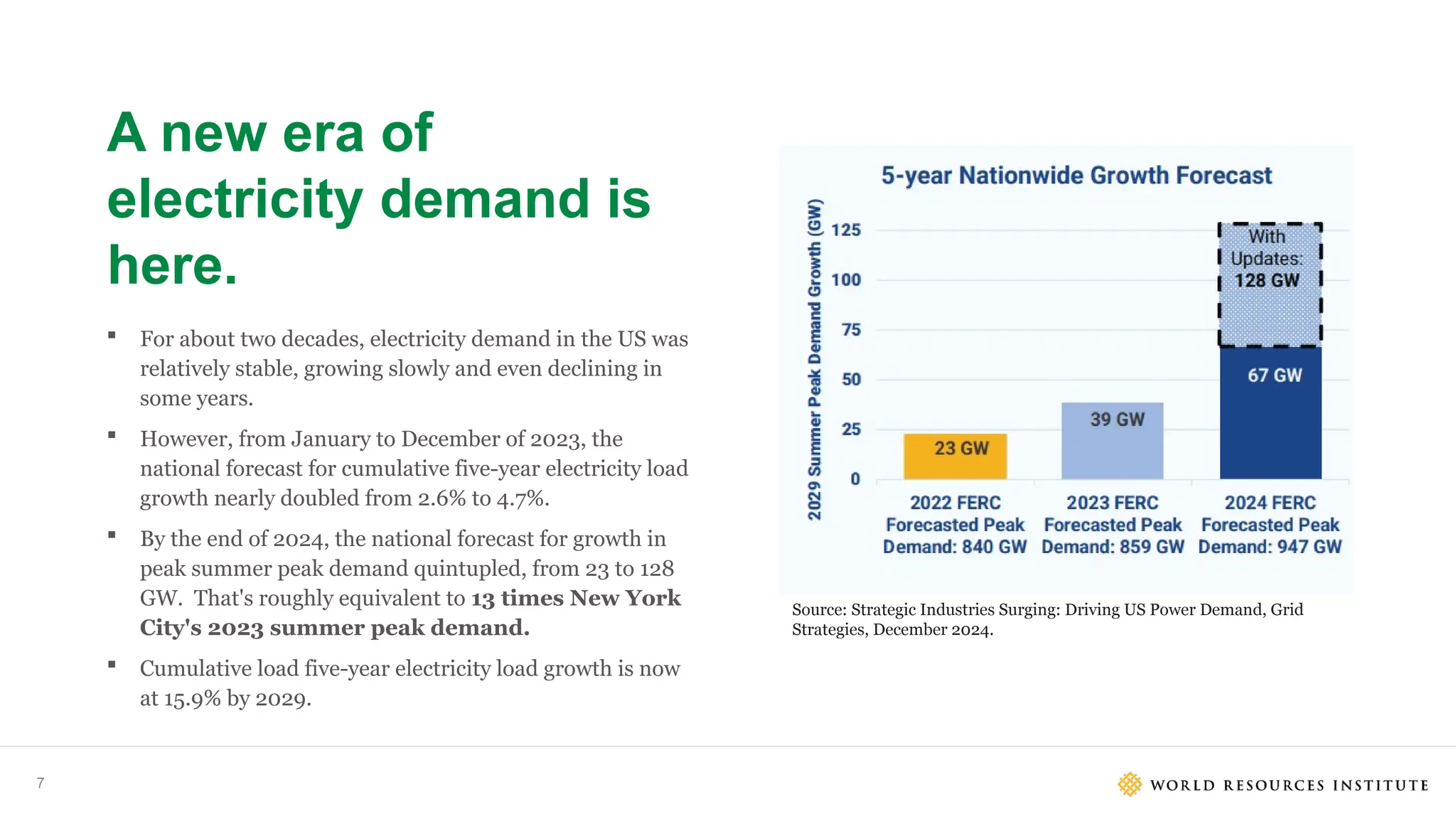

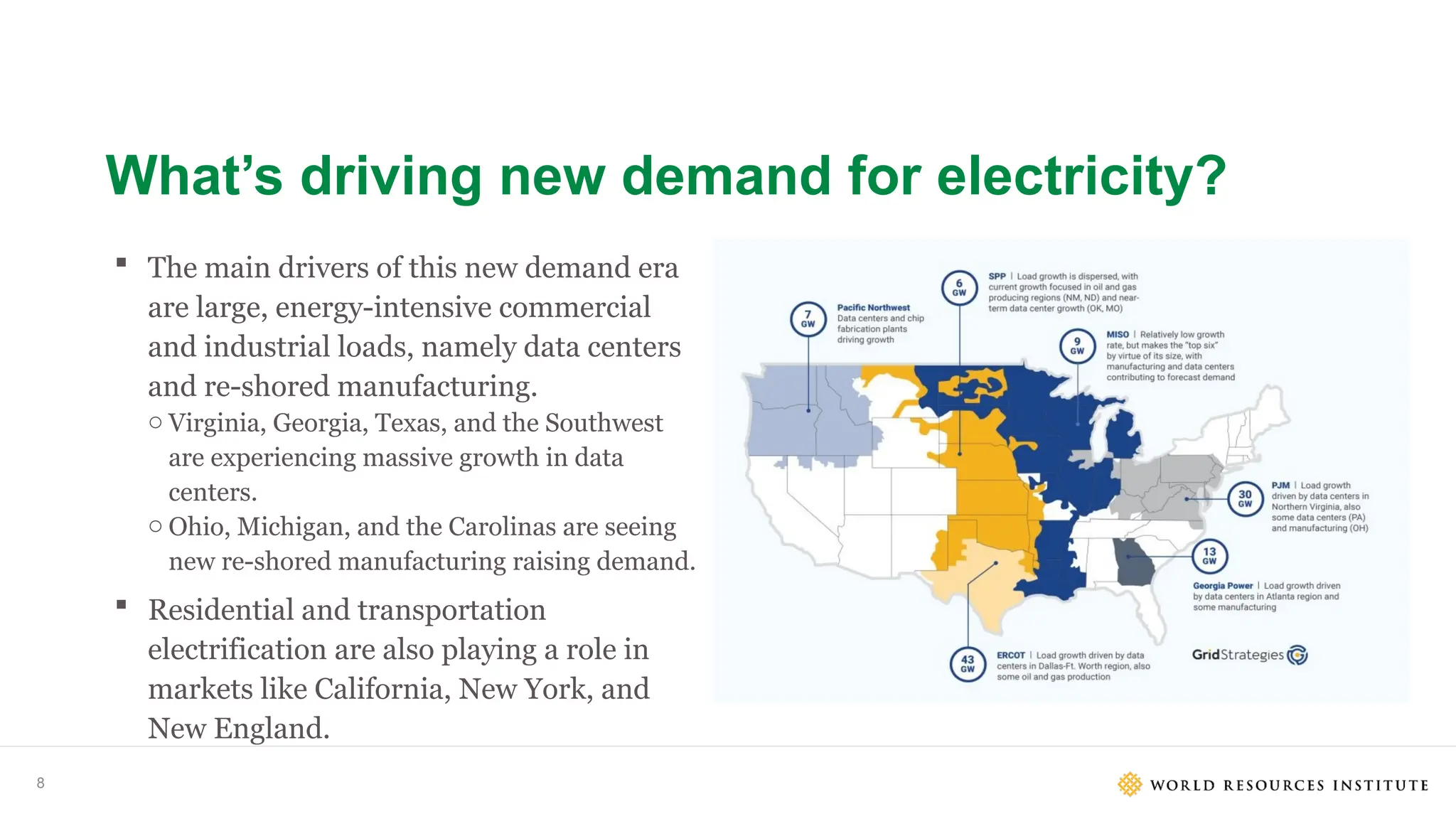

