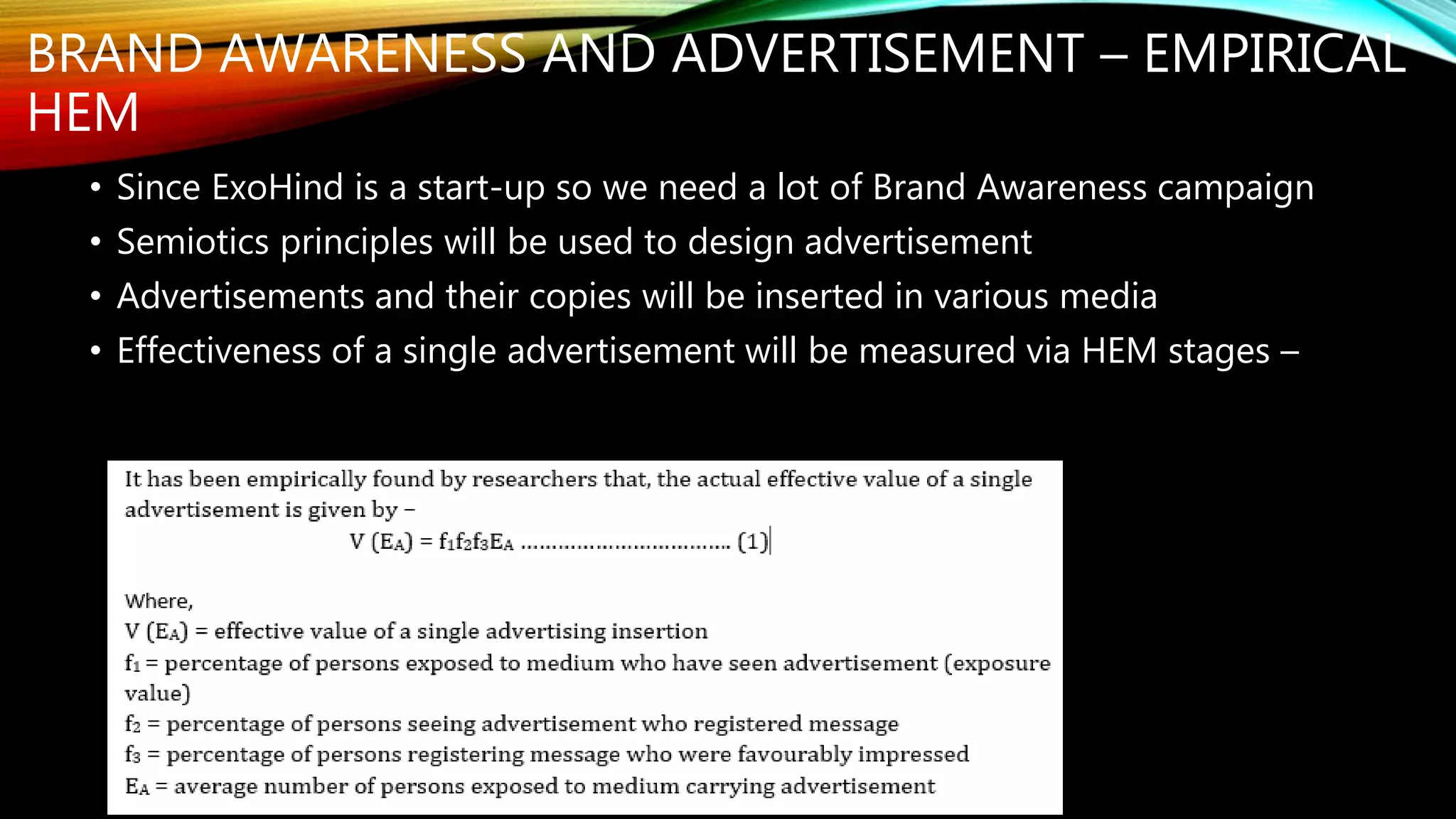

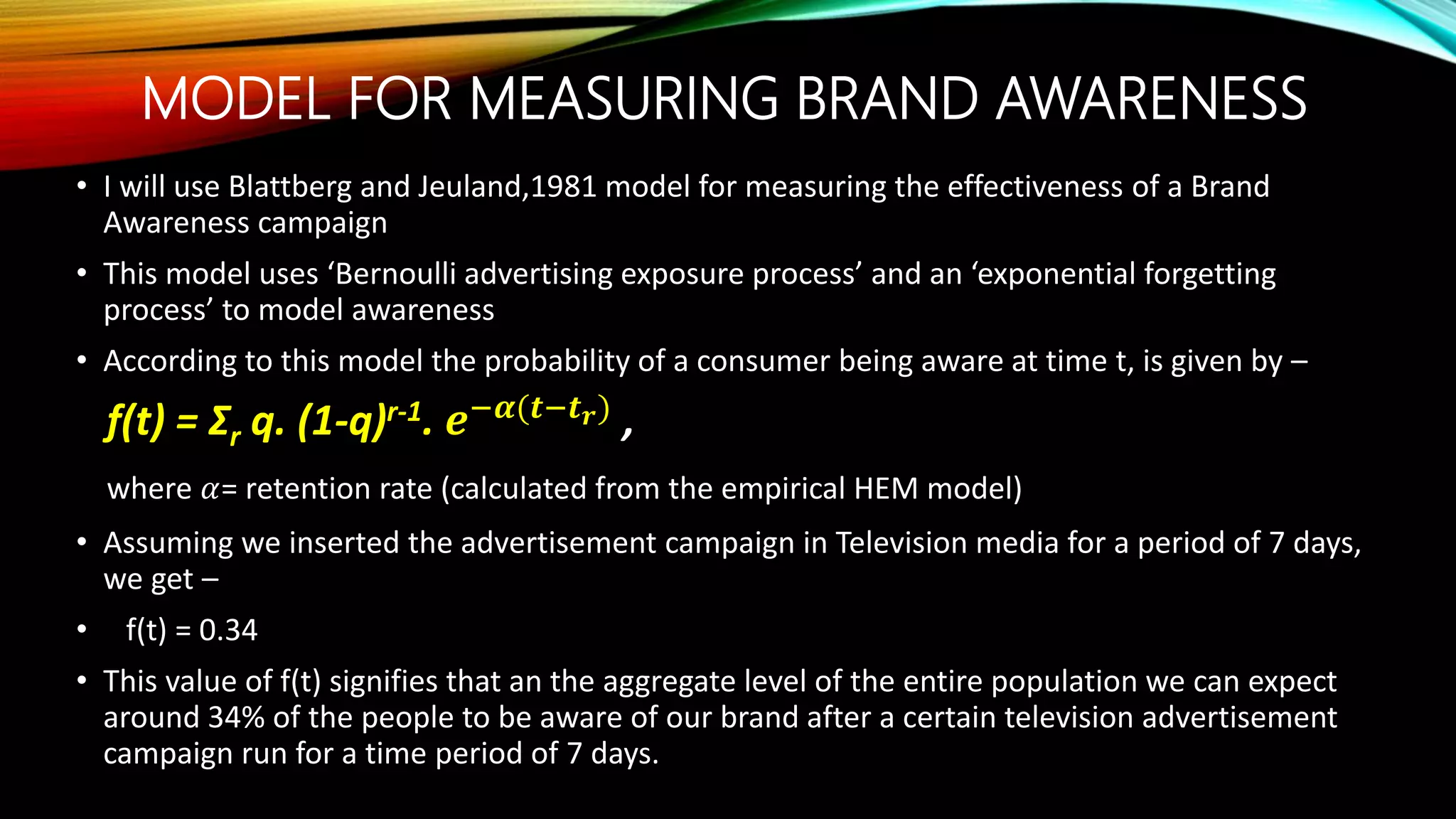

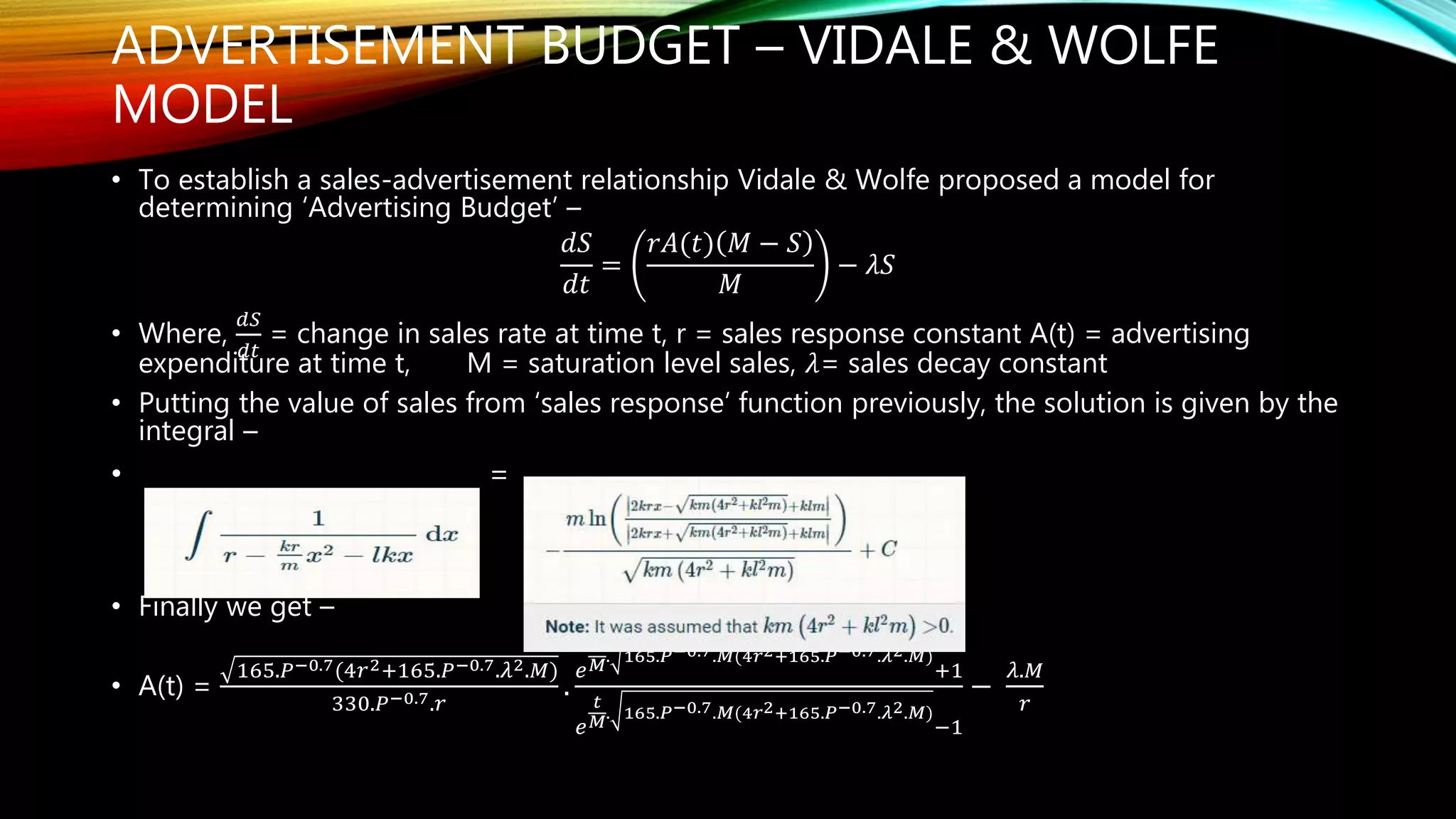

Exohind is a start-up in the lifestyle travel sector, utilizing a growth plan based on the Bass diffusion model for sales forecasting and market share analysis. The document outlines various marketing strategies including customer segmentation using decision tree algorithms and the development of brand awareness campaigns through empirical models. Additionally, it details pricing and advertising strategies using several theoretical frameworks to optimize market entry and growth.