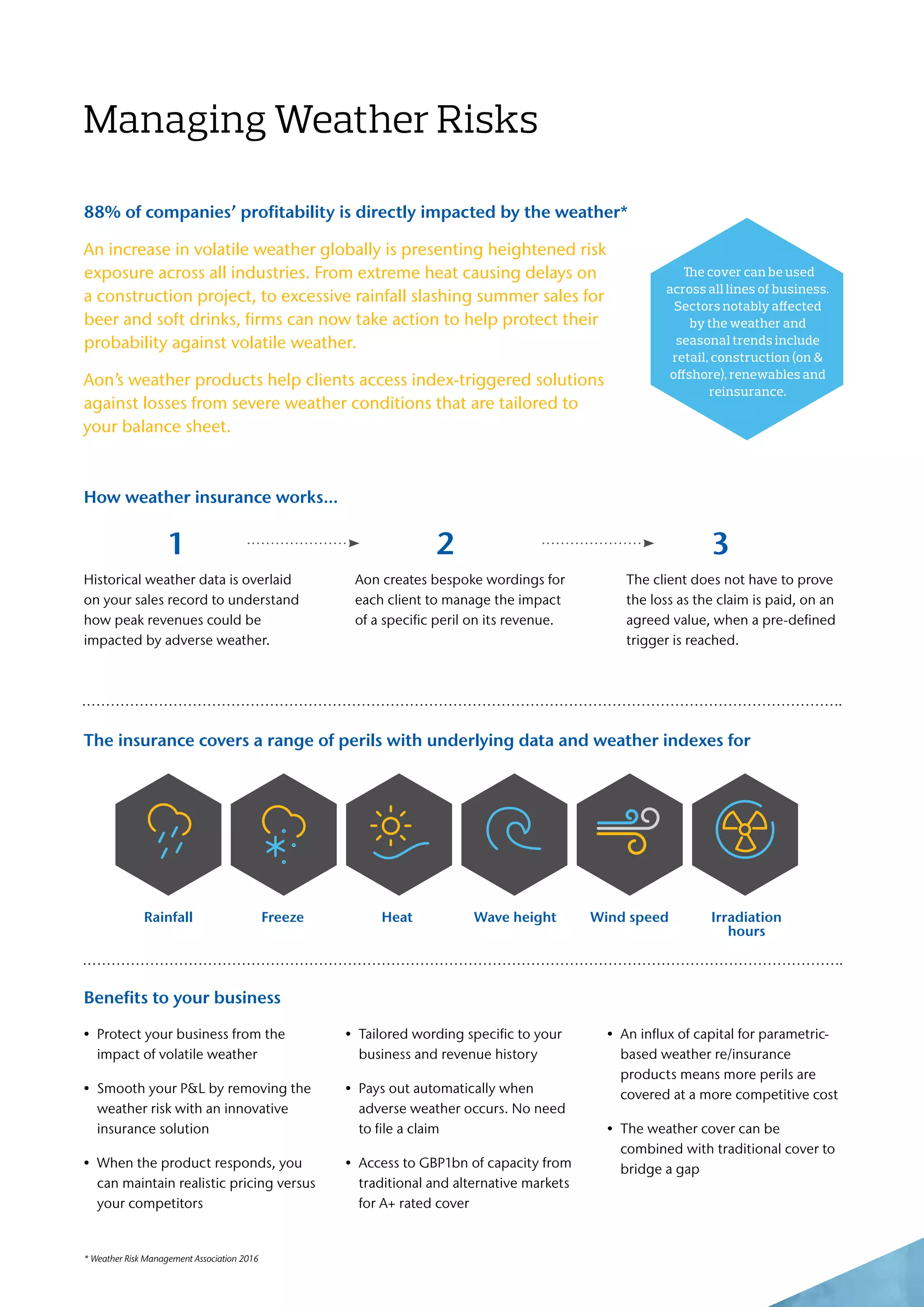

Aon provides weather insurance solutions designed to protect businesses from profitability risks tied to volatile weather, which significantly impacts many industries. Their tailored products release payouts automatically upon predefined weather events without the need for claims, enhancing financial stability for clients. Utilizing advanced weather data analytics, Aon offers bespoke coverage options across various sectors, demonstrating successful applications in protecting project profitability against adverse weather-related disruptions.