Market Watch - September 2016

•

0 likes•188 views

The post-Brexit world creates a sweet spot for high yielding assets. There is enough good economic data to take recession risks off the table, but also enough uncertainty to keep central banks in easing mode. As long as these macro conditions remain, the hunt for yield will continue.

Report

Share

Report

Share

Download to read offline

Recommended

Market Watch - August 2016

One month after Brexit, financial markets are behaving as if the UK’s exit vote had never happened. Stock markets, including the UK, have not only recovered from the sharp post-Brexit losses but have surged ahead. The US stock market moved further into uncharted territory as it touched new high levels. The reason for the risk rally is in the expectation that central banks will over-compensate Brexit’s presumed negative effects with excessive easing. But despite markets setting new highs, we urge investors not to chase this rally. Instead, investors should stay cautious and take some profit.

Market Watch - May 2017

Markets are in a consolidation mode. The upside is capped by geopolitical risk and Trump’s inability to make any economic reforms. But more importantly the direction of markets has been determined by economic momentum. From November last year, the rise in markets was largely due to the improving economic cycle. The consolidation now in evidence is due to economic momentum moderating.

Market Watch - June 2017

With markets hitting new highs and most assets looking fully valued to us, we are sceptical that prices can continue to go higher. The rally in risky assets since the end of last year was largely due to the improvement in the economic cycle. However, with growth moderating and the increasing likelihood that President Trump cannot enact big economic reforms, it is difficult to see much market upside.

Market Watch - July 2017

There are still opportunities despite stretched valuations. Looking at the macro-backdrop and overlaying it with the stock market, we find that the current episode of moderation is not out of synch with history: we have seen this before. It is not out of the ordinary to see a growth moderation of the current magnitude.

Market Watch - October 2016

For most of the third quarter, it was unusually calm for markets. As the fourth quarter unfolds, we predict markets will enter into a phase of higher uncertainty. Read this month’s Market Watch ‘Bracing for a bumpier ride’ to find out more.

Market Watch - March 2016

Markets have been engaged in a blame game, moving the focus from China, to oil, European banks and now “Brexit”. How valid are these “blame” factors and will the recent relief in market continue?

Market Watch - December 2015/January 2016

Market Watch: Another year has flown by and in this month’s edition we consider the prospects for 2016. Of course the calendar-based delineation is arbitrary and we should always be prepared to re-assess our portfolio, but somehow the year end provides the chance to step back from the daily noise and take a longer-term view.

Recommended

Market Watch - August 2016

One month after Brexit, financial markets are behaving as if the UK’s exit vote had never happened. Stock markets, including the UK, have not only recovered from the sharp post-Brexit losses but have surged ahead. The US stock market moved further into uncharted territory as it touched new high levels. The reason for the risk rally is in the expectation that central banks will over-compensate Brexit’s presumed negative effects with excessive easing. But despite markets setting new highs, we urge investors not to chase this rally. Instead, investors should stay cautious and take some profit.

Market Watch - May 2017

Markets are in a consolidation mode. The upside is capped by geopolitical risk and Trump’s inability to make any economic reforms. But more importantly the direction of markets has been determined by economic momentum. From November last year, the rise in markets was largely due to the improving economic cycle. The consolidation now in evidence is due to economic momentum moderating.

Market Watch - June 2017

With markets hitting new highs and most assets looking fully valued to us, we are sceptical that prices can continue to go higher. The rally in risky assets since the end of last year was largely due to the improvement in the economic cycle. However, with growth moderating and the increasing likelihood that President Trump cannot enact big economic reforms, it is difficult to see much market upside.

Market Watch - July 2017

There are still opportunities despite stretched valuations. Looking at the macro-backdrop and overlaying it with the stock market, we find that the current episode of moderation is not out of synch with history: we have seen this before. It is not out of the ordinary to see a growth moderation of the current magnitude.

Market Watch - October 2016

For most of the third quarter, it was unusually calm for markets. As the fourth quarter unfolds, we predict markets will enter into a phase of higher uncertainty. Read this month’s Market Watch ‘Bracing for a bumpier ride’ to find out more.

Market Watch - March 2016

Markets have been engaged in a blame game, moving the focus from China, to oil, European banks and now “Brexit”. How valid are these “blame” factors and will the recent relief in market continue?

Market Watch - December 2015/January 2016

Market Watch: Another year has flown by and in this month’s edition we consider the prospects for 2016. Of course the calendar-based delineation is arbitrary and we should always be prepared to re-assess our portfolio, but somehow the year end provides the chance to step back from the daily noise and take a longer-term view.

