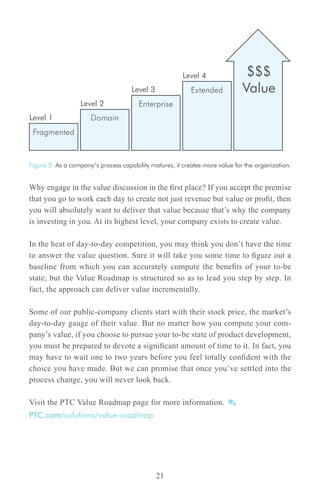

This document provides an introduction to the Value Roadmap, a tool developed by PTC to help companies improve their product development processes and consistently create valuable products. It discusses how the Value Roadmap can help companies identify opportunities to grow and increase profitability. The Value Roadmap analyzes a company's current "as-is" processes and maps out improved "to-be" processes to help the company better align its strategies, initiatives, and capabilities. It identifies nine opportunities for value creation, such as growing market share with customer-focused products, protecting product position through barriers to entry, and improving the ability to fulfill demand through supply chain flexibility. The document argues that mastering change management and having a strong product development process are keys