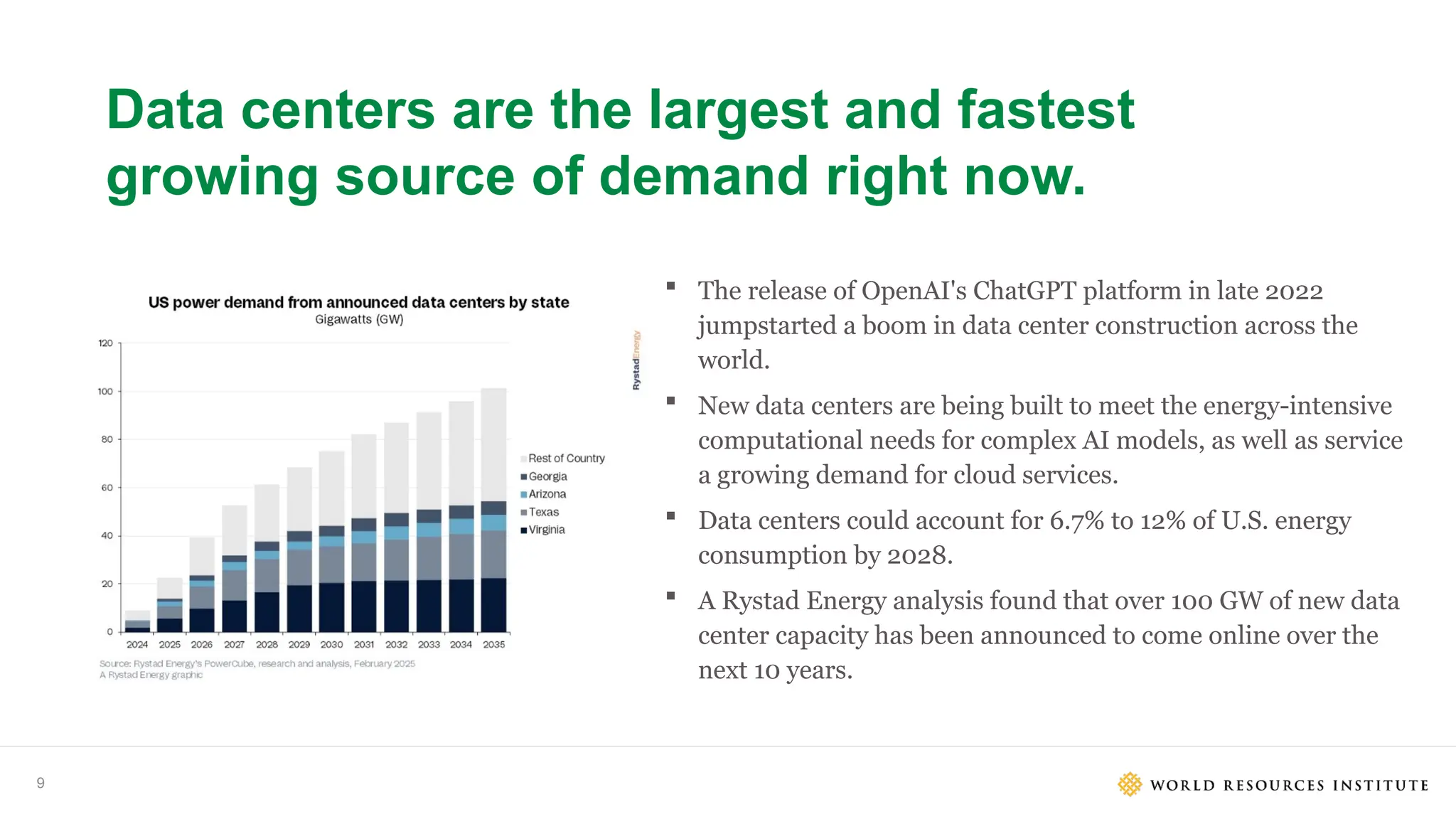

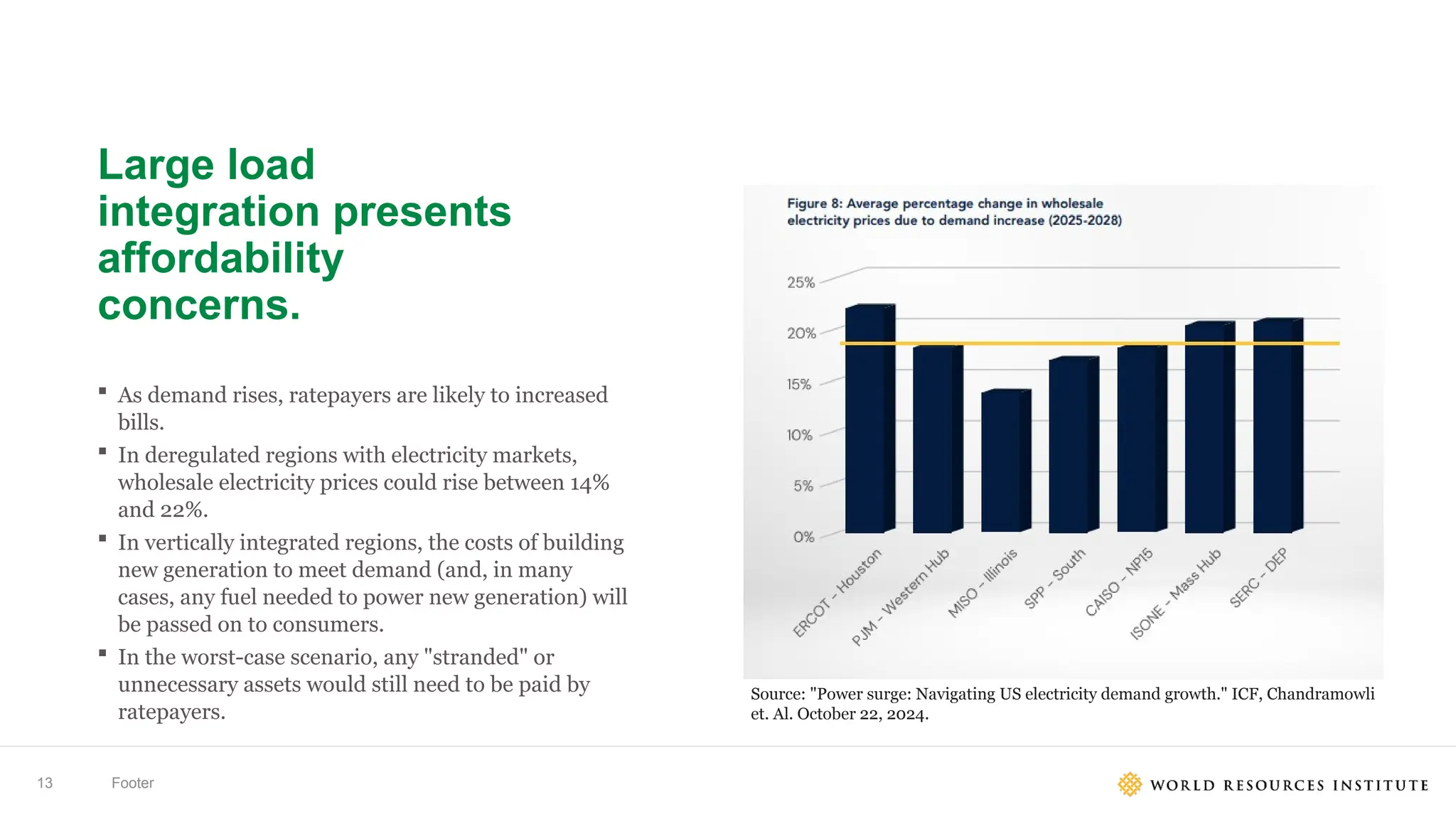

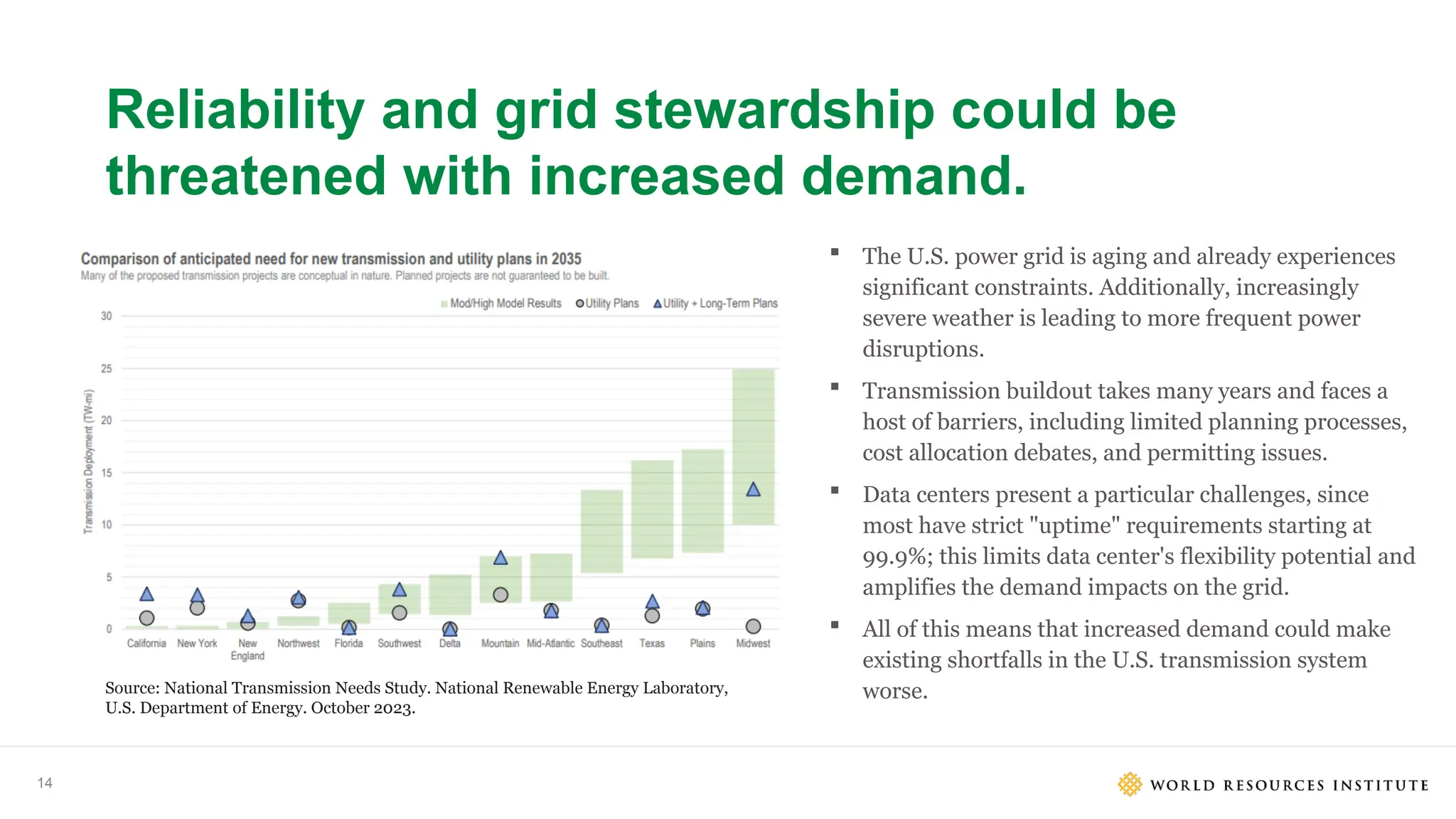

