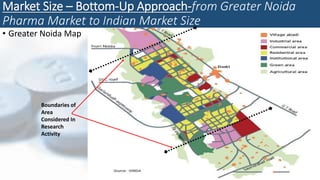

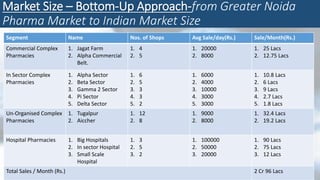

This document summarizes market research on the pharmacy market in Greater Noida, India. It estimates the current market size to be approximately 2 crore 96 lakh (29.6 million) rupees per month using a bottom-up approach, and approximately 1 crore 75 lakh (17.5 million) rupees using a top-down approach based on Greater Noida's population. The market was segmented based on commercial complexes, in-sector complexes, unorganized complexes, and hospital pharmacies. The market is expected to grow at 15% annually in line with India's domestic pharmaceutical industry growth rate. The conclusion recommends hospital pharmacies for high volume sales and in-sector or unorganized pharmacies