Market Watch - November 2015

Market Watch: The past few months have provided a salutary reminder of the dangers and difficulties in trying to time the market. A month ago we were arguing that the markets were overshooting and were looking for an opportunity to turn more positive on risk assets, but the rebound has come through earlier and much more sharply than expected. This rebound supports our relatively positive view on the global economy, in particular the recovery in developed markets.

Market Watch - November 2016

A momentous decision looms for Americans on 8 November. There was a sense that after the debates, Clinton would win big in the race for Presidency. However, Trump has made a comeback, and the race looks to be tighter than initially expected.

Market Watch - February 2016

Markets started 2016 with wide swings, resembling the mischief and unpredictability of a monkey. As we usher in the Year of the Monkey, we ask whether this new lunar year will bring prosperity or danger for investors.

Market Watch - December 2016

Trump’s election victory has sent a global shockwave, mixing positive demand and negative supply elements in his policy rhetoric. There remains considerable ambiguity about the actual mix of Trump’s policies. Since it is too early to extrapolate Trump, it is best to assess his policies through the prism of three scenarios: the “good”, the “not so bad”, and the “ugly”.

What are objectives of investing in mutual funds

Since past two decades, the growth percentage of mutual fund industry has seen a noticeable hike. This growth is the result of increased education levels which has penetrated through individual’s mind about understanding their financial requirements.

Current Update on Fixed Income Market - Valuations turned attractive

Keeping the Positive Macros and RBI’s increased headroom for action

• We believe the fixed income market has become quite attractive even though the current volatility has

been high

• We expect RBI to take action very soon, due to which the opportunity to invest remain right now before the

RBI comes into action

• The entire yield curve across rating category is now looking attractive

• Even in 2008 & 2013 post the volatility the fixed income market generated high positive returns for the

investors

Hence, we give a strong buy call on the fixed income market and recommend investing in schemes in the Low

Duration, Ultra Short, Short Duration and Medium Duration categories based on your indicative investment

horizon.

ETT: IPO vs. RTO

How to list Erdenes Tavan Tolgoi JSC ("ETT"), comparison between IPO and RTO, Reverse Take Over ?

IMPORTANCE OF DEBT FUNDS

In this slides we will see why debt funds are important and what are its advantages.

Understanding Balanced Funds

Our work demands often leave us with little or no time to spend with the family. This routine can lead to unwarranted stress and fatigue.

Both work and family are the cornerstones of life, neither of which can be ignored. That is why we need to strike a right balance between work and personal life to lead a happy and a healthier life.

Balancing both aspects of your life means you have to give yourself equally so that one will not suffer at the expense of the other. In the long run, the joy, happiness and fulfilment derived from both are worth the effort.

Investing in balanced funds (also known as Hybrid funds) is not much different. Similar to work-life balance, balanced funds are here to give us the best of both worlds.

Today’s lesson by Prof. Simply Simple attempts to explain the importance of balanced funds.

Look forward to your valuable feedback at professor@tataamc.com

Mukesh Kumar

Identify the three different fund for Aggressive,Moderate and Conservative Investors.Suggest best fund type with reansons.

Classification of debt mutual funds

Mutual Funds does not always mean Up and Down, Risky and gives a feeling of "No, not for me".

Debt Mutual Funds can be a great Portfolio diversifier and

Market Watch - May 2016

While it's hard to predict the markets, when it comes to the month of May, one thing is for certain: You will hear the financial media and market participants say "Sell in May and Go Away." However, after examining the data, there is no convincing case for investors to “Sell in May and Go Away” this year, especially, if 2016 is not going to be a recession year.

Market Watch - July 2016

What's next after Brexit? The only certainty is that there will be a high degree of uncertainty. In this month's Market Watch, we assess Brexit’s damage through the prism of economic, financial and political contagion.

Market Watch - April 2016

Fed’s dovish guidance was a game changer. Investors are now showing renewed enthusiasm for risk assets; a stark contrast to when the year started. This newfound optimism reflects the improvement in economic data, coupled with the delay in the Fed’s rate hike cycle and more stimulus from the ECB.

More Related Content

What's hot

Market Watch - November 2015

Market Watch: The past few months have provided a salutary reminder of the dangers and difficulties in trying to time the market. A month ago we were arguing that the markets were overshooting and were looking for an opportunity to turn more positive on risk assets, but the rebound has come through earlier and much more sharply than expected. This rebound supports our relatively positive view on the global economy, in particular the recovery in developed markets.

Market Watch - November 2016

A momentous decision looms for Americans on 8 November. There was a sense that after the debates, Clinton would win big in the race for Presidency. However, Trump has made a comeback, and the race looks to be tighter than initially expected.

Market Watch - February 2016

Markets started 2016 with wide swings, resembling the mischief and unpredictability of a monkey. As we usher in the Year of the Monkey, we ask whether this new lunar year will bring prosperity or danger for investors.