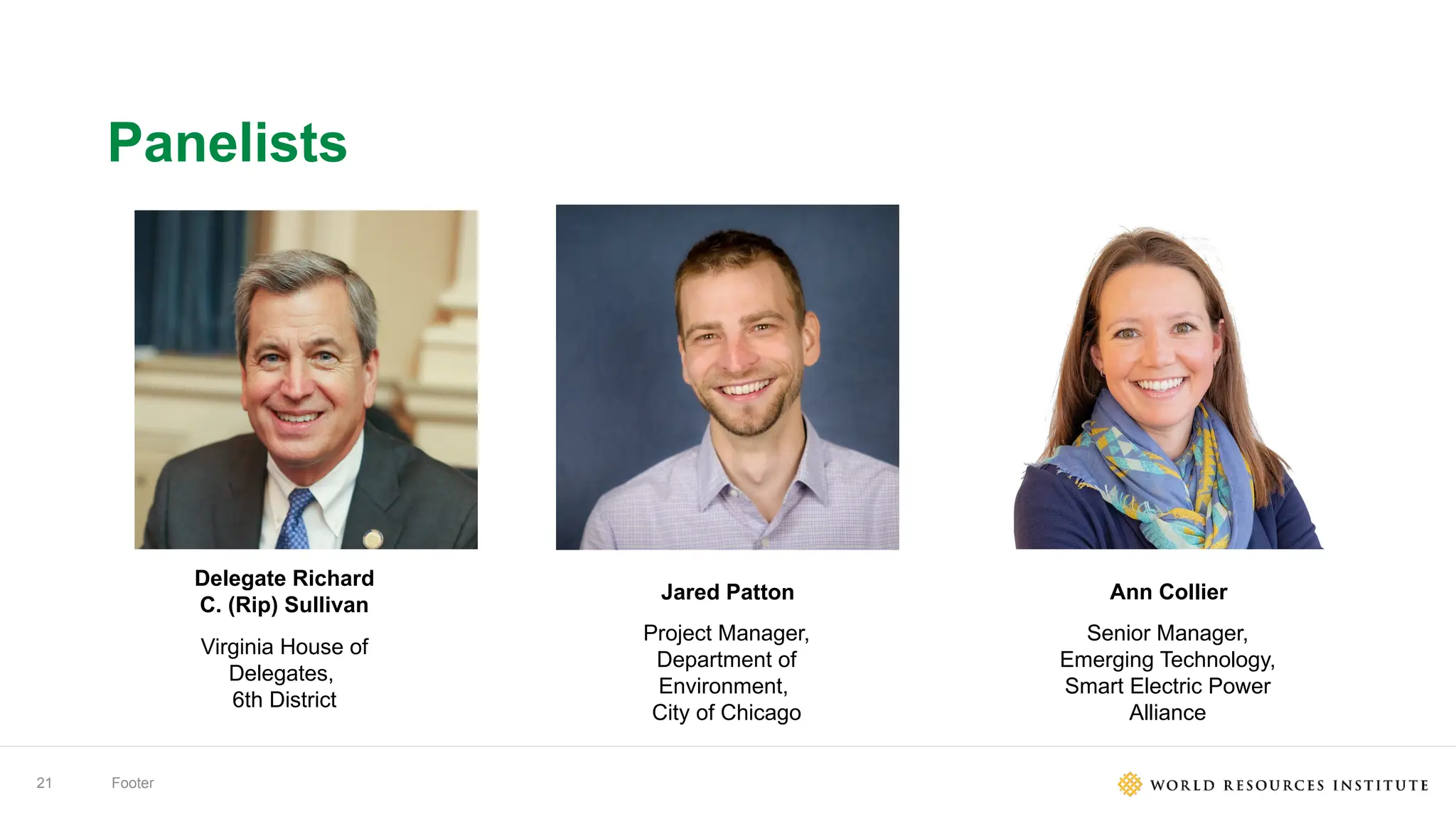

This webinar provides an overview of electricity load growth in the U.S. and its drivers and expected impacts. It focuses on how load growth particularly affects states and localities, and explores levers available to state and local policymakers to mitigate any negative consequences and capture any opportunities.