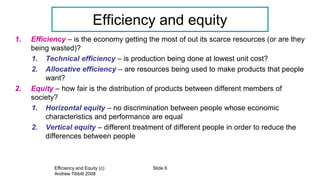

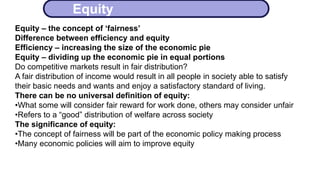

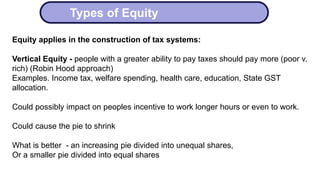

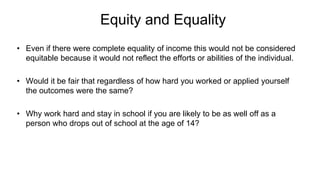

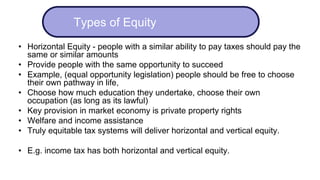

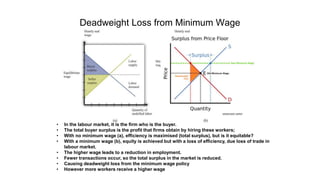

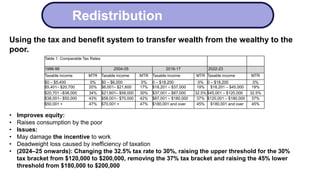

Equity refers to fairness, while equality refers to sameness. Equity aims to address unequal outcomes, even if they arise from equal treatment or opportunity. Competitive markets do not always result in equitable distributions, as people have different abilities and needs. Governments can promote equity through policies like progressive taxation, welfare spending on education and healthcare. However, redistribution reduces the incentive to work and causes some loss of economic efficiency. Overall, markets promote efficiency while governments aim to enhance equity through various programs and taxation systems.