Market Watch - December 2016

Trump’s election victory has sent a global shockwave, mixing positive demand and negative supply elements in his policy rhetoric. There remains considerable ambiguity about the actual mix of Trump’s policies. Since it is too early to extrapolate Trump, it is best to assess his policies through the prism of three scenarios: the “good”, the “not so bad”, and the “ugly”.

What are objectives of investing in mutual funds

Since past two decades, the growth percentage of mutual fund industry has seen a noticeable hike. This growth is the result of increased education levels which has penetrated through individual’s mind about understanding their financial requirements.

Current Update on Fixed Income Market - Valuations turned attractive

Keeping the Positive Macros and RBI’s increased headroom for action

• We believe the fixed income market has become quite attractive even though the current volatility has

been high

• We expect RBI to take action very soon, due to which the opportunity to invest remain right now before the

RBI comes into action

• The entire yield curve across rating category is now looking attractive

• Even in 2008 & 2013 post the volatility the fixed income market generated high positive returns for the

investors

Hence, we give a strong buy call on the fixed income market and recommend investing in schemes in the Low

Duration, Ultra Short, Short Duration and Medium Duration categories based on your indicative investment

horizon.

ETT: IPO vs. RTO

How to list Erdenes Tavan Tolgoi JSC ("ETT"), comparison between IPO and RTO, Reverse Take Over ?

IMPORTANCE OF DEBT FUNDS

In this slides we will see why debt funds are important and what are its advantages.

Understanding Balanced Funds

Our work demands often leave us with little or no time to spend with the family. This routine can lead to unwarranted stress and fatigue.

Both work and family are the cornerstones of life, neither of which can be ignored. That is why we need to strike a right balance between work and personal life to lead a happy and a healthier life.

Balancing both aspects of your life means you have to give yourself equally so that one will not suffer at the expense of the other. In the long run, the joy, happiness and fulfilment derived from both are worth the effort.

Investing in balanced funds (also known as Hybrid funds) is not much different. Similar to work-life balance, balanced funds are here to give us the best of both worlds.

Today’s lesson by Prof. Simply Simple attempts to explain the importance of balanced funds.

Look forward to your valuable feedback at professor@tataamc.com

Mukesh Kumar

Identify the three different fund for Aggressive,Moderate and Conservative Investors.Suggest best fund type with reansons.

Classification of debt mutual funds

Mutual Funds does not always mean Up and Down, Risky and gives a feeling of "No, not for me".

Debt Mutual Funds can be a great Portfolio diversifier and

What's hot (19)

Current Update on Fixed Income Market - Valuations turned attractive

Current Update on Fixed Income Market - Valuations turned attractive

Similar to Market Watch - September 2016

Market Watch - May 2016

While it's hard to predict the markets, when it comes to the month of May, one thing is for certain: You will hear the financial media and market participants say "Sell in May and Go Away." However, after examining the data, there is no convincing case for investors to “Sell in May and Go Away” this year, especially, if 2016 is not going to be a recession year.

Market Watch - July 2016

What's next after Brexit? The only certainty is that there will be a high degree of uncertainty. In this month's Market Watch, we assess Brexit’s damage through the prism of economic, financial and political contagion.

Market Watch - April 2016

Fed’s dovish guidance was a game changer. Investors are now showing renewed enthusiasm for risk assets; a stark contrast to when the year started. This newfound optimism reflects the improvement in economic data, coupled with the delay in the Fed’s rate hike cycle and more stimulus from the ECB.

Market Watch - February 2017

Trump’s inauguration speech is clear: American First – both for American jobs and American goods. This means more protectionism and less free trade. The best way to assess Trump’s first 100 days is to look at what he can implement – in the context of what needs approval by Congress as well as the complexity of drawing up the policies.

Federal Bank

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/Federal-Bank-Ltd-3709 for more

Monetary policy review 18dec13

RBI's monetary policy announcement and its implication on investment strategy . . .

ITD Cementation India Ltd

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/ITD-Cementation-India-Ltd-105 for more

“Our Equity Valuation Index now into Deep Green Zone” - Invest aggressively i...

Our Equity Valuation Index highlights that Equities are available at attractive valuations

Our VCTS (Valuation, Cycle, Trigger, and Sentiments) framework indicates that the Valuations are

attractive, we are in the low to mid-phase of the business cycle and sentiments around the asset class

is negative

Hence, we recommend invest aggressively in equities at this juncture

Global crisis usually provided a good opportunity to invest in equities. We believe with recent

market correction due to concerns around COVID-19 spread, the market has stepped into an oversold

zone. This provides a good margin of safety for equity investments

Avoiding paralysis in the face of volatility

UBS Intellectual Capital Blog:

Avoiding paralysis in the face of volatility.

Daily Technical Report:06 June 2019

Axis Direct presents daily derivatives report presenting recommendations based on technical analysis. For trading in derivatives visit https://simplehai.axisdirect.in/offerings/products/derivatives

Ashok Leyland

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/Ashok-Leyland-Ltd-31 for more

Reliance Nippon Life Asset Management Ltd

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/Reliance-Nippon-Life-Asset-Management-Ltd-12622 for more

Time to Invest in Equities – Valuations Attractive

Our Equity Valuation Index highlights that Equities are available at attractive valuations

Our VCTS (Valuation, Cycle, Trigger, and Sentiments) framework indicates that the Valuations are attractive, we are in the low to mid-phase of business cycle and sentiments around the asset class is negative

Hence, we recommend to invest aggressively in equities at this juncture

Global crisis usually provided a good opportunity to invest in equities. We believe with a recent market correction due to concerns around COVID-19 spread outside China, the market has stepped into an oversold zone. This provides a good margin of safety for equity investments

Minda Inds

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/Minda-Industries-Ltd-12295 for more

Mold-Tek Pack

A thorough analysis of company , industry and economy goes behind our stock ideas for you. With these picks, you may earn superior returns over a medium to long term period. Visit https://simplehai.axisdirect.in/share-stock-prices/nse/Mold-Tek-Packaging-Ltd-28243 for more

Time to add Equities

We recommend adding equities through Asset allocation schemes and Fund of fund schemes like

ICICI Prudential Balanced Advantage Fund and ICICI Prudential Asset Allocator Fund (FOF)

Read the full doc to know more

Daily Technical Report:16 October 2019

Axis Direct presents daily derivatives report presenting recommendations based on technical analysis. For trading in derivatives visit https://simplehai.axisdirect.in/offerings/products/derivatives

Similar to Market Watch - September 2016 (20)

“Our Equity Valuation Index now into Deep Green Zone” - Invest aggressively i...

“Our Equity Valuation Index now into Deep Green Zone” - Invest aggressively i...

Time to Invest in Equities – Valuations Attractive

Time to Invest in Equities – Valuations Attractive

Global Macro Commentary January 4 - The Bond Awakens

Global Macro Commentary January 4 - The Bond Awakens

Recently uploaded

how can i use my minded pi coins I need some funds.

If you are interested in selling your pi coins, i have a verified pi merchant, who buys pi coins and resell them to exchanges looking forward to hold till mainnet launch.

Because the core team has announced that pi network will not be doing any pre-sale. The only way exchanges like huobi, bitmart and hotbit can get pi is by buying from miners.

Now a merchant stands in between these exchanges and the miners. As a link to make transactions smooth. Because right now in the enclosed mainnet you can't sell pi coins your self. You need the help of a merchant,

i will leave the telegram contact of my personal pi merchant below. 👇 I and my friends has traded more than 3000pi coins with him successfully.

@Pi_vendor_247

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...Falcon Invoice Discounting

Falcon stands out as a top-tier P2P Invoice Discounting platform in India, bridging esteemed blue-chip companies and eager investors. Our goal is to transform the investment landscape in India by establishing a comprehensive destination for borrowers and investors with diverse profiles and needs, all while minimizing risk. What sets Falcon apart is the elimination of intermediaries such as commercial banks and depository institutions, allowing investors to enjoy higher yields.how to sell pi coins effectively (from 50 - 100k pi)

Anywhere in the world, including Africa, America, and Europe, you can sell Pi Network Coins online and receive cash through online payment options.

Pi has not yet been launched on any exchange because we are currently using the confined Mainnet. The planned launch date for Pi is June 28, 2026.

Reselling to investors who want to hold until the mainnet launch in 2026 is currently the sole way to sell.

Consequently, right now. All you need to do is select the right pi network provider.

Who is a pi merchant?

An individual who buys coins from miners on the pi network and resells them to investors hoping to hang onto them until the mainnet is launched is known as a pi merchant.

debuts.

I'll provide you the Telegram username

@Pi_vendor_247

The Role of Non-Banking Financial Companies (NBFCs)

The Role of Non-Banking Financial Companies (NBFCs)

how to sell pi coins on Bitmart crypto exchange

Yes. Pi network coins can be exchanged but not on bitmart exchange. Because pi network is still in the enclosed mainnet. The only way pioneers are able to trade pi coins is by reselling the pi coins to pi verified merchants.

A verified merchant is someone who buys pi network coins and resell it to exchanges looking forward to hold till mainnet launch.

I will leave the telegram contact of my personal pi merchant to trade with.

@Pi_vendor_247

how to sell pi coins at high rate quickly.

Where can I sell my pi coins at a high rate.

Pi is not launched yet on any exchange. But one can easily sell his or her pi coins to investors who want to hold pi till mainnet launch.

This means crypto whales want to hold pi. And you can get a good rate for selling pi to them. I will leave the telegram contact of my personal pi vendor below.

A vendor is someone who buys from a miner and resell it to a holder or crypto whale.

Here is the telegram contact of my vendor:

@Pi_vendor_247

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

The world of bitcoin is constantly changing, with new opportunities and hazards surfacing practically daily.

USDA Loans in California: A Comprehensive Overview.pptx

USDA Loans in California: A Comprehensive Overview

If you're dreaming of owning a home in California's rural or suburban areas, a USDA loan might be the perfect solution. The U.S. Department of Agriculture (USDA) offers these loans to help low-to-moderate-income individuals and families achieve homeownership.

Key Features of USDA Loans:

Zero Down Payment: USDA loans require no down payment, making homeownership more accessible.

Competitive Interest Rates: These loans often come with lower interest rates compared to conventional loans.

Flexible Credit Requirements: USDA loans have more lenient credit score requirements, helping those with less-than-perfect credit.

Guaranteed Loan Program: The USDA guarantees a portion of the loan, reducing risk for lenders and expanding borrowing options.

Eligibility Criteria:

Location: The property must be located in a USDA-designated rural or suburban area. Many areas in California qualify.

Income Limits: Applicants must meet income guidelines, which vary by region and household size.

Primary Residence: The home must be used as the borrower's primary residence.

Application Process:

Find a USDA-Approved Lender: Not all lenders offer USDA loans, so it's essential to choose one approved by the USDA.

Pre-Qualification: Determine your eligibility and the amount you can borrow.

Property Search: Look for properties in eligible rural or suburban areas.

Loan Application: Submit your application, including financial and personal information.

Processing and Approval: The lender and USDA will review your application. If approved, you can proceed to closing.

USDA loans are an excellent option for those looking to buy a home in California's rural and suburban areas. With no down payment and flexible requirements, these loans make homeownership more attainable for many families. Explore your eligibility today and take the first step toward owning your dream home.

The secret way to sell pi coins effortlessly.

Well as we all know pi isn't launched yet. But you can still sell your pi coins effortlessly because some whales in China are interested in holding massive pi coins. And they are willing to pay good money for it. If you are interested in selling I will leave a contact for you. Just telegram this number below. I sold about 3000 pi coins to him and he paid me immediately.

Telegram: @Pi_vendor_247

一比一原版(UoB毕业证)伯明翰大学毕业证如何办理

UoB本科学位证成绩单【微信95270640】伯明翰大学没毕业>办理伯明翰大学毕业证成绩单【微信UoB】UoB毕业证成绩单UoB学历证书UoB文凭《UoB毕业套号文凭网认证伯明翰大学毕业证成绩单》《哪里买伯明翰大学毕业证文凭UoB成绩学校快递邮寄信封》《开版伯明翰大学文凭》UoB留信认证本科硕士学历认证

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到伯明翰大学伯明翰大学硕士毕业证成绩单;

3、不清楚流程以及材料该如何准备伯明翰大学伯明翰大学硕士毕业证成绩单;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★伯明翰大学伯明翰大学硕士毕业证成绩单毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查伯明翰大学伯明翰大学硕士毕业证成绩单】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助伯明翰大学同学朋友

你做代理,可以拯救伯明翰大学失足青年

你做代理,可以挽救伯明翰大学一个个人才

你做代理,你将是别人人生伯明翰大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会大块就啃啃得满嘴满脸猴屁股般的红艳大家一个劲地指着对方吃吃地笑瓜裂得古怪奇形怪状却丝毫不影响瓜味甜丝丝的满嘴生津遍地都是瓜横七竖八的活像掷满了一地的大石块摘走二三只爷爷是断然发现不了的即便发现爷爷也不恼反而教山娃辨认孰熟孰嫩孰甜孰淡名义上是护瓜往往在瓜棚里坐上一刻饱吃一顿后山娃就领着阿黑漫山遍野地跑阿黑是一条黑色的大猎狗挺机灵的是山娃多年的忠实伙伴平时山娃上学阿黑也摇头晃脑地跟去暑假用不着上学阿钩

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

The U.S. economy is continuing its impressive recovery from the COVID-19 pandemic and not slowing down despite re-occurring bumps. The U.S. savings rate reached its highest ever recorded level at 34% in April 2020 and Americans seem ready to spend. The sectors that had been hurt the most by the pandemic specifically reduced consumer spending, like retail, leisure, hospitality, and travel, are now experiencing massive growth in revenue and job openings.

Could this growth lead to a “Roaring Twenties”? As quickly as the U.S. economy contracted, experiencing a 9.1% drop in economic output relative to the business cycle in Q2 2020, the largest in recorded history, it has rebounded beyond expectations. This surprising growth seems to be fueled by the U.S. government’s aggressive fiscal and monetary policies, and an increase in consumer spending as mobility restrictions are lifted. Unemployment rates between June 2020 and June 2021 decreased by 5.2%, while the demand for labor is increasing, coupled with increasing wages to incentivize Americans to rejoin the labor force. Schools and businesses are expected to fully reopen soon. In parallel, vaccination rates across the country and the world continue to rise, with full vaccination rates of 50% and 14.8% respectively.

However, it is not completely smooth sailing from here. According to M Capital Group, the main risks that threaten the continued growth of the U.S. economy are inflation, unsettled trade relations, and another wave of Covid-19 mutations that could shut down the world again. Have we learned from the past year of COVID-19 and adapted our economy accordingly?

“In order for the U.S. economy to continue growing, whether there is another wave or not, the U.S. needs to focus on diversifying supply chains, supporting business investment, and maintaining consumer spending,” says Grace Feeley, a research analyst at M Capital Group.

While the economic indicators are positive, the risks are coming closer to manifesting and threatening such growth. The new variants spreading throughout the world, Delta, Lambda, and Gamma, are vaccine-resistant and muddy the predictions made about the economy and health of the country. These variants bring back the feeling of uncertainty that has wreaked havoc not only on the stock market but the mindset of people around the world. MCG provides unique insight on how to mitigate these risks to possibly ensure a bright economic future.

how to sell pi coins on Binance exchange

Currently pi network is not tradable on binance or any other exchange because we are still in the enclosed mainnet.

Right now the only way to sell pi coins is by trading with a verified merchant.

What is a pi merchant?

A pi merchant is someone verified by pi network team and allowed to barter pi coins for goods and services.

Since pi network is not doing any pre-sale The only way exchanges like binance/huobi or crypto whales can get pi is by buying from miners. And a merchant stands in between the exchanges and the miners.

I will leave the telegram contact of my personal pi merchant. I and my friends has traded more than 6000pi coins successfully

Tele-gram

@Pi_vendor_247

What price will pi network be listed on exchanges

The rate at which pi will be listed is practically unknown. But due to speculations surrounding it the predicted rate is tends to be from 30$ — 50$.

So if you are interested in selling your pi network coins at a high rate tho. Or you can't wait till the mainnet launch in 2026. You can easily trade your pi coins with a merchant.

A merchant is someone who buys pi coins from miners and resell them to Investors looking forward to hold massive quantities till mainnet launch.

I will leave the telegram contact of my personal pi vendor to trade with.

@Pi_vendor_247

where can I find a legit pi merchant online

Yes. This is very easy what you need is a recommendation from someone who has successfully traded pi coins before with a merchant.

Who is a pi merchant?

A pi merchant is someone who buys pi network coins and resell them to Investors looking forward to hold thousands of pi coins before the open mainnet.

I will leave the telegram contact of my personal pi merchant to trade with

@Pi_vendor_247

The European Unemployment Puzzle: implications from population aging

We study the link between the evolving age structure of the working population and unemployment. We build a large new Keynesian OLG model with a realistic age structure, labor market frictions, sticky prices, and aggregate shocks. Once calibrated to the European economy, we quantify the extent to which demographic changes over the last three decades have contributed to the decline of the unemployment rate. Our findings yield important implications for the future evolution of unemployment given the anticipated further aging of the working population in Europe. We also quantify the implications for optimal monetary policy: lowering inflation volatility becomes less costly in terms of GDP and unemployment volatility, which hints that optimal monetary policy may be more hawkish in an aging society. Finally, our results also propose a partial reversal of the European-US unemployment puzzle due to the fact that the share of young workers is expected to remain robust in the US.

how can I sell/buy bulk pi coins securely

Even tho Pi network is not listed on any exchange yet.

Buying/Selling or investing in pi network coins is highly possible through the help of vendors. You can buy from vendors[ buy directly from the pi network miners and resell it]. I will leave the telegram contact of my personal vendor.

@Pi_vendor_247

一比一原版(IC毕业证)帝国理工大学毕业证如何办理

IC毕业证文凭证书【微信95270640】一比一伪造帝国理工大学文凭@假冒IC毕业证成绩单+Q微信95270640办理IC学位证书@仿造IC毕业文凭证书@购买帝国理工大学毕业证成绩单IC真实使馆认证/真实留信认证回国人员证明

如果您是以下情况,我们都能竭诚为您解决实际问题:【公司采用定金+余款的付款流程,以最大化保障您的利益,让您放心无忧】

1、在校期间,因各种原因未能顺利毕业,拿不到官方毕业证+微信95270640

2、面对父母的压力,希望尽快拿到帝国理工大学帝国理工大学毕业证学历书;

3、不清楚流程以及材料该如何准备帝国理工大学帝国理工大学毕业证学历书;

4、回国时间很长,忘记办理;

5、回国马上就要找工作,办给用人单位看;

6、企事业单位必须要求办理的;

面向美国乔治城大学毕业留学生提供以下服务:

【★帝国理工大学帝国理工大学毕业证学历书毕业证、成绩单等全套材料,从防伪到印刷,从水印到钢印烫金,与学校100%相同】

【★真实使馆认证(留学人员回国证明),使馆存档可通过大使馆查询确认】

【★真实教育部认证,教育部存档,教育部留服网站可查】

【★真实留信认证,留信网入库存档,可查帝国理工大学帝国理工大学毕业证学历书】

我们从事工作十余年的有着丰富经验的业务顾问,熟悉海外各国大学的学制及教育体系,并且以挂科生解决毕业材料不全问题为基础,为客户量身定制1对1方案,未能毕业的回国留学生成功搭建回国顺利发展所需的桥梁。我们一直努力以高品质的教育为起点,以诚信、专业、高效、创新作为一切的行动宗旨,始终把“诚信为主、质量为本、客户第一”作为我们全部工作的出发点和归宿点。同时为海内外留学生提供大学毕业证购买、补办成绩单及各类分数修改等服务;归国认证方面,提供《留信网入库》申请、《国外学历学位认证》申请以及真实学籍办理等服务,帮助众多莘莘学子实现了一个又一个梦想。

专业服务,请勿犹豫联系我

如果您真实毕业回国,对于学历认证无从下手,请联系我,我们免费帮您递交

诚招代理:本公司诚聘当地代理人员,如果你有业余时间,或者你有同学朋友需要,有兴趣就请联系我

你赢我赢,共创双赢

你做代理,可以帮助帝国理工大学同学朋友

你做代理,可以拯救帝国理工大学失足青年

你做代理,可以挽救帝国理工大学一个个人才

你做代理,你将是别人人生帝国理工大学的转折点

你做代理,可以改变自己,改变他人,给他人和自己一个机会美景更增添一份性感夹杂着一份纯洁的妖娆毫无违和感实在给人带来一份悠然幸福的心情如果说现在的审美已经断然拒绝了无声的话那么在树林间飞掠而过的小鸟叽叽咋咋的叫声是否就是这最后的点睛之笔悠然走在林间的小路上宁静与清香一丝丝的盛夏气息吸入身体昔日生活里的繁忙与焦躁早已淡然无存心中满是悠然清淡的芳菲身体不由的轻松脚步也感到无比的轻快走出这盘栾交错的小道眼前是连绵不绝的山峦浩荡天地间大自然毫无吝啬的展现它的达

Recently uploaded (20)

how can i use my minded pi coins I need some funds.

how can i use my minded pi coins I need some funds.

Analyzing the instability of equilibrium in thr harrod domar model

Analyzing the instability of equilibrium in thr harrod domar model

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

innovative-invoice-discounting-platforms-in-india-empowering-retail-investors...

how to sell pi coins effectively (from 50 - 100k pi)

how to sell pi coins effectively (from 50 - 100k pi)

The Role of Non-Banking Financial Companies (NBFCs)

The Role of Non-Banking Financial Companies (NBFCs)

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

Which Crypto to Buy Today for Short-Term in May-June 2024.pdf

USDA Loans in California: A Comprehensive Overview.pptx

USDA Loans in California: A Comprehensive Overview.pptx

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

US Economic Outlook - Being Decided - M Capital Group August 2021.pdf

The European Unemployment Puzzle: implications from population aging

The European Unemployment Puzzle: implications from population aging

Market Watch - September 2016

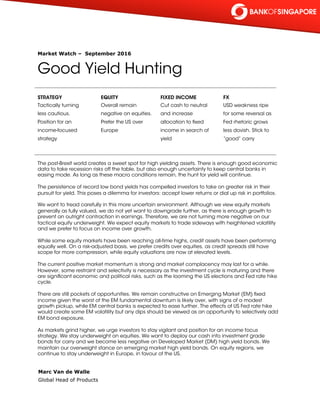

- 1. Market Watch – September 2016 Good Yield Hunting STRATEGY Tactically turning less cautious. Position for an income-focused strategy EQUITY Overall remain negative on equities. Prefer the US over Europe FIXED INCOME Cut cash to neutral and increase allocation to fixed income in search of yield FX USD weakness ripe for some reversal as Fed rhetoric grows less dovish. Stick to “good” carry The post-Brexit world creates a sweet spot for high yielding assets. There is enough good economic data to take recession risks off the table, but also enough uncertainty to keep central banks in easing mode. As long as these macro conditions remain, the hunt for yield will continue. The persistence of record low bond yields has compelled investors to take on greater risk in their pursuit for yield. This poses a dilemma for investors: accept lower returns or dial up risk in portfolios. We want to tread carefully in this more uncertain environment. Although we view equity markets generally as fully valued, we do not yet want to downgrade further, as there is enough growth to prevent an outright contraction in earnings. Therefore, we are not turning more negative on our tactical equity underweight. We expect equity markets to trade sideways with heightened volatility and we prefer to focus on income over growth. While some equity markets have been reaching all-time highs, credit assets have been performing equally well. On a risk-adjusted basis, we prefer credits over equities, as credit spreads still have scope for more compression, while equity valuations are now at elevated levels. The current positive market momentum is strong and market complacency may last for a while. However, some restraint and selectivity is necessary as the investment cycle is maturing and there are significant economic and political risks, such as the looming the US elections and Fed rate hike cycle. There are still pockets of opportunities. We remain constructive on Emerging Market (EM) fixed income given the worst of the EM fundamental downturn is likely over, with signs of a modest growth pickup, while EM central banks is expected to ease further. The effects of US Fed rate hike would create some EM volatility but any dips should be viewed as an opportunity to selectively add EM bond exposure. As markets grind higher, we urge investors to stay vigilant and position for an income focus strategy. We stay underweight on equities. We want to deploy our cash into investment grade bonds for carry and we become less negative on Developed Market (DM) high yield bonds. We maintain our overweight stance on emerging market high yield bonds. On equity regions, we continue to stay underweight in Europe, in favour of the US. Marc Van de Walle Global Head of Products

- 2. Disclaimer This article, prepared by Bank of Singapore Limited (Co. Reg. No.: 197700866R) (the “Bank”), is for information purposes only and is not an offer or a solicitation to deal in any of the financial products referred to herein or to enter into any legal relations, nor an advice or a recommendation with respect to such financial products. This document is prepared for general circulation. It does not have regard to the specific investment objectives, financial situation and the particular needs of any recipient. You should independently evaluate each financial product and consider the suitability of such financial product, taking into account your specific investment objectives, investment experience, financial situation and/or particular needs and consult an independent financial adviser as necessary, before dealing in any financial products mentioned in this article. This article may not be published, circulated, reproduced or distributed in whole or in part to any other person without the Bank’s prior written consent. This article is not intended for distribution, publication to or use by any person in any jurisdiction outside Singapore, Hong Kong or such other jurisdiction as the Bank may determine in its absolute discretion, where such distribution, publication or use would be contrary to applicable law or would subject the Bank and its related corporations, connected persons, associated persons and/or affiliates (collectively, “Affiliates”) to any registration, licensing or other requirements within such jurisdiction. While reasonable efforts have been made to ensure that the contents of this article have been obtained or derived from sources believed by the Bank and its Affiliates to be reliable, the Bank, its Affiliates and their respective officers, employees, agents and representatives do not make any express or implied representations or warranties as to the accuracy, timeliness or completeness of the information, data or prevailing state of affairs that are mentioned in this article and do not accept any liability for any loss or damage whatsoever, direct or indirect, arising from or in connection with the use of or reliance on the contents of this article. The Bank and its Affiliates may have issued other reports, analyses, or other documents expressing views different from the contents hereof and all views expressed in all reports, analyses and documents are subject to change without notice. The Bank and its Affiliates reserve the right to act upon or use the contents hereof at any time, including before its publication herein. Bank of Singapore Limited is a licensed bank regulated by the Monetary Authority of Singapore in Singapore and an Authorized Institution as defined in the Banking Ordinance of Hong Kong (Cap. 155), regulated by the Hong Kong Monetary Authority in Hong Kong. Bank of Singapore Limited, its employees and discretionary accounts managed by Bank of Singapore Limited may have long or short positions or may be otherwise interested in any of the financial products (including derivatives thereof) referred to in this article. Bank of Singapore Limited forms part of the OCBC Group (being for this purpose OCBC Bank and / or its subsidiaries, related and affiliated companies). Companies in the OCBC Group may perform or seek to perform broking, banking, and other investment or securities-related services for the corporations whose securities are mentioned in this presentation as well as other parties generally. Past performance is not always indicative of likely or future performance. All investments involve an element of risk, including capital